SEC対Binance(2023年5月)の訴状の文字起こしです。機械翻訳用に括弧を削除してあります。

Plaintiff Securities and Exchange Commission (the “SEC” or the “Commission”), for its Complaint against Defendants Binance Holdings Limited (“Binance”), BAM Trading Services Inc. (“BAM Trading”), BAM Management US Holdings Inc. (“BAM Management”), and Changpeng Zhao (“Zhao”), alleges as follows:

Contents

- 1 SUMMARY

- 2 VIOLATIONS

- 3 NATURE OF THE PROCEEDING AND RELIEF SOUGHT

- 4 JURISDICTION AND VENUE

- 5 DEFENDANTS

- 6 CERTAIN OTHER ENTITIES

- 7 BACKGROUND

- 7.1 I. STATUTORY AND LEGAL FRAMEWORK

- 7.1.1 A. The Securities Act’s Registration and Disclosure Requirements

- 7.1.2 B. The Exchange Act’s Registration and Other Requirements

- 7.1.3 C. Registration of Exchanges, Broker-Dealers, and Clearing Agencies Is Essential to the Proper Functioning of the U.S. Securities Markets and to the Protection of Investors

- 7.2 II. BACKGROUND ON CRYPTO ASSETS AND CRYPTO TRADING PLATFORMS

- 7.1 I. STATUTORY AND LEGAL FRAMEWORK

- 8 FACTS

- 8.1 III. UNDER ZHAO’S CONTROL, BINANCE PROVIDED EXCHANGE, BROKER-DEALER, AND CLEARING AGENCY SERVICES TO U.S. INVESTORS THROUGH THE BINANCE.COM PLATFORM.

- 8.1.1 A. The Binance.com Platform Provides a Marketplace and Facilities for Trading Crypto Asset Securities.

- 8.1.2 B. Binance Holds and Controls Customers’ Funds and Crypto Assets.

- 8.1.3 C. Binance Clears and Settles Customers’ Trades.

- 8.1.4 D. Binance’s Receives Compensation.

- 8.1.5 E. Zhao and Binance Actively Solicited Investors in the United States to Trade Crypto Assets on the Binance.com Platform.

- 8.1.5.1 i. Binance Marketed its Services Worldwide, Including Specifically to U.S. Customers.

- 8.1.5.2 ii. Zhao and Binance Developed a Plan to Evade U.S. Legal Scrutiny While Continuing to Profit from U.S. Investors.

- 8.1.5.3 iii. Consistent with the Tai Chi Plan, Binance Encouraged and Assisted U.S. Customers to Circumvent Binance’s Supposed Restrictions.

- 8.2 IV. ZHAO AND BINANCE ESTABLISHED THE BINANCE.US PLATFORM WHILE MAINTAINING SUBSTANTIAL INVOLVEMENT AND CONTROL OF ITS OPERATIONS.

- 8.2.1 A. Zhao and Binance Created U.S. Entities BAM Management and BAM Trading and Developed the Binance.US Platform.

- 8.2.2 B. Binance Announced the Launch of the Binance.US Platform.

- 8.2.3 C. Zhao and Binance Exerted Substantial Control Over and Were Integral Participants in the Operations of the Binance.US Platform and BAM Trading.

- 8.2.3.1 i. Zhao and Binance Directed and Were Integrally Involved in the Operation of the Binance.US Platform’s Trading Services.

- 8.2.3.2 ii. Zhao and Binance Directed Selection of Crypto Assets for Trading on the Binance.US Platform.

- 8.2.3.3 iii. Zhao and Binance Have Controlled BAM Trading’s Bank Accounts and Finances.

- 8.2.3.4 iv. Zhao and Binance Controlled Binance.US Platform Customers’ Funds and Crypto Assets Deposited, Held, Traded, and/or Accrued on the Platform.

- 8.2.3.5 v. Zhao and Binance Directed BAM Trading to Engage Zhao-Controlled Market Makers on the Binance.US Platform.

- 8.2.4 D. Zhao Rejected BAM CEO A’s and BAM CEO B’s Efforts to Give BAM Trading “Independence” from Zhao and Binance.

- 8.3 V. UNDER ZHAO’S CONTROL, BAM TRADING AND BINANCE PROVIDE EXCHANGE AND CLEARING AGENCY FUNCTIONS TO U.S. CUSTOMERS, AND BAM TRADING ALSO PROVIDES BROKERAGE SERVICES TO U.S. CUSTOMERS.

- 8.3.1 A. BAM Trading and Binance, Under Zhao’s Control, Solicit Investors.

- 8.3.2 B. BAM Trading and Binance Together, Under Zhao’s Control, Maintain and Provide a Marketplace and Facilities for Trading Crypto Asset Securities.

- 8.3.3 C. BAM Trading and Binance, Under Zhao’s Control, Hold and Control Customers’ Funds and Crypto Assets.

- 8.3.4 D. BAM Trading Receives Compensation.

- 8.4 VI. BAM TRADING AND BAM MANAGEMENT ENGAGED IN ACTS AND PRACTICES THAT OPERATED AS A FRAUD AND DECEIT UPON, AND MADE FALSE AND MISLEADING STATEMENTS TO, INVESTORS.

- 8.4.1 A. BAM Trading and BAM Management Touted Their Prohibition of Manipulative Trading on the Binance.US Platform to Investors.

- 8.4.2 B. BAM Trading and BAM Management Misleadingly Touted the Trading Volume of the Binance.US Platform and of Various Crypto Asset Securities to Investors.

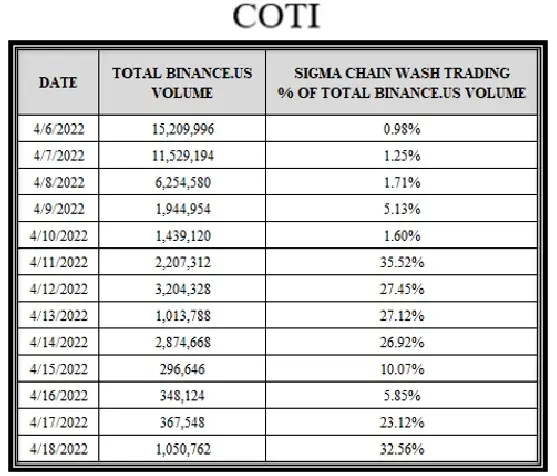

- 8.4.3 C. BAM Trading’s and BAM Management’s Statements Were Materially False and Misleading, and BAM Trading and BAM Management Engaged in Acts and Practices That Operated as a Fraud and Deceit Upon Purchasers.

- 8.4.4 D. Sigma Chain’s Wash Trading on the Binance.US Platform Further Demonstrated the Falsity of BAM Trading and BAM Management’s Statements.

- 8.4.5 E. BAM Trading’s and BAM Management’s False and Misleading Statements and Deceptive Acts and Practices Were Material.

- 8.5 VII. BINANCE AND BAM TRADING ENGAGED IN UNREGISTERED OFFERS AND SALES OF SECURITIES.

- 8.6 VIII. THE CRYPTO ASSETS TRADED ON THE BINANCE.COM PLATFORM AND BINANCE.US PLATFORM INCLUDE ASSETS THAT WERE OFFERED AND SOLD AS SECURITIES.

- 8.7 IX. BINANCE AND BAM TRADING WERE REQUIRED TO BUT DID NOT REGISTER AS AN EXCHANGE, BROKER-DEALER, OR CLEARING AGENCY.

- 8.1 III. UNDER ZHAO’S CONTROL, BINANCE PROVIDED EXCHANGE, BROKER-DEALER, AND CLEARING AGENCY SERVICES TO U.S. INVESTORS THROUGH THE BINANCE.COM PLATFORM.

- 9 FIRST CLAIM FOR RELIEF Violations of Sections 5(a) and 5(c) of the Securities Act (Against Binance for Unregistered Offers and Sales of BNB)

- 10 SECOND CLAIM FOR RELIEF Violations of Sections 5(a) and 5(c) of the Securities Act (Against Binance for the Unregistered Offers and Sales of BUSD)

- 11 THIRD CLAIM FOR RELIEF Violations of Sections 5(a) and 5(c) of the Securities Act (Against Binance for the Unregistered Offer and Sale of Simple Earn and BNB Vault)

- 12 FOURTH CLAIM FOR RELIEF Violations of Sections 5(a) and 5(c) of the Securities Act (Against BAM Trading for the Unregistered Offer and Sale of its Staking Program)

- 13 FIFTH CLAIM FOR RELIEF Violation of Exchange Act Section 5 (Against Binance for Failing to Register as an Exchange for the Binance.com Platform)

- 14 SIXTH CLAIM FOR RELIEF Violations of Exchange Act Section 15(a) (Against Binance for Failing to Register as a Broker-Dealer for the Binance.com Platform)

- 15 SEVENTH CLAIM FOR RELIEF Violations of Exchange Act Section 17A(b) (Against Binance for Failing to Register as a Clearing Agency for the Binance.com Platform)

- 16 EIGHTH CLAIM FOR RELIEF Violations of Exchange Act Section 5 (Against Binance and BAM Trading for Failure to Register as an Exchange for the Binance.US Platform)

- 17 NINTH CLAIM FOR RELIEF Violations of Exchange Act Section 15(a) (Against BAM Trading for Failing to Register as a Broker for the Binance.US Platform)

- 18 TENTH CLAIM FOR RELIEF Violations of Exchange Act Section 17A(b) (Against Binance and BAM Trading Failing to Register as a Clearing Agency for the Binance.US Platform)

- 19 ELEVENTH CLAIM FOR RELIEF Violations of Exchange Act Sections 5, 15(a), and 17A(b) (Against Zhao as Control Person over Binance for the Binance.com Platform)

- 20 TWELFTH CLAIM FOR RELIEF Violations of Exchange Act Sections 5, 15(a), and 17A(b) (Against Zhao as Control Person over Binance and BAM Trading for the Binance.US Platform Violations)

- 21 THIRTEENTH CLAIM FOR RELIEF Violations of Securities Act Sections 17(a)(2) and (a)(3) (Against BAM Management and BAM Trading)

- 22 PRAYER FOR RELIEF

- 23 DEMAND FOR JURY TRIAL

SUMMARY

1. This case arises from Defendants’ blatant disregard of the federal securities laws and the investor and market protections these laws provide. In so doing, Defendants have enriched themselves by billions of U.S. dollars while placing investors’ assets at significant risk.

2. Defendants have unlawfully solicited U.S. investors to buy, sell, and trade crypto asset securities through unregistered trading platforms available online at Binance.com(“Binance.com Platform”) and Binance.US (“Binance.US Platform”) (collectively, “Binance Platforms”). Defendants have engaged in multiple unregistered offers and sales of crypto asset securities and other investment schemes. And Defendants BAM Trading and BAM Management defrauded equity, retail, and institutional investors about purported surveillance and controls over manipulative trading on the Binance.US Platform, which were in fact virtually non-existent.

3. First, Binance and BAM Trading, under Zhao’s leadership and control, have unlawfully offered three essential securities market functions—exchange, broker-dealer, and clearing agency—on the Binance Platforms without registering with the SEC. Acutely aware that U.S. law requires registration for these functions, Defendants nevertheless chose not to register, so they could evade the critical regulatory oversight designed to protect investors and markets.

4. Second, Binance and BAM Trading have unlawfully engaged in unregistered offers and sales of crypto asset securities, including Binance’s own crypto assets called “BNB” and “BUSD,” as well as Binance’s profit-generating programs called “BNB Vault” and “Simple Earn,” and a so-called “staking” investment scheme available on the Binance.US Platform. In so doing, they have deprived investors of material information, including the risks and trends that affect the enterprise and an investment in these securities.

5. Third, BAM Trading and BAM Management have made misrepresentations to investors about controls they claimed to have implemented on the Binance.US Platform, while raising approximately $200 million from private investors in BAM Management and attracting billions of dollars in trading volume from investors (including retail and institutional investors)seeking to transact on the Binance.US Platform.

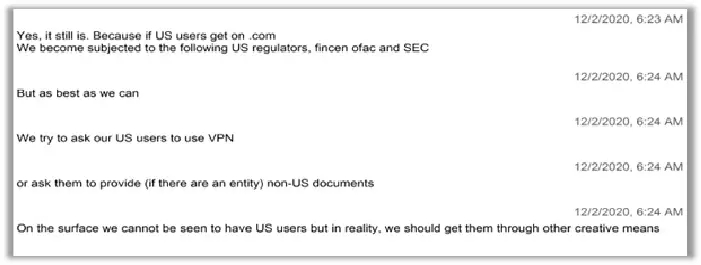

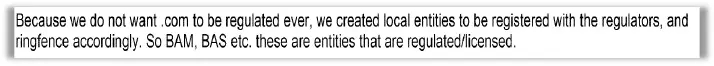

6. Starting in or around 2018, determined to escape the registration requirements of the federal securities laws, Defendants—under Zhao’s control—designed and implemented a multi-step plan to surreptitiously evade U.S. laws. As Binance’s Chief Compliance Officer(“Binance CCO”) admitted, “we do not want [Binance].com to be regulated ever.”

7. As one part of this plan to evade United States regulatory oversight over Zhao, Binance, and the Binance.com Platform, Zhao and Binance created BAM Management and BAM Trading in the United States and claimed publicly that these entities independently controlled the operation of the Binance.US Platform. Behind the scenes, however, Zhao and Binance were intimately involved in directing BAM Trading’s U.S. business operations and providing and maintaining the crypto asset services of the Binance.US Platform. BAM Trading employees referred to Zhao’s and Binance’s control of BAM Trading’s operations as “shackles” that often prevented BAM Trading employees from understanding and freely conducting the business of running and operating the Binance.US Platform—so much so that, by November2020, BAM Trading’s then-CEO told Binance’s CFO that her “entire team feels like [it had] been duped into being a puppet.”

8. As a second part of Zhao’s and Binance’s plan to shield themselves from U.S. regulation, they consistently claimed to the public that the Binance.com Platform did not serve U.S. persons, while simultaneously concealing their efforts to ensure that the most valuable U.S. customers continued trading on the platform. When the Binance.US Platform launched in 2019,Binance announced that it was implementing controls to block U.S. customers from theBinance.com Platform. In reality, Binance did the opposite. Zhao directed Binance to assist certain high-value U.S. customers in circumventing those controls and to do so surreptitiously because—as Zhao himself acknowledged—Binance did not want to “be held accountable” for these actions. As the Binance CCO explained, “on the surface we cannot be seen to have US users, but in reality, we should get them through other creative means.” Indeed, Zhao’s stated “goal” was “to reduce the losses to ourselves, and at the same time to make the U.S. regulatory authorities not trouble us.”

9. Defendants’ purposeful efforts to evade U.S. regulatory oversight while simultaneously providing securities-related services to U.S. customers put the safety of billions of dollars of U.S. investor capital at risk and at Binance’s and Zhao’s mercy. Lacking regulatory oversight, Defendants were free to and did transfer investors’ crypto and fiat assets as Defendants pleased, at times commingling and diverting them in ways that properly registered brokers, dealers, exchanges, and clearing agencies would not have been able to do. For example, through accounts owned and controlled by Zhao and Binance, billions of U.S. dollars of customer funds from both Binance Platforms were commingled in an account held by a Zhao-controlled entity (called Merit Peak Limited), which funds were subsequently transferred to a third party apparently in connection with the purchase and sale of crypto assets.

10. Moreover, Defendants understood the importance to crypto asset investors of implementing trading surveillance and controls over crypto trading platforms. Zhao himself stated in 2019 that “CREDIBILITY is the most important asset for any exchange! If an exchange fakes their volumes, would you trust them with your funds?”

11. Defendants BAM Trading and BAM Management touted the surveillance and controls supposedly in place to prevent manipulative trading on the Binance.US Platform.

12. But Defendants failed to implement on the Binance.US Platform the trade surveillance or manipulative trading controls BAM Trading and BAM Management touted to investors. Thus, Defendants failed to satisfy basic requirements of registered exchanges—to have rules designed to prevent fraudulent and manipulative acts and the capacity to carry out that purpose. The supposed controls were virtually non-existent, and those that did exist did not monitor for or protect against “wash trading” or self-dealing, which was occurring on theBinance.US Platform. Most notably, from at least September 2019 until June 2022, Sigma Chain AG (“Sigma Chain”), a trading firm owned and controlled by Zhao, engaged in wash trading that artificially inflated the trading volume of crypto asset securities on the Binance.US Platform.

13. Congress enacted the Securities Act of 1933 (“Securities Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) in part to provide for the regulation of the offer and sale of securities and the national securities markets through registration and attendant disclosure, recordkeeping, inspection, and conflict-of-interest mitigation requirements. Binance and BAM Trading—both under Zhao’s control—have engaged and continue to engage in unregistered offers and sales of crypto asset securities, effecting unregistered crypto asset securities transactions on the Binance Platforms, combining core securities market functions while purposefully evading registration, and operating while impaired by obvious conflicts of interest. In doing so, they have dodged the disclosure and other requirements that Congress and the SEC have constructed over the course of decades to protect our capital markets and investors and thereby have violated—and continue to violate—the law.

VIOLATIONS

14. By engaging in the conduct set forth in this Complaint, Binance and BAM Trading engaged in, and are currently engaging in, the unlawful offer and sale of securities in violation of Sections 5(a) and 5(c) of the Securities Act [15 U.S.C. §§ 77e(a) and 77e(c)].

15. By engaging in the conduct set forth in this Complaint, Binance acted as an exchange, broker and dealer, and clearing agency for the Binance.com Platform without registering in any such capacities, in violation of Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a), and 78q-1(b)]. Similarly, with respect to the Binance.US Platform, Binance acted together with BAM Trading as an exchange, BAM Trading acted as a broker, and Binance and BAM Trading each acted as a clearing agency, without registering in any such capacities, in violation of Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C.§§ 78e, 78o(a), and 78q-1(b)]. As a control person over Binance and BAM Trading under Exchange Act Section 20(a) [15 U.S.C. § 78t(a)], Zhao has also violated Sections 5, 15(a), and17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a), and 78q-1(b)] for Binance and BAM Trading’s violations with respect to both Binance Platforms.

16. By engaging in the conduct set forth in this Complaint, BAM Trading and BAM Management have further obtained money or property by means of materially false and misleading statements and engaged in transactions, practices, and courses of business that operated as a fraud or deceit upon purchasers in the offer and sale of securities in violation of Section 17(a)(2) and (3) of the Securities Act [15 U.S.C. § 77q(a)(2) and 77q(a)(3)].

17. Unless Defendants are permanently restrained and enjoined, there is a reasonable likelihood that they will continue to engage in the acts, practices, and courses of business set forth in this Complaint and in acts, practices, and courses of business of similar type and object in violation of the federal securities laws.

NATURE OF THE PROCEEDING AND RELIEF SOUGHT

18. The Commission brings this action pursuant to the authority conferred upon it by Sections 20(b), 20(d), and 22(a) of the Securities Act [15 U.S.C. §§ 77t(b), 77t(d), and 77v(a)]and Sections 21(d) and 27(a) of the Exchange Act [15 U.S.C. §§ 78u(d) and 78aa(a)].

19. The Commission seeks a final judgment: (a) permanently enjoining Defendants from committing further violations of the federal securities laws they are alleged to have violated; (b) ordering Defendants to disgorge their ill-gotten gains with prejudgment interest;(c) permanently enjoining Defendants and any entity controlled by them from, directly or indirectly, using the means or instrumentalities of interstate commerce to: (i) participate in the issuance, purchase, offer, or sale of any security, including any crypto asset security, in any unregistered transaction; (ii) act as an unregistered exchange with respect to any securities, including any crypto asset securities; (iii) act as an unregistered broker or dealer with respect to any securities, including any crypto asset securities; and (iv) act as an unregistered clearing agency with respect to any securities, including any crypto asset securities; (d) imposing civil money penalties on Defendants; and (e) ordering equitable relief that may be appropriate or necessary for the benefit of investors.

JURISDICTION AND VENUE

20. This Court has jurisdiction over this action pursuant to Sections 20(b), 20(d), and22(a) of the Securities Act [15 U.S.C. §§ 77t(b), 77t(d), and 77v(a)] and Sections 21(d) and 27(a)of the Exchange Act [15 U.S.C. §§ 78u(d) and 78aa(a)].

21. Defendants, directly or indirectly, have made use of the means or instruments of transportation or communication in interstate commerce or of the mails, including Defendants’ regular use of the Internet and the U.S. banking system, in connection with the transactions, acts, practices, and courses of business alleged in this Complaint.

22. Venue is proper in the District of Columbia pursuant to Section 22(a) of the Securities Act [15 U.S.C. § 77v(a)] and Section 27(a) of the Exchange Act [15 U.S.C. § 78aa(a)].Among other acts, Defendants failed to register with the SEC in this District as an exchange, broker-dealer, or clearing agency as required under the Exchange Act. In addition, they failed to register with the SEC in this District the offer and sale of securities, and they conducted unregistered offers and sales of securities to residents of, or persons located in, this District.

23. Defendants also transacted business in this District. At least before September2019, Binance (as controlled by Zhao) made the Binance.com Platform available for trading to customers in this District. Further, BAM Management and BAM Trading (also under Zhao’s and Binance’s control) obtained District of Columbia business licenses and transacted business in this District, including through the operation and availability of the Binance.US Platform, which was accessed by individuals in the District, and through personnel (such as one of its CEOs) in this District, who provided services to and engaged in business with all Defendants.

24. Defendants’ violations of the federal securities laws alleged in this Complaint occurred within the United States and had a foreseeable substantial effect within the United States. Binance and Zhao actively solicited U.S. investors to trade on the Binance Platforms. Binance and Zhao, for example, regularly solicited U.S. investors via their social media and other internet postings to trade on both of the Binance Platforms. Zhao also directed other Binance employees to actively solicit and take other steps to retain U.S. investors on theBinance.com Platform, even after Binance publicly announced in June 2019 that it would no longer serve U.S. investors. By then, Binance estimated that it had over 1.47 million U.S.-based investors on the Binance.com Platform, and it continued to maintain a substantial U.S. customer base for several years thereafter. In addition, Binance has employees located in the United States, and residents of this District invested in schemes Binance offered and sold as securities including BUSD and the Simple Earn program.

25. Moreover, until at least the end of 2022, Binance, at Zhao’s direction, maintained custody and control of the crypto assets deposited, held, traded, and/or accrued by customers on the Binance.US Platform.

DEFENDANTS

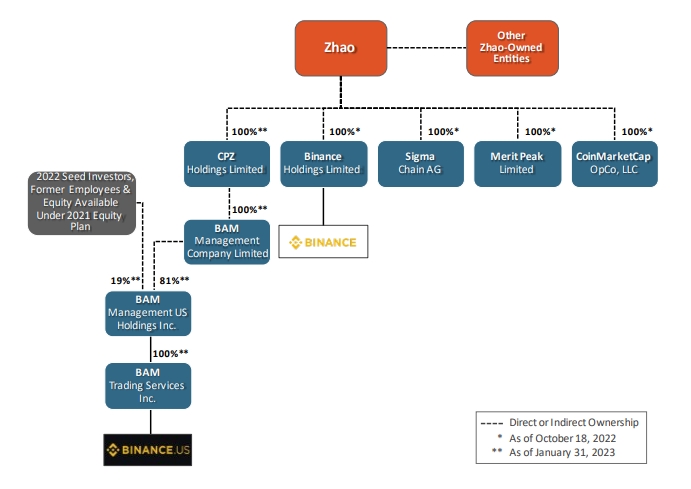

26. The Binance Platforms were founded and are maintained and operated by an opaque web of corporate entities, including those identified below, all of which are beneficially owned and controlled by Zhao, Binance’s Chief Executive Officer (“CEO”) and, at least through March 2022, the Chairman of BAM Trading’s and BAM Management’s Boards of Directors.

27. Binance, d/b/a Binance.com, is a Cayman Islands limited liability company founded and owned by Zhao. Since at least July 2017, it has operated the Binance.com Platform, an international crypto asset trading platform. The Binance.com Platform markets itself as being available to customers in more than 100 countries. It currently offers trading in over 350 crypto assets and makes available various other investment opportunities involving crypto assets, including crypto asset securities. Binance operates through a number of subordinate or affiliated entities, in multiple jurisdictions, all tied to Zhao as the beneficial owner. Zhao has been publicly dismissive of “traditional mentalities” about corporate formalities and their attendant regulatory requirements. He has refused to identify the headquarters of Binance, claiming, “Wherever I sit is the Binance office. Wherever I meet somebody is going to be the Binance office.” According to Zhao, the concept of a formal corporate entity with a headquarters and its own bank account is unnecessary: “All of those things doesn’t have to exist for blockchain companies.” Notably, however, billions of dollars from the platforms flowed through dozens of Binance and Zhao-owned U.S.-based bank accounts. Neither Binance nor any of its subsidiaries or affiliated entities have ever been registered with the SEC in any capacity.

28. BAM Management is a Delaware corporation and the parent of BAM Trading and other affiliated entities. When the Binance.US Platform launched in 2019, BAM Management was wholly owned by BAM Management Company Limited, a Cayman Islands company, which in turn was wholly owned by CPZ Holdings Limited, a British Virgin Islands company that was owned and controlled by Zhao. Presently, Zhao continues to own 81 percent of BAM Management. Neither BAM Management nor any of its subsidiaries or affiliated entities (including BAM Trading) has ever been registered with the SEC in any capacity.

29. BAM Trading, d/b/a Binance.US, is a Delaware corporation with a principal place of business in Miami, Florida. It is wholly owned by BAM Management. BAM Trading holds 43 money transmitter licenses with U.S. jurisdictions, including this District.

30. Zhao, widely known as “CZ,” is a Canadian citizen who resides outside of the United States, is Binance’s founder, beneficial owner, and CEO, and was Chairman of BAM Trading’s and BAM Management’s Boards of Directors at least until approximately March 2022. Zhao also owns several entities that have regularly traded on the Binance Platforms. Between October 2022 and January 2023, Zhao personally received $62.5 million from one of the Binance bank accounts. Zhao has never been associated with any entity registered with the SEC.

CERTAIN OTHER ENTITIES

31. Trust Company A is a New York limited purpose trust company. Beginning in September 2019, pursuant to a “Stablecoin as a Service” agreement with a Binance affiliate, Trust Company A issued in partnership with Binance the crypto asset “BUSD,” which was approved by and under the supervision of the New York Department of Financial Services(“NYDFS”). BUSD is a Binance-branded U.S. Dollar denominated crypto asset on the Ethereum blockchain. In December 2019, BAM Trading entered into a partnership with Trust Company A, whereby Trust Company A provided certain services with respect to BUSD purchases and sales on the Binance.US Platform. Effective February 21, 2023, Trust Company A ceased issuing new BUSD pursuant to an NYDFS order.

32. Trust Company B is a Nevada-based trust company. In or around July 2019,BAM Trading entered into an agreement with Trust Company B to provide certain services to customers purchasing crypto assets on the Binance.US Platform with U.S. dollars.

33. Sigma Chain is a crypto asset trading firm incorporated in Switzerland. Zhao is Sigma Chain’s beneficial owner, and several Binance employees conducted its operations. Among others, Binance’s back office manager (“Binance Back Office Manager”) was Sigma Chain’s President at the same time she also had signatory authority over BAM Trading’s bank accounts. Sigma Chain was an active trader on both Binance Platforms, and described itself as “the main market maker for Binance.com.” Upon the Binance.US Platform’s launch, Zhao directed that Sigma Chain be one of its first market makers. Further, since the Binance.US Platform began offering over-the-counter (“OTC”) trading and its Convert Trading and One Click Buy Sell (“OCBS”) Services to customers, Sigma Chain has served as one of the counterparties to Binance.US Platform customers, including, at times, serving as the only counterparty.

34. Merit Peak Limited (“Merit Peak”) is a crypto asset trading firm incorporated in the British Virgin Islands. Zhao is Merit Peak’s beneficial owner, and several Binance employees conducted its operations. It has described itself as “a proprietary firm trading with our owner’s [Zhao’s] self-made wealth from the digital asset business.” Merit Peak was an OTC trading service provider on the Binance.com Platform and was one of the earliest market makers on the Binance.US Platform. Through Merit Peak, Zhao has also directed over $16 million to BAM Management to fund the Binance.US Platform’s operations.

35. Below is a high-level graphical representation of a certain limited number of relationships and entities relevant to the allegations herein.

BACKGROUND

I. STATUTORY AND LEGAL FRAMEWORK

36. As the Supreme Court recently reemphasized, the Securities Act and the Exchange Act are the “backbone of American securities laws.”

37. The Securities Act and the Exchange Act define “security” to include a wide range of assets including “investment contracts.” Investment contracts are instruments through which a person invests money in a common enterprise and reasonably expects profits or returns derived from the entrepreneurial or managerial efforts of others. As the United States Supreme Court noted in SEC v. W.J. Howey Co., Congress defined “security” broadly to embody a “flexible rather than a static principle, one that is capable of adaptation to meet the countless and variable schemes devised by those who seek the use of the money of others on the promise of profits.” 328 U.S. 293, 299 (1946). Courts have found a variety of novel or unique investment vehicles to be investment contracts, including those involving orange groves, animal breeding programs, cattle embryos, mobile phones, enterprises that exist only on the Internet, and crypto assets (which crypto asset market participants at times also label “cryptocurrencies”).

A. The Securities Act’s Registration and Disclosure Requirements

38. Congress enacted the Securities Act to regulate the offer and sale of securities. Sections 5(a) and 5(c) [15 U.S.C. §§ 77e(a) and (c)] require those that directly or indirectly offer and sell securities to register those offers and sales with the SEC.

39. Registration statements provide the investing public with material, sufficient, and accurate information to make informed investment decisions, including financial and managerial information about the issuer, how the issuer will use offering proceeds, and the risks and trends that affect the enterprise and an investment in its securities.

B. The Exchange Act’s Registration and Other Requirements

40. To fulfill the purposes of the Exchange Act, Congress imposed registration and disclosure obligations on certain defined participants in the national securities markets, including but not limited to broker-dealers, exchanges, and clearing agencies. It also empowered the SEC to write rules to protect investors who use the services of those intermediaries.

41. In the Exchange Act, Congress explained that such oversight is essential to the proper functioning of the national securities markets and the national economy:

Transactions in securities as commonly conducted upon securities exchanges and over-the-counter markets are effected with a national public interest which makes it necessary to provide for regulation and control of such transactions and of practices and matters related thereto … to perfect the mechanisms of a national market system for securities and a national system for the clearance and settlement of securities transactions and the safeguarding of securities and funds related thereto, and to impose requirements necessary to make such regulation and control reasonably complete and effective, in order to protect interstate commerce, the national credit, the Federal taxing power, to protect and make more effective the national banking system and Federal Reserve System, and to insure the maintenance of fair and honest markets in such transactions.

15 U.S.C. § 78b.

42. Congress also determined that “[t]he prompt and accurate clearance and settlement of securities transactions, including the transfer of record ownership and the safeguarding of securities and funds related thereto, are necessary for the protection of investors and persons facilitating transactions by and acting on behalf of investors.” 15 U.S.C. § 78q-1.

i. Registration of Exchanges

43. In enacting registration provisions for national securities exchanges, Congress found in Section 2(3) of the Exchange Act [15 U.S.C. §78b(3)] that:

Frequently the prices of securities on such exchanges and markets are susceptible to manipulation and control, and the dissemination of such prices gives rise to excessive speculation, resulting in sudden and unreasonable fluctuations in the prices of securities which (a) cause alternately unreasonable expansion and unreasonable contraction of the volume of credit available for trade, transportation, and industry in interstate commerce, (b) hinder the proper appraisal of the value of securities and thus prevent a fair calculation of taxes owing to the United States and to the several States by owners, buyers, and sellers of securities, and (c) prevent the fair valuation of collateral for bank loans and/or obstruct the effective operation of the national banking system.

44. Accordingly, Section 5 of the Exchange Act [15 U.S.C. § 78e] requires an organization, association, or group of persons that meets the definition of “exchange” under Section 3(a)(1) of the Exchange Act, unless otherwise exempt, to register with the Commission as a national securities exchange pursuant to Section 6 of the Exchange Act.

45. Section 3(a)(1) of the Exchange Act [15 U.S.C. § 78c(a)(1)] defines “exchange” to mean “any organization, association, or group of persons, whether incorporated or unincorporated, which constitutes, maintains, or provides a market place or facilities for bringing together purchasers and sellers of securities or for otherwise performing with respect to securities the functions commonly performed by a stock exchange as that term is generally understood, and includes the market place and the market facilities maintained by such exchange.”

46. Exchange Act Rule 3b-16(a) [17 C.F.R. § 240.3b-16(a)] further defines certain terms in the definition of “exchange” under Section 3(a)(1) of the Exchange Act, including “an organization, association, or group of persons,” as one that: “(1) [b]rings together the orders for securities of multiple buyers and sellers; and (2) uses established, non-discretionary methods(whether by providing a trading facility or by setting rules) under which such orders interact with each other, and the buyers and sellers entering such orders agree to the terms of a trade.”

47. Registration of a trading platform as an “exchange” under the Exchange Act is a bedrock Congressional requirement that permits the SEC to carry out its role of oversight over the national securities markets.

48. For example, properly registered exchanges must enact rules to govern their and their members’ behavior. Under Section 6 of the Exchange, the rules, among other things, must be “designed to prevent fraudulent and manipulative acts and practices, to promote just and equitable principles of trade … and, in general, to protect investors and the public interest.”

49. These rules are subject to review by the SEC under Section 19 of the Exchange Act [15 U.S.C. § 78s], including before an exchange can be registered and begin operating. This review process is designed to ensure that securities marketplaces operate in a manner consistent with the Exchange Act as its practices and procedures evolve over time, in part to protect investors and the integrity of securities markets that affect national commerce and the economy.

ii. Registration of Broker-Dealers

50. Section 15(a) of the Exchange Act [15 U.S.C. § 78o(a)] generally requires brokers and dealers to register with the SEC, and a broker or dealer must also become a member of one or more “self-regulatory organizations” (“SROs”), which in turn require members to adhere to rules governing members’ activities.

51. Section 3(a)(4) of the Exchange Act [15 U.S.C. § 78c(a)(4)] defines “broker” generally as “any person engaged in the business of effecting transactions in securities for the account of others.” Section 3(a)(5) of the Exchange Act [15 U.S.C. § 78c(a)(5)] defines “dealer” generally as “any person engaged in the business of buying and selling securities for his own account, through a broker or otherwise.”

52. The regulatory regime applicable to broker-dealers is a cornerstone of the federal securities laws and provides important safeguards to investors and market participants. Registered broker-dealers are subject to comprehensive regulation and rules that include recordkeeping and reporting obligations, SEC and SRO examination, and general and specific requirements aimed at addressing certain conflicts of interest, among other things. All of these rules and regulations are critical to the soundness of the national securities markets and to protecting investors in the public markets who interact with broker-dealers.

53. To preserve the fair and orderly markets, avoid conflicts of interests, and protect investors, Section 11(a) of the Exchange Act [15 U.S.C. § 78k(a)] prohibits broker-dealers that are members of exchanges from effecting transactions on that exchange for their accounts.

iii. Registration of Clearing Agencies

54. Section 17A(b) of the Exchange Act [15 U.S.C. § 78q-1(b)] generally makes it unlawful “for any clearing agency, unless registered in accordance with this subsection, directly or indirectly, to make use of the mails or any means or instrumentality of interstate commerce to perform the functions of a clearing agency with respect to any security.”

55. Section 3(a)(23)(A) of the Exchange Act [15 U.S.C. § 78c(a)(23)(A)] defines the term “clearing agency” as “any person who acts as an intermediary in making payments or deliveries or both in connection with transactions in securities or who provides facilities for comparison of data respecting the terms of settlement of securities transactions, to reduce the number of settlements of securities transactions, or for the allocation of securities settlement responsibilities,” as well as “any person … who (i) acts as a custodian of securities in connection with a system for the central handling of securities whereby all securities of a particular class or series of any issuer deposited within the system are treated as fungible and may be transferred, loaned, or pledged by bookkeeping entry without physical delivery of securities certificates, or(ii) otherwise permits or facilitates the settlement of securities transactions or the hypothecation or lending of securities without physical delivery of securities certificates.”

56. Registered clearing agencies are subject to comprehensive regulation under the Exchange Act and the rules thereunder, providing important safeguards to investors and market participants, and to the maintenance of fair competition. These regulations and rules include recordkeeping obligations and require SEC examination. Moreover, clearing agencies properly registered under the Exchange Act must enact a set of rules to govern their and their members’ behavior, and these rules are subject to review by the SEC.

C. Registration of Exchanges, Broker-Dealers, and Clearing Agencies Is Essential to the Proper Functioning of the U.S. Securities Markets and to the Protection of Investors

57. In U.S. securities markets, the functions described above are typically carried out by separate legal entities that are independently registered and regulated by the SEC. Separation of these core functions aims to minimize conflicts between the interests of securities intermediaries and the investors they serve. Registration and concomitant disclosure obligations allow the SEC to oversee the business of intermediaries and their relationships with investors and to thereby protect investors from manipulation, fraud, and other abuses.

58. Investors in securities markets do not interact directly with exchanges or clearing agencies but instead are customers of broker-dealers that effect transactions on investors’ behalf. Only broker-dealers (or natural persons associated with a broker-dealer) may become members of a national securities exchange. In addition, broker-dealers that have customers must become members of the Financial Industry Regulatory Authority (“FINRA”), an SRO that imposes its own rules and oversight over broker-dealers, particularly as to protecting retail investors.

59. Registered national securities exchanges and clearing agencies are also SROs and therefore must submit all of their proposed rules and rules changes to the SEC for review.

60. As noted, the Exchange Act also subjects registered intermediaries to important record-keeping and inspection requirements. For example, Section 17 of the Exchange Act [15U.S.C. § 78q] requires registered national securities exchanges, broker-dealers, and clearing agencies to make and keep records as the SEC prescribes by rule and subjects those records to reasonable periodic, special, or other examinations by representatives of the SEC.

61. These provisions are designed to ensure that intermediaries follow the rules that protect investors and promote the fair and efficient operation of the securities markets. These provisions also seek to ensure, among other things, that investors’ securities orders are handled fairly and transparently, that securities transactions result in settlement finality, and that investors’ assets are protected and can be recovered if necessary.

II. BACKGROUND ON CRYPTO ASSETS AND CRYPTO TRADING PLATFORMS

A. Crypto Assets

62. As used herein, the terms “crypto asset,” “digital asset,” or “token” generally refer to an asset issued and/or transferred using blockchain or distributed ledger technology, including assets referred to colloquially as “cryptocurrencies,” “virtual currencies,” and digital “coins.”

63. A blockchain or distributed ledger is a database spread across a network of computers that records transactions in theoretically unchangeable, digitally recorded data packages, referred to as “blocks.” These systems typically rely on cryptographic techniques to secure recording of transactions.

64. Some crypto assets may be “native tokens” to a particular blockchain—meaning that they are represented on their own blockchain—though other crypto assets may also be represented on that same blockchain.

65. Crypto asset owners typically store the software providing them control over their crypto assets on a piece of hardware or software called a “crypto wallet.” Crypto wallets offer a method to store and manage critical information about crypto assets, i.e., cryptographic information necessary to identify and transfer those assets. The primary purpose of a crypto wallet is to store the “public key” and the “private key” associated with a crypto asset so that the user can make transactions on the associated blockchain. The public key is colloquially known as the user’s blockchain “address” and can be freely shared with others. The private key is analogous to a password and confers the ability to transfer a crypto asset. Whoever controls the private key controls the crypto asset associated with that key. Crypto wallets can reside on devices that are connected to the internet (sometimes called a “hot wallet”), or on devices that are not connected to the internet (sometimes called a “cold wallet” or “cold storage”). All wallets are at risk of being compromised or “hacked,” but internet connectivity makes hot wallets easier to access and therefore puts them at greater risk from certain hacks.

B. Consensus Mechanisms and Validation of Transactions on a Blockchain

66. Blockchains typically employ a “consensus” mechanism that, among other things, aims to achieve agreement among users to a data value or on the state of the ledger.

67. A consensus mechanism describes the particular protocol used by a blockchain to agree on, among other things, which ledger transactions are valid, when and how to update the blockchain, and potentially to compensate certain participants for validating transactions and adding new blocks. There can be multiple sources for compensation under the terms of the blockchain protocol, including from fees charged to those transacting on the blockchain, or through the creation or “minting” of additional amounts of the blockchain’s native crypto asset.

68. “Proof of work” and “proof of stake” are the two major consensus mechanisms used by blockchains. Proof of work, the mechanism used by the Bitcoin blockchain, involves computers, known as “validator nodes,” attempting to “mine” a “block” of transactions, in part by solving a complex mathematical problem. The first miner to successfully solve the problem earns the right to update the blockchain and is rewarded with the blockchain’s native crypto asset. Proof of stake, the consensus mechanism currently used by the Ethereum blockchain, involves the blockchain protocol selecting block validators from crypto asset holders who have committed or “staked” a minimum number of crypto assets as part of the validation process.

C. The Offer and Sale of Crypto Assets

69. Persons have offered and sold crypto assets in capital-raising events in exchange for consideration, including but not limited to through so-called “initial coin offerings” or “ICOs,” “crowd sales,” or public “token sales.” In some instances, the entities offering or selling the crypto assets may release a “whitepaper” or other marketing materials describing a project to which the asset relates, the terms of the offering, and any rights associated with the asset.

70. Some issuers continue to sell the crypto assets after the initial offer and sale, including by directly or indirectly by selling it on crypto asset trading platforms.

D. Crypto Asset Trading Platforms

71. Crypto asset trading platforms—like the Binance Platforms, which are described in more detail below—are marketplaces that generally offer a variety of services relating to crypto assets, often including brokerage, trading, and settlement services.

72. Crypto asset trading platforms allow their customers to purchase and sell crypto assets for fiat currency (legal tender issued by a country) or for other crypto assets. “Off-chain” transactions are tracked in the internal recordkeeping mechanisms of the platform but do not involve transferring crypto assets from one wallet to another, while “on-chain” transactions are those involving the transfer of a crypto asset from one blockchain address to another.

73. Crypto asset trading platforms typically possess and control the crypto assets deposited and/or traded by their customers and thus function as a central depository. The customers’ entitlements are then typically tracked and maintained on the crypto asset trading platform’s internal ledgers. Consistent with their failures to register with the SEC in any capacity and follow rules applicable to registered intermediaries, the Binance Platforms did not segregate a customer’s crypto assets from other customers’ or the firm’s assets.

74. The graphic user interfaces employed by crypto asset trading platforms—such as on websites, mobile apps, or other software—typically emulate and function like traditional securities trading screens: They show order books of the various assets available to trade and historical trading information like high and low prices, trading volumes, and capitalizations.

75. However, unlike in traditional securities markets, crypto asset trading platforms(including the Binance Platforms) typically solicit, accept, and handle customer orders for securities; allow for the interaction and intermediation of multiple bids and offers resulting in purchases and sales; act as an intermediary in making payments or deliveries, or both; and maintain a central securities depository for the settlement of securities transactions.

76. By contrast, a registered national securities exchange submits information regarding executed trades to a registered clearing agency that takes responsibility for ensuring settlement finality and safekeeping of the assets being traded and, in doing so, protects investors’ interests. Thus, registered national securities exchanges typically do not assume possession or control of the underlying assets being traded. Moreover, crypto asset trading platforms usually settle transactions by updating internal records with each investor’s positions, a function typically carried out by clearing agencies in compliant securities markets.

77. Likewise, crypto asset trading platforms typically perform roles traditionally assigned to broker-dealers in regulatory compliant securities markets, without following or even recognizing the legal obligations and restrictions on activities that accompany status as a broker-dealer. For example, unregistered and non-compliant crypto asset trading platforms often do not adequately disclose that they have the ability and financial incentive to trade crypto asset securities against their own customers on the platform, putting customers on the losing side of each trade.

E. The DAO Report

78. On July 25, 2017, the SEC issued the Report of Investigation Pursuant to Section21(a) of the Securities Exchange Act of 1934: The DAO (the “DAO Report”), advising “those who would use … distributed ledger or blockchain-enabled means for capital raising[] to take appropriate steps to ensure compliance with the U.S. federal securities laws,” and finding that the offerings of certain crypto assets identified therein were offerings of securities.

79.The DAO Report also advised that “any entity or person engaging in the activities of an exchange must register as a national securities exchange or operate pursuant to an exemption from such registration” and “stressed the obligation to comply with the registration provisions of the federal securities laws with respect to products and platforms involving emerging technologies and new investor interfaces.” The DAO Report also found that the trading platforms at issue therein “provided users with an electronic system that matched orders from multiple parties to buy and sell [certain crypto asset securities] for execution based on non-discretionary methods” and therefore “appear to have satisfied the criteria” for being an exchange under the Exchange Act.

FACTS

III. UNDER ZHAO’S CONTROL, BINANCE PROVIDED EXCHANGE, BROKER-DEALER, AND CLEARING AGENCY SERVICES TO U.S. INVESTORS THROUGH THE BINANCE.COM PLATFORM.

80. In 2017, Binance, controlled by Zhao, launched the Binance.com Platform to provide services to crypto asset investors. To finance its start-up costs, Zhao and Binance created a new crypto asset security called “Binance Coin,” also known as “BNB.”

81. From approximately June 26 to July 3, 2017, Zhao and Binance conducted a so-called ICO of BNB that raised approximately $15 million from investors globally, including U.S. investors, by selling 100 million BNB tokens at an average price of $0.15 per token. As of May14, 2023, BNB traded as high as $314.70.

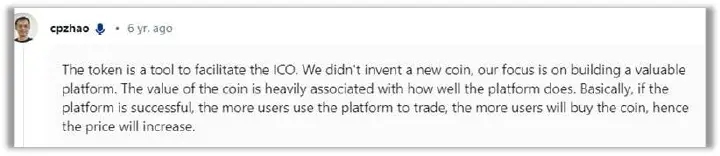

82. From inception, as set forth in greater detail in Section VII.A below, BNB was offered and sold as a security because Binance touted an investment in BNB as an investment in Binance’s efforts to create a successful crypto asset trading platform centered around BNB. For example, to promote the BNB ICO, Binance published a “Binance Exchange” whitepaper (the “Binance Whitepaper”) announcing Binance’s ambition to build “a world-class crypto exchange, powering the future of crypto finance,” in which BNB would play an integral role as a so-called “exchange token”— i.e., a crypto asset associated by its issuer with a crypto asset trading platform that the issuer markets as an investment in the success of the platform itself.

83. Central to the Binance Whitepaper’s proposal was the “Binance Exchange Matching Engine” that would match crypto asset buy and sell orders and be “capable of sustaining 1,400,000 orders/second, making Binance one of the fastest exchanges in the market.”

84. In July 2017, shortly after completion of the BNB ICO, Zhao and Binance launched the Binance.com Platform.

85. Since Binance’s inception, Zhao has been Binance’s CEO and its ultimate decision maker. All Binance employees directly or indirectly report to him. He had and continues to have the ability to exercise control—and does in fact exercise such control—over all aspects of Binance’s business, including its operation of the Binance.com Platform, and he directs and oversees the platform’s various functions and services.

86. From the time it launched the Binance.com Platform, Binance, under Zhao’s control, has acted as an exchange, clearing agency, and broker-dealer in crypto asset securities without registering in those capacities.

A. The Binance.com Platform Provides a Marketplace and Facilities for Trading Crypto Asset Securities.

i. Display and Order Book

87. Customers can access and create accounts on the Binance.com Platform via theBinance.com website, a Binance mobile phone application, or a Binance-created application programming interface (“API”).

88. The Binance.com Platform displays customer account information, including account balances, and open orders, order history, and trade history with respect to crypto assets available on the platform. The platform also displays open crypto asset orders on the order book and provides real-time data of bid and ask prices, trading volume, and the times that the orders were submitted. Additionally, the Binance.com Platform displays information about executed trades (i.e., price, quantity, and time historical data for such trades).

ii. Order Matching and Trading Rules

89. The Binance.com Platform offers “spot” (immediate) market trading through anorder-matching functionality similar to that of a traditional securities exchange.

90. According to Binance, when an investor places an order on the Binance.com Platform, the order enters Binance’s internal automated matching engine, called “MatchBox,” which matches buy-and-sell orders based on programmed, non-discretionary rules that govern how orders will interact. When separate customers’ buy and sell orders have prices that overlap, MatchBox executes the trade and removes the orders from the order book. Orders that do not execute immediately are typically ranked and displayed in price-time priority, meaning that orders placed earlier in time are prioritized for any given price.

91. MatchBox does not indicate to one party the identity of the other party to a trade. Upon execution of a trade, other functionality in the Binance.com Platform settles the trade.

iii. Binance OTC

92. Since at least January 2019, Binance has operated additional functionality that it refers to as “Binance OTC.” As advertised and described by Binance, Binance OTC allows customers to transact directly with Binance, where Binance is the counterparty trading in its own account. Binance quotes prices directly to Binance OTC customers, acts as the principal on each trade, and profits from the spread between their bid and ask quotations.

93. In marketing Binance OTC, Binance has touted “a number of advantages to trading with us,” including “Fast Settlement” and a “Simple Process – The trading discussion happens on chat, and a trade can be confirmed in as quickly as 1-2 minutes from the time your each out to us for a price. Once we agree on a price, we fully take care of the settlement process by moving the coins you’re selling out of your Binance account and the coins you’re buying in… you don’t need to send coins anywhere.”

94. Since the launch of the Binance.com Platform, Binance provided OTC trading services through Merit Peak—a Zhou-owned entity—serving as the counterparty to customers on the Binance.com Platform, and Merit Peak also provided market making services on theBinance.US Platform.

B. Binance Holds and Controls Customers’ Funds and Crypto Assets.

95. To utilize any of the functionalities on the Binance.com Platform, investors must create and fund accounts with Binance. Customers must have sufficient assets in their accounts to cover the value of any trading order, plus applicable fees. Once customers have funded their Binance accounts, they can buy, sell, transfer, and store crypto assets on the platform.

96. Customers can establish and fund Binance accounts with fiat currency or crypto assets. There are separate procedures for depositing crypto assets and for depositing fiat currency. To deposit crypto assets, customers are required to transfer crypto assets from their own crypto asset wallets on the blockchain to wallets that Binance controls. Binance holds these customer crypto assets in omnibus wallets, and it tracks transactions on the Binance.com Platform on an internal ledger.

97. If a customer submits a request to withdraw crypto assets from the Binance.com Platform, Binance transfers the requested amount of crypto assets from its omnibus wallets to a wallet designated by the customer on the relevant blockchain.

98. Since at least 2018, Binance has also allowed customers to fund their accounts and purchase crypto assets with U.S. dollars or other fiat currencies by, among other things, linking credit cards through a third-party processor, or through bank accounts or payment services. It also has corresponding methods of permitting customers to withdraw in fiat.

99. Until at least 2021, accounts in the name of Binance entities, beneficially owned by Zhao, sent billions of dollars of customer assets to U.S.-based bank accounts in the name of Merit Peak, which transferred to Trust Company A all of those funds that appear to relate to the issuance of Binance’s stablecoin, called “BUSD.” The use of Merit Peak as an intermediary to transfer platform customer money to buy BUSD presented an undisclosed counterparty risk for investors.

C. Binance Clears and Settles Customers’ Trades.

100. Binance clears and settles all trades on the Binance.com Platform. After matching a buy and sell order, Binance settles the resulting trade by debiting and crediting the accounts associated with each of the counterparties on the internal ledger Binance maintains. Customer crypto assets generally stay in Binance-controlled omnibus wallets.

D. Binance’s Receives Compensation.

101. Binance’s revenue derives primarily from taking fees for transactions in crypto assets effected through the Binance.com Platform. For spot trading, Binance typically charges between 0.015 percent and 0.2 percent of the nominal value of transactions, depending on various parameters. Binance also charges fees for withdrawals and for trading on margin.

102. By 2021, its trading volume spiked to $9.58 trillion, making it the largest crypto asset trading platform in the world.

103. Between June 2018 and July 2021, Binance earned at least $11.6 billion in revenue, most of which derived from transaction fees.

E. Zhao and Binance Actively Solicited Investors in the United States to Trade Crypto Assets on the Binance.com Platform.

i. Binance Marketed its Services Worldwide, Including Specifically to U.S. Customers.

104. At least since the launch of the Binance.com Platform in 2017, Binance has regularly solicited customers in the United States—at first overtly and later furtively—to transact in crypto asset securities. Throughout, it has held itself out as being in the business of effecting transactions in many different crypto assets offered and sold as securities. It has engaged in this solicitation on a worldwide basis, including through its website, blog posts, and social media.

105. Among other things, Binance’s website has solicited “investors” and “traders” to “buy and sell crypto in minutes,” inviting them to “Trade. Anywhere.” Binance advertises theBinance.com Platform on its social media accounts, including on Facebook, Twitter, and Reddit, where it collectively has over 12 million followers, many of whom reside in the United States.

106. From the Binance.com Platform’s launch until at least September 2019, Binance overtly marketed its services to all customers and imposed no restrictions whatsoever on the ability of U.S. persons to buy, sell, and trade crypto assets on the Binance.com Platform. During this period, Binance opened tens of thousands of accounts for customers who submitted “Know Your Customer” (“KYC”) identity verification information that indicated they were based in the United States or who accessed the platform via Internet Protocol (“IP”) addresses indicating that they were physically located in the United States. Binance, and Zhao as its control person, knew that U.S. persons transacted on the Binance.com Platform.

107. In addition, until at least August 2021, Binance did not require customers whose accounts were limited to withdrawing two bitcoin per day to submit any KYC information, allowing those investors to bypass well-recognized international anti-money laundering restrictions and disclosures when seeking to open accounts on the Binance.com Platform.

108. Zhao and Binance regularly tracked customer activity on the Binance.com Platform and were thus aware that U.S. customers made up a substantial portion of Binance’s business. For example, in an August 2019 internal presentation, Binance estimated that theBinance.com Platform had over 1.47 million customers in the United States.

109. Moreover, by 2019, Binance had over 3,500 U.S. customers who were large-volume traders that Binance referred to as “VIPs.” These U.S. customers were important to Binance not only because they directly produced substantial revenues, but also because they provided substantial liquidity on the Binance.com Platform, which in turn encouraged other investors to trade on the platform.

ii. Zhao and Binance Developed a Plan to Evade U.S. Legal Scrutiny While Continuing to Profit from U.S. Investors.

110. Zhao and Binance understood that they were operating the Binance.com Platform in violation of numerous U.S. laws, including the federal securities laws, and that these ongoing violations presented existential risks to their business.

111. As Binance’s CCO bluntly admitted to another Binance compliance officer in December 2018, “we are operating as a fking unlicensed securities exchange in the USA bro.” (Emphasis added.)

112. In 2018, Zhao and Binance hired several advisors to advise them on managing their U.S. legal exposure. One of these advisors was a consultant who operated a crypto asset trading firm in the United States (“Binance Consultant”). In November 2018, the Binance Consultant proposed a plan to Zhao and Binance that involved the creation of a U.S. entity, which the Binance Consultant at the time dubbed the “Tai Chi” entity (“Tai Chi Plan”).

113. In presentations shared with Zhao and other Binance senior officials in November2018, the Binance Consultant warned against Binance continuing the “status quo” of unrestricted U.S. customer access to the Binance.com Platform, dubbing this a “high” risk due to potential U.S. “regulatory actions,” including actions by the SEC with respect to the “issuance of BNB to US Persons” and “for [operating an] unregistered securities brokerage.”

114. The Binance Consultant then discussed two alternative approaches for Zhao and Binance to consider. First, he discussed what he described as a “low” risk approach of “active outreach to regulators and resolve all potential issues,” but ultimately advised against this approach because, among other things, “settlement costs can be substantial” and could result in the “complete loss of the US market during the settlement process.”

115. Second, the Binance Consultant described a “moderate” risk approach in which Binance would establish a U.S. entity—the Tai Chi entity—that “will become the target of all built-up enforcement tensions,” “reveal, retard, and resolve built-up enforcement tensions,” and “insulate Binance from legacy and future liabilities.” The Binance Consultant recommended that Zhao and Binance adopt this approach, known as the Tai Chi Plan.

116. To implement the Tai Chi Plan, the Binance Consultant recommended that Binance brand a U.S. entity a Binance entity through a “franchise model” that would rely on Binance’s technology “by visualizing Binance as a technology vendor.”

117. He further recommended that Binance provide liquidity and market access from the Binance.com Platform to the proposed U.S. crypto asset platform established by the Tai Chi entity “through either affiliated . . . or contracted market makers.”

118. The Binance Consultant touted this approach as both “maintaining functional access to the US market,” and providing “license and services fees paid by the US Service Company to Binance” that “are functionally US-sourced trading fees.”

119. As another benefit to Binance, the Binance Consultant further recommended that Binance use the Tai Chi entity’s OTC trading services to provide “functional fiat capacity” – i.e., Binance could serve as an OTC counterparty on the U.S. platform to sell crypto assets for fiat currency, thereby giving Binance ready access to fiat currency without having to separately establish a bank account.

120. In addition, the Binance Consultant recommended steps to “insulate Binance from US Enforcement.” Those steps included having “key Binance personnel continue to operate from non-US locations to avoid enforcement risk” and ensuring that “cryptocurrency wallets and key servers continue to be hosted at non-US locations to avoid asset forfeiture.”

121. As to the SEC, the Binance Consultant also recommended that, “just for publicity,” the Tai Chi entity should “release a long and detailed Howey Test Asset-Evaluation Framework … to show Howey test sophistication” and then engage with the SEC to discuss the “formation or acquisition of a broker/dealer or alternative trading system (ATS), with no expectation of success and solely to pause potential enforcement efforts.” (Emphasis added.)

122. The Binance Consultant also recommended that Binance take steps to “reduce the attractiveness of enforcement” by U.S. regulators concerning the Binance.com Platform. This included publicly “restricting US persons’ access to the main Binance site” while privately encouraging U.S. customers to bypass these restrictions through the “strategic treatment” of virtual private networks (“VPNs”) that would disguise their locations and thereby “minimize the economic impact” of Binance’s public proclamations that it was prohibiting U.S investors on the platform.

123. Longer term, the Binance Consultant recommended the “eventual integration with Binance” by “acquiring the US operation at a nominal price and re-arranging its leadership when it has served its purposes.”

124. After considering the Tai Chi Plan, Zhao informed the Binance Consultant that Binance had also talked to U.S. law firms that proposed “a more conservative approach” that was “probably safer for now.” But Zhao made clear that he would “still very much like to continue to work with” the Binance Consultant, explaining, “There are elements from both of your proposals[] we may combine.” Zhao further noted that “having [a U.S. law firm] behind us reduces the personal exposure you take on as well.” Finally, Zhao emphasized to the Binance Consultant that they “should work together as a team.”

iii. Consistent with the Tai Chi Plan, Binance Encouraged and Assisted U.S. Customers to Circumvent Binance’s Supposed Restrictions.

125. In fact, Binance implemented much of the Tai Chi Plan. In addition to creating BAM Trading and the Binance.US Platform, Zhao and Binance implemented policies and controls to give the impression that the Binance.com Platform was blocking U.S. customers while at the same time secretly subverting those controls.

126. On June 14, 2019, Binance updated the Binance.com Platform’s “Terms of Use” to provide—for the first time—that U.S. customers were not permitted to trade on theBinance.com Platform. Binance further announced that it would begin implementing measures to block U.S. customers from trading or depositing assets on the platform after 90 days. Zhao and Binance timed this announcement to coincide with its announcement that an ostensibly independent U.S. entity, BAM Trading, would soon launch the Binance.US Platform.

127. But Zhao and Binance were unwilling to risk losing all of Binance’s U.S. business—particularly its VIP U.S. customers—on the well-established and more liquidBinance.com Platform. And so Zhao and Binance engaged in widespread covert efforts to permit U.S. customers to continue to trade on the platform.

128. First, Zhao directed Binance to implement a plan to encourage customers to circumvent Binance’s geographic blocking of U.S.-based IP addresses by using a VPN service to conceal their U.S. location. Second, Zhao directed Binance to encourage certain U.S.-based VIP customers to circumvent the new KYC restrictions by submitting updated KYC information that omitted any U.S. nexus.

129. As Zhao explained in a June 9, 2019 weekly meeting of senior Binance officials:

We don’t want to lose all the VIPs which actually contribute to quite a large number of volume. So ideally we would help them facilitate registering companies or moving the trading volume offshore in some way—in a way that we can accept without them being labeled completely U.S. to us.

130. Binance implemented Zhao’s instructions. On or about June 13, 2019, a Binance employee who belonged to a team that managed VIP customers messaged Zhao and other senior Binance officials, “We contacted 16 US top clients so far, some of them already have offshore entity, they said they can understand and they are happy that we can get ahead of that.” A few days later, Binance’s Chief Marketing Officer reported that the team had reached out to the top22 U.S. VIP customers and that 19 had “already agreed to change KYC, or change their IP.”

131. With respect to its thousands of other VIP U.S. customers, Zhao explained in a June 24, 2019 meeting with other Binance senior officials:

We do need to let users know that they can change their KYC onBinance.com and continue to use it. But the message, the message needs to be finessed very carefully because whatever we send will be public. We cannot be held accountable for it.

132. The following day, Zhao met with other senior Binance officials to discuss their VIP U.S. customers, and Zhao provided further instructions on crafting the message to customers about changing IP addresses or KYC documentation. During the meeting, the Binance CCO noted that Binance would engage in “the international circumvention of KYC,” and Zhao affirmed that his “goal” was “to reduce the losses to ourselves, and at the same time to make the U.S. regulatory authorities not trouble us.”

133. To that end, the Binance CCO drafted a “VIP Handling” document, dated June26, 2019, which included draft emails to send to VIP customers who were identified as having U.S. KYC documents or U.S. IP addresses, along with instructions to Binance employees about messaging to customers. For customers with U.S. KYC documents, the “VIP Handling” document instructed Binance employees to make sure the U.S. customers opened new accounts “with no US documents allowed” and to inform the customer “to keep this confidential.”

134. For customers with U.S. IP addresses, the “VIP Handling” document instructed Binance employees to “inform the user that the reason why he/she can’t use ourwww.binance.com is because his/her IP is detected as US IP; if user doesn’t get the hint, indicate that IP is the sole reason why he/she can’t use .com.” The document further instructed Binance employees not to “explicitly instruct user to use different IP. We cannot teach users how to circumvent controls. If they figure it out on their own, it’s fine.”

135. Binance continued to circumvent these controls for several years. On February12, 2020, for example, a Binance employee asked the Binance CCO whether it was still a “hard requirement” for Binance to block U.S. customers, and the Binance CCO replied:

136. Similarly, on July 15, 2020, a Binance VIP customer team member asked the Binance CCO how they could onboard a large U.S. customer. The Binance CCO replied, “The best way I can think of is to onboard with US exchange … but we let them trade on .com through a special arrangement.” He further explained, “[W]e ask them to onboard with US, and then if their volume is really very big … we will push hard on .com side to accept it on an exceptional basis … we always have a way for whales … either we do it, or [a competitor crypto trading platform] does it.” (“Whales” is a market term referring to large volume investors.)

137. The Binance CCO further admitted, “CZ will definitely agree to this lol … I have been briefed by top management to always find a way to support biz.”

138. Moreover, despite statements about its compliance efforts, Binance did not even require all customers to submit KYC documents until after August 2021. Around that time, Binance had over 62 million worldwide customers, but only approximately 25 million had submitted KYC documentation. Thereafter, more Binance.com Platform customers began submitting KYC documentation, but Binance continued to have large numbers of customers that still had not done so at least through mid-2022.

139. Binance’s plan to retain lucrative U.S. investors while pretending to restrict them was a success. For example, a March 2020 internal Binance presentation reported that theBinance.com Platform still had approximately 159 U.S. VIP customers, representing almost 70 percent of all global VIP trading volume. Similarly, in May 2021—two years after the launch of the Binance.US Platform—an internal Binance presentation reported that U.S. VIP customers still accounted for over 63 percent of the Binance.com Platform’s VIP customer trading volume.

140. U.S. customer trading volume on the Binance.com Platform included substantial activity trading in crypto asset securities. For example, between January 2019 and September2021, over 47,000 U.S. investors traded in BNB on the Binance.com Platform.

IV. ZHAO AND BINANCE ESTABLISHED THE BINANCE.US PLATFORM WHILE MAINTAINING SUBSTANTIAL INVOLVEMENT AND CONTROL OF ITS OPERATIONS.

141. In 2019, while continuing their efforts to covertly maintain U.S. VIP customers on the Binance.com Platform, Zhao and Binance also began implementing plans to launch a new crypto asset platform in the United States consistent with the Tai Chi Plan.

142. In March 2019, Binance’s Chief Financial Officer (“Binance CFO”) reaffirmed to Zhao that the “first goal” was “to protect [Binance].com from U.S. regulatory engagement.” Todo so, he noted that Binance “will need to launch” a new U.S. crypto asset platform, and that “the main goal for that one is to limit the loss of users from the U.S.”

A. Zhao and Binance Created U.S. Entities BAM Management and BAM Trading and Developed the Binance.US Platform.

143. In February 2019, Zhao and Binance directed the creation of two U.S. corporate entities that would launch the Binance.US Platform: BAM Management and BAM Trading.

144. Since inception, Zhao has been BAM Management’s beneficial owner, directly or indirectly owning between as much as 100 percent and approximately 81 percent of its equity.

145. BAM Trading is a wholly-owned subsidiary of BAM Management. BAM Trading is the public facing entity that operates the Binance.US Platform. As further set forth below, BAM Trading operates the Binance.US Platform as part of a group of persons with Binance, which plays a significant and integral role in the operation of the platform.

146. In June 2019, Zhao provided $500,000 in initial funding for the Binance.US Platform, and later he periodically injected additional funds, including through his entity Merit Peak. As of July 2020, Zhao had contributed over $16 million to finance the Binance.US Platform’s operations, money that was critical for the Binance.US Platform’s ongoing expenses.

147. At its inception, Zhao controlled BAM Trading’s business, which was largely operated by Binance employees under Zhao’s direction.

148. At Zhao’s direction, the Binance Consultant was hired to provide advice on “regulatory compliance” for the platform. The Binance Consultant had substantial involvement in the development and operation of the Binance.US Platform until at least the fall of 2019, primarily assisting in implementing the Tai Chi Plan he had proposed to Zhao.

149. Zhao, the Binance Consultant, and numerous Binance personnel working at Zhao’s direction developed and planned the launch of the Binance.US Platform. They designed and implemented all aspects of platform operations, including managing customer access, arranging fiat services with U.S. banks, establishing crypto asset wallets, developing a trading engine, and developing the platform’s trade clearing and settlement functions.

150. Zhao was also involved in the hiring of BAM Trading’s first Chief Executive Officer (“BAM CEO A”), who began her tenure in June 2019. At all times prior to her tenure with BAM Trading, which ended in or around March 2021, BAM CEO A reported to and was directed by Zhao and the Binance CFO. During this period, Zhao, BAM CEO A, and the Binance CFO constituted BAM Trading’s Board of Directors.

B. Binance Announced the Launch of the Binance.US Platform.

151. On June 13, 2019, Binance issued a press release announcing that BAM Trading would soon be launching the Binance.US Platform. Binance claimed that it had entered into a “partnership with BAM Trading … to launch trading services for users in the United States” by“ licensing its cutting-edge matching engine and wallet technologies to its U.S. partner BAM to launch Binance.US.”

152. Zhao was quoted in the press release, stating that “Binance.US will be led by our local partner BAM and will serve the U.S. market in full regulatory compliance.”

153. Consistent with the Tai Chi Plan, Binance’s press release coincided with updates to the Binance.com Platform’s Terms of Use that purported to prohibit U.S. investors. But Binance was careful not to make the link explicit. The same day the Binance.US Platform was announced, the Binance Consultant provided Binance internal guidelines advising that “on the US launch, it is important to NOT link it to the .COM IP blocking [of U.S. investors]. That would suggest both that Binance is aware of previous violation and that BAM and .COM are alter egos of each other coordinating the work.”

C. Zhao and Binance Exerted Substantial Control Over and Were Integral Participants in the Operations of the Binance.US Platform and BAM Trading.

154. Binance’s “partnership” with BAM Trading went beyond technology licensing. For example, during her tenure, BAM CEO A took direction from Zhao and Binance, and she referred to Binance as the “mothership.” BAM CEO A and other BAM Trading employees also provided weekly updates to Zhao and Binance concerning BAM Trading’s operations.

155. By July 2019, the Binance Consultant had crafted four purported “service-level agreements” between Binance and BAM Trading that governed their affiliation in operating the Binance.US Platform: a Master Services Agreement, a Wallet Custody Agreement, a Software License Agreement, and a Trademark Agreement (collectively, the “SLAs”).