2023年11月20日に提起されたSEC対Kraken訴訟の訴状の文字起こしです。機械翻訳用に括弧を削除してあります。

In support of its Complaint against Defendants Payward, Inc. (“Payward”) and Payward Ventures, Inc. (“Payward Ventures”), which collectively do business as “Kraken,” Plaintiff Securities and Exchange Commission (“SEC” or the “Commission”) alleges as follows:

Contents

- 1 I. SUMMARY

- 2 II. JURISDICTION AND VENUE

- 3 III. DIVISIONAL ASSIGNMENT

- 4 IV. DEFENDANTS

- 5 V. BACKGROUND

- 6 VI. FACTUAL ALLEGATIONS

- 6.1 A. Kraken’s Operations

- 6.2 B. Many of the Crypto Assets Available Through Kraken Are Securities

- 6.3 C. Kraken Was Required to Register with the Commission

- 6.4 D. Kraken’s Business Practices Create Heightened Risks for its Customers

- 6.5 E. Crypto Assets Securities Available Through Kraken

- 7 FIRST CLAIM FOR RELIEF Violations of Exchange Act Section 5 (Payward and Payward Ventures)

- 8 SECOND CLAIM FOR RELIEF Violations of Exchange Act Section 15(a) (Payward and Payward Ventures)

- 9 THIRD CLAIM FOR RELIEF Violations of Exchange Act Section 17A (Payward and Payward Ventures)

- 10 PRAYER FOR RELIEF

I. SUMMARY

1. Since 2013, Kraken has operated an online trading platform through which its customers can buy and sell crypto assets, many of which form the basis of investment contracts covered under U.S. securities laws. Without registering with the SEC in any capacity, Kraken has simultaneously acted as a broker, dealer, exchange, and clearing agency with respect to these crypto asset securities. In doing so, Kraken has created risk for investors and taken in billions of dollars in fees and trading revenue from investors without adhering to or even recognizing the requirements of the U.S. securities laws that are designed to protect investors.

2. Kraken’s business practices, deficient internal controls, and inadequate recordkeeping present a range of additional risks that would also be prohibited for any properly registered securities intermediary. For example, Kraken has at times held customer crypto assets valued at more than $33 billion, but it has commingled these crypto assets with its own, creating what its independent auditor had identified in its audit plan as “a significant risk of loss” to its customers. Similarly, Kraken has held at times more than $5 billion worth of its customers’ cash, and it also commingles some of its customers’ cash with some of its own. In fact, Kraken has at times paid operational expenses directly from bank accounts that hold customer cash. In addition, during 2023, the independent auditor determined that issues related to Kraken’s recordkeeping for customer custodial assets had resulted in material errors to Kraken’s financial statements for 2020 and 2021.

3. Congress enacted the Securities Exchange Act of 1934 (the “Exchange Act”) in part to provide for the regulation of the national securities markets. Congress charged the SEC with protecting investors, preserving fair and orderly markets, and facilitating capital formation. The SEC carries out these statutorily mandated goals in part through a series of registration, disclosure, recordkeeping, inspection, and anti-conflict-of-interest regulations. These regulations have generally led to the separation of key intermediaries in the securities markets⸺including the separation of brokers and dealers from exchanges and clearing agencies⸺thereby protecting investors and their assets from the conflicts of interest and risks that can arise when these functions merge. The SEC has also taken steps to protect investor assets when held by brokers or clearing agencies, including by issuing regulations that restrict the commingling of customer assets with those of the companies handling their investments.

4. By operating a platform on which crypto assets are offered and sold as investment contracts, Kraken’s operations place it squarely within the purview of U.S. securities laws. Over seventy years ago, the Supreme Court in SEC v. W.J. Howey Co., 328 U.S. 293 (1946), set forth the relevant test for determining whether an instrument is an investment contract subject to regulation under U.S. securities laws. And in July 2017, the Commission issued a public report reminding members of the public that crypto assets may be considered investment contracts subject to securities laws if they satisfy Howey’s test. The SEC has also enforced the relevant securities laws by bringing a range of enforcement actions based on the offer and sale of crypto assets as securities. Nonetheless, Kraken has turned a blind eye to its legal responsibilities and engaged in its securities intermediary conduct without registering with the Commission, depriving investors of the disclosures and protections that registration entails.

5. In failing to prevent known conflicts of interest and commingling its investors’ assets with its own, Kraken demonstrates why registration and the investor protections that come with regulatory oversight are critical to the soundness of the United States capital markets. Defendants have placed their own financial interests ahead of the legal obligations they owe to customers as securities intermediaries. By engaging in the conduct set forth in this Complaint, Defendants have acted as an exchange, a broker, a dealer, and a clearing agency without registration in violation of Exchange Act Sections 5, 15(a), and 17A(b) [15 U.S.C. §§ 78e, 78o(a), and 78q1(b)]. Unless Defendants are permanently restrained and enjoined, they will continue to violate these statutes.

6. The Commission brings this action pursuant to the authority conferred upon it by Exchange Act Section 21(d) [15 U.S.C. § 78u(d)].

7. The Commission seeks a final judgment: (i) permanently enjoining Defendants from violating Sections 5, 15(a), and 17A of the Exchange Act [15 U.S.C. §§ 78e, 78o(a), and 78q-1(b)(1)]; (ii) ordering Defendants to disgorge their ill-gotten gains, on a joint and several basis, and to pay prejudgment interest thereon; (iii) permanently enjoining Defendants from acting as an unregistered exchange, broker, dealer, or clearing agency; and (iv) imposing civil money penalties on Defendants.

II. JURISDICTION AND VENUE

8. The Court has jurisdiction over this action pursuant to Section 21(d) of the Exchange Act, 15 U.S.C. § 78u(d).

9. Defendants, directly or indirectly, have made use of the means or instrumentalities of interstate commerce, of the mails, or of the facilities of an exchange within or subject to the jurisdiction of the United States in connection with the transactions, acts, practices, and courses of business alleged in this Complaint.

10. Venue is proper in this district pursuant to Section 27(a) of the Exchange Act, 15 U.S.C. § 78aa(a), because certain of the transactions, acts, practices, and courses of conduct constituting violations of the federal securities laws occurred within this district. In addition, venue is proper because Defendants are headquartered in this district.

III. DIVISIONAL ASSIGNMENT

11. Under Civil Local Rule 3-2(d), this case should be assigned to the San Francisco Division or the Oakland Division because a substantial part of the events or omissions that give rise to the claims alleged herein occurred in San Francisco County.

IV. DEFENDANTS

12. Payward is a Delaware corporation founded in 2011, with an address in San Francisco, CA. Payward has a number of wholly owned subsidiaries headquartered throughout the world, including Payward Ventures, Inc. Payward and most of its subsidiaries do business as Kraken. Payward has never registered with the Commission in any capacity.

13. Payward Ventures is a Delaware corporation founded in 2013, with an address in San Francisco, CA. Payward Ventures has never registered with the Commission in any capacity. On February 9, 2023, the SEC filed a settled action against Payward Ventures in connection with the unregistered offer and sale of Kraken’s staking-as-a-service program. See SEC v. Payward Ventures, Inc., No. 3:23-cv-588 (N.D. Cal.).

V. BACKGROUND

14. Kraken is subject to the laws and regulations governing the U.S. securities markets because many of the crypto assets bought and sold through its platform are offered, bought, and sold as investment contracts. As discussed below, investment contracts are defined broadly under the law with a focus on an investor’s reasonable expectations in acquiring an asset, rather than the form of the transaction itself. Moreover, Kraken has long been on notice that its role in the offer and sale of crypto assets as investment contracts made it subject to U.S. securities laws.

A. Statutory and Legal Framework Regarding the Scope of U.S. Securities Regulations

15. As the Supreme Court has recently reemphasized, the Exchange Act and the Securities Act of 1933 (“Securities Act”) “form the backbone of American securities laws.” Slack Tech., LLC v. Pirani, 598 U.S. 759, 762 (2023). Together, these acts provide for the regulation of various entities involved in the purchase and sale of securities and define “security” broadly to include a wide range of assets, including “investment contracts.” Securities Act § 2(a)(1) [15 U.S.C. § 77b(a)(1)]; Exchange Act § 3(a)(10) [15 U.S.C. § 78c(a)(10)].

16. Investment contracts are instruments through which a person invests money in a common enterprise and reasonably expects profits or returns derived from the entrepreneurial or managerial efforts of others. As the United States Supreme Court noted in Howey, Congress defined “security” broadly to embody a “flexible rather than a static principle, one that is capable of adaptation to meet the countless and variable schemes devised by those who seek the use of the money of others on the promise of profits.” 328 U.S. at 299. Following Congress’s intent, courts have found novel or unique investment vehicles to be investment contracts, including those involving orange groves, animal breeding programs, cattle embryos, mobile phones, enterprises that exist only on the internet, and crypto assets.

17. To protect investors and fulfill the purposes of the Exchange Act, Congress imposed registration and disclosure obligations on certain defined participants in the national securities markets, including but not limited to brokerdealers, exchanges, and clearing agencies. The Exchange Act empowers the SEC to write rules to, among other things, protect investors who use the services of those participants and provide for stability of the nation’s securities markets.

B. Crypto Assets and Crypto Trading Platforms

1. Crypto Assets

18. As used herein, the terms “crypto asset,” “digital asset,” or “token” generally refer to an asset issued and/or transferred using blockchain or distributed ledger technology, including assets referred to colloquially as “cryptocurrencies,” “virtual currencies,” and digital “coins.”

19. A blockchain or distributed ledger is a database spread across a network of computers that records transactions in theoretically unchangeable, digitally recorded data packages, referred to as “blocks.” These systems typically rely on cryptographic techniques to secure recording of transactions.

20. Some crypto assets are “native” to a particular blockchain, meaning that they are the blockchain’s core asset that is integral to how the blockchain functions. In contrast, other crypto assets may be non-native and are built on top of an existing blockchain.

21. Some crypto assets may provide a holder with certain pre-determined rights, coded into the software itself, such as the right to “burn” (or destroy) the asset in order to propose transactions on the asset’s blockchain, or to interact with other portions of the blockchain’s existing or yet-to-be-developed protocols and software.

22. Crypto asset owners typically store key information about their crypto assets on a piece of hardware or software called a “crypto wallet.” The primary purpose of a crypto wallet is to store the “public key” and the “private key” associated with a crypto asset so that the user can make transactions on the associated blockchain. The public key is colloquially known as the user’s blockchain “address” and can be freely shared with others. The private key is analogous to a password and confers the ability to transfer a crypto asset. Therefore, whoever controls the private key controls the crypto asset associated with that key. Crypto wallets can reside on devices that are connected to the internet (sometimes called “hot wallets”), or on devices that are not connected to the internet (sometimes called “cold wallets” or “cold storage”). Although, all wallets are at risk of being compromised or “hacked,” hot wallets are at greater risk because their internet connectivity makes them easier to access remotely.

23. Crypto assets can be transferred directly on the relevant blockchain or through a third-party intermediary. The transfer of a crypto asset from one person to another that is verified and recorded on the relevant blockchain’s publicly-available ledger is known as an “on-chain” transaction. The reliability of on-chain crypto asset transfers is one of the core functionalities of blockchain technology, as described in Section B.2 below.

24. Crypto asset transactions that occur without being submitted to, verified, or recorded on a blockchain are known as “off-chain” transactions. For example, the transfer of crypto assets between two customers on the same centralized trading platform, such as Kraken’s, is an off-chain transaction.

2. Consensus Mechanisms and Validation of Transactions on a Blockchain

25. Blockchains typically employ a “consensus mechanism” that, among other things, aims to achieve agreement among users as to a data value or as to the state of the ledger.

26. A consensus mechanism describes the particular protocol used by a blockchain to agree on, among other things, which ledger transactions are valid, when and how to update the blockchain, and whether to compensate certain participants for validating transactions and adding new blocks. There can be multiple compensation sources for consensus mechanisms under the terms of the blockchain protocol, including from fees charged to those transacting on the blockchain, or through the creation or “mining” of additional amounts of the blockchain’s native crypto asset.

27. “Proof of work” and “proof of stake” are two of the most prevalent consensus mechanisms used by blockchains. Proof of work, the mechanism used by the Bitcoin blockchain, involves a network of computers, known as “miners,” expending computational effort to guess the value of a predetermined number. The first miner to successfully guess this number earns the right to update the blockchain with a block of transactions and is rewarded with the blockchain’s native crypto asset. Proof of stake, the consensus mechanism currently used on the Ethereum blockchain, involves selecting “validators” from a network of crypto asset holders who have committed or “staked” a minimum number of crypto assets.

3. The Offer and Sale of Crypto Assets

28. Persons have offered and sold crypto assets in capital-raising events in exchange for consideration, including but not limited to through so-called “initial coin offerings” or “ICOs,” “crowdsales,” or public “token sales.” In some instances, the entities offering or selling the crypto assets may release a “whitepaper” or other marketing materials describing a project to which the asset relates, the terms of the offering, and any rights associated with the asset.

29. Some issuers continue to sell the crypto assets after the initial offer and sale, including directly or indirectly by selling them on crypto asset trading platforms.

4. Crypto Asset Trading Platforms

30. Crypto asset trading platforms—like Kraken’s—are marketplaces that offer a variety of services relating to crypto assets, often including brokerage, trading, custody, and settlement services.

31. Crypto asset trading platform interfaces—like Kraken’s—also look similar to traditional custodial securities brokerage platforms. Whether web-, desktop-, or mobile-based, application programming interfaces (APIs), or other software, these crypto asset trading platform interfaces typically emulate those offered within the traditional securities markets: they show order books of the various assets available to trade and historical trading information like high and low prices, trading volumes, and capitalizations which serve in part to help investors recognize market opportunities.

32. Crypto asset trading platforms allow their customers to deposit fiat (legal tender issued by a country) into bank accounts and crypto assets into crypto wallets controlled by the platform, and then to purchase and sell crypto assets for fiat or other crypto assets. These transactions can be finalized on-chain, with the intermediary transferring the purchased crypto asset from the seller’s account to the buyer’s crypto wallet. Or, if the purchaser has an account with the intermediary and customer assets are stored collectively in what is called an omnibus wallet, then the transactions can be finalized off-chain, with the platform recording the necessary debits and credits internally, without having to transfer crypto assets from one blockchain address to another.

33. By possessing and controlling the fiat and crypto assets deposited and/or traded by their customers, crypto asset trading platforms function as central depositories.

34. However, unlike in traditional securities markets, crypto asset trading platforms (including that of Kraken) perform various other functions, in that they also typically solicit, accept, and handle customer orders for securities; allow for the interaction and intermediation of multiple bids and offers resulting in purchases and sales; act as an intermediary in making payments or deliveries, or both; and maintain a central securities depository for the settlement of securities transactions.

35. By contrast, a registered national securities exchange submits information regarding executed trades to a registered clearing agency that takes responsibility for ensuring settlement finality and safekeeping of the assets being traded and, in doing so, protects investors’ interests. Thus, registered national securities exchanges typically do not assume possession or control of the underlying assets being traded. Moreover, crypto asset trading platforms usually settle transactions by updating internal records with each investor’s positions, a function typically carried out by clearing agencies and broker-dealers in compliant securities markets.

36. Likewise, crypto asset trading platforms typically perform roles traditionally assigned to broker-dealers in compliant securities markets, such as effecting securities transactions on behalf of their customers, without the platforms following or even acknowledging the legal obligations and restrictions on activities that accompany status as a broker-dealer.

C. The SEC’s “DAO Report”

37. On July 25, 2017, the SEC issued the Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO (the “DAO Report”), advising “those who would use … distributed ledger or blockchain-enabled means for capital raising[] to take appropriate steps to ensure compliance with the U.S. federal securities laws,” and finding that the offering of crypto assets at issue in the DAO Report were offerings of securities.

38. The DAO Report also advised that “any entity or person engaging in the activities of an exchange must register as a national securities exchange or operate pursuant to an exemption from such registration,” and “stressed the obligation to comply with the registration provisions of the federal securities laws with respect to products and platforms involving emerging technologies and new investor interfaces.” The DAO Report also found that the trading platforms at issue there “provided users with an electronic system that matched orders from multiple parties to buy and sell [the crypto asset securities at issue] for execution based on nondiscretionary methods” and therefore “appear to have satisfied the criteria” for being an exchange under the Exchange Act.

VI. FACTUAL ALLEGATIONS

A. Kraken’s Operations

39. In 2013, Kraken launched its “Kraken Trading Platform,” which allows customers to buy and sell crypto assets through an online market. On its website, Kraken describes the Kraken Trading Platform as “one of the world’s largest digital asset exchanges” and advertises that it has more than nine million retail and institutional customers located in over 190 countries.

40. With the launch of the Kraken Trading Platform, Kraken also began providing services for customers to open accounts, deposit funds, enter orders, and trade crypto assets (“Kraken Services”).

41. Today, Kraken’s Trading Platform resembles those found in the traditional securities industry with a matching engine, customer interface applications, a range of order types, and advanced trading tools. From its start in 2013 to the present (the “Relevant Period”), the Kraken Trading Platform and Kraken Services have evolved into an expansive online trading operation that lists more than 220 crypto assets and permits margin trading while offering securities trading services such as an over-the-counter trading desk (“OTC Desk”), “instant buy” features, and multiple applications and pathways for customers to interface with the Kraken Trading Platform and Kraken Services.

42. Through the Kraken Trading Platform and Kraken Services, Kraken facilitates transactions in crypto assets in multiple ways. This includes: (1) allowing customers to submit orders for crypto assets and operating a system that attempts to match those orders; (2) opening and maintaining customer accounts and holding funds and crypto assets that have been transferred to or purchased through Kraken by customers; (3) operating “Instant Buy,” where Kraken acts as the counterparty for a customer’s request to buy or sell crypto assets; (4) operating the OTC Desk, which facilitates large crypto asset orders; (5) operating applications that allow customers to access their accounts and place and direct orders; and (6) offering margin lending for trading in crypto assets on the Kraken Trading Platform.

43. In 2020 and 2021 together, Kraken earned more than $43 billion in revenue from trading-based transactions, including from fees charged to customers, sales of crypto assets to customers, and proprietary trading.

44. The Kraken Trading Platform and Kraken Services are available to both retail and institutional customers, including to customers inside and outside the United States.

45. The Kraken Trading Platform’s servers are located in the United States, and are the means through which the platform operates a single set of order books and a matching engine. Kraken does not segregate or segment the order books based on geography or local operating entity.

46. Payward utilizes a single set of Terms of Service to cover the Kraken Trading Platform and Kraken Services. According to Kraken’s Terms of Service, the Kraken Trading Platform and Kraken Services are offered through “local operating entities,” which are wholly owned subsidiaries of Payward. For customers residing in the United States, the local operating entity is Payward Ventures.

47. Despite the geographic designations referenced in the Terms of Service, Payward’s operations are not geographically segregated, allowing U.S. customers to trade crypto assets regardless of where Kraken’s operations occur. Personnel of various local operating entities are cross-staffed according to product or service (not by region) and report to Payward executive management. For example, personnel of the Kraken Trading Platform and OTC Desk ultimately report to Payward’s chief operating officer. Payward’s current and former chief executive officers participated in promotional videos and media interviews promoting the Kraken Trading Platform. Moreover, Payward’s marketing materials to venture capital investors do not differentiate between Payward and these local operating entities.

48. The crypto assets made available for trading on the Kraken Trading Platform and through the Kraken Services may be bought, sold, or exchanged for consideration, including U.S. dollars, other fiat currencies, or other crypto assets.

49. Each unit of a particular crypto asset on the Kraken Trading Platform trades at the same price as another unit of that same crypto asset.

50. These crypto assets are interchangeable (e.g., any “FIL” crypto asset or fraction thereof is just like any other FIL crypto asset) on the Kraken Trading Platform. Accordingly, to the extent the assets change in price on the Kraken Trading Platform, all tokens of the same asset increase or decrease in price in the same amounts and to the same extent, such that one token is equal in value to any other one token, on a pro rata basis.

51. However, investors may buy or sell crypto assets through the Kraken Services at prices different than the contemporaneous price on the Kraken Trading Platform. For example, Kraken may sell to an investor a crypto asset through its Instant Buy feature at a different price then the last executed trade or current offer on the Kraken Trading Platform.

52. Nevertheless, the purchase of any particular unit of a crypto asset does not appear to give an investor any special rights not available to any other investor in that crypto asset, such as separately managed accounts, or different capital appreciation as to the value of that crypto asset. This includes assets purchased on the Kraken Trading Platform and assets purchased through the Instant Buy feature.

53. The crypto assets on the Kraken Trading Platform are available for sale broadly to any person who creates an account with Kraken. Kraken applications display information (like asset price changes) in a format highly similar to trading applications offered by registered broker-dealers in the traditional securities markets. Kraken makes these crypto assets available for trading without restricting transactions to those who might acquire or treat the asset as something other than as an investment.

54. Kraken customers can access asset-specific webpages from the “Crypto Prices” page on Kraken’s website. There, customers can click on the name of a particular crypto asset and are redirected to a page where Kraken provides additional information about that crypto asset. The information on each asset-specific page includes: (i) an “about” section describing the crypto asset; (ii) a “who created” section describing the team of people who created or launched the crypto asset and are developing the network for the crypto asset; (iii) a “how does it work” section that describes the protocol and blockchain for the crypto asset and any parameters or characteristics of the crypto asset; (iv) a roadmap section describing the anticipated development of the crypto network or project; (v) a section describing various analysts assessments about the future price of the crypto asset; (vi) historical information about the “price” of the asset including its “all-time high” price during the past year and the “price change” over the last 24 hours and the last year stated as a percentage return change; (vii) a link to another page about the crypto asset to “learn more about” it; (viii) links to purchase the crypto asset on the Kraken Trading Platform or through the Kraken Services and a description of the other crypto assets owned by owners of the particular crypto asset, and (ix) information specifically promoting a purchase of the asset as an investment into the asset’s promoter’s efforts to develop, create, grow, and/or maintain the asset’s ecosystem in the hope that this will increase the asset’s value.

55. Because Kraken has not registered as a broker, dealer, national securities exchange, or clearing agency, there is no formal mechanism to ensure the accuracy or consistency of the information Kraken selectively discloses about the crypto assets it makes available for trading or about its own operations.

56. Kraken does not restrict how many units of a crypto asset any given investor may purchase. Moreover, investors are not required to purchase quantities tied to a purported non-investment “use” that may exist for the asset, if any. To the contrary, investors may purchase crypto assets in any amount and for any purpose.

57. The crypto assets made available for trading on the Kraken Trading Platform and through the Kraken Services are transferable and immediately eligible for resale on the Kraken Trading Platform and through the Kraken Services (both subject to settlement) without any apparent restrictions on resale (including as to the prices or amounts of resale, or the identity of the new buyers).

B. Many of the Crypto Assets Available Through Kraken Are Securities

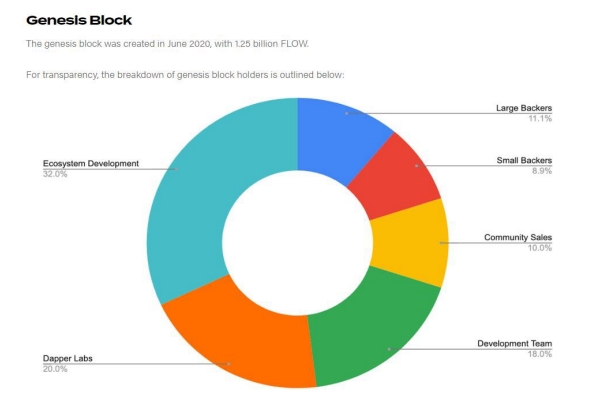

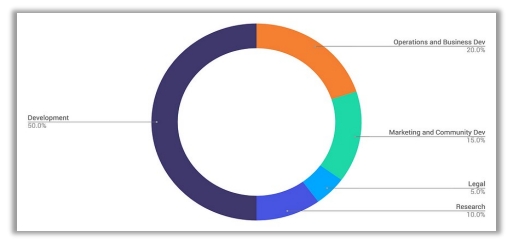

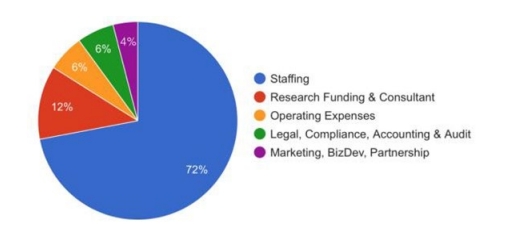

58. Throughout the Relevant Period, Kraken has made available for trading many “crypto assets securities.” These crypto asset securities are investment contracts represented by the underlying crypto asset. In fact, Kraken currently makes available for trading crypto assets that have been the subject of prior SEC enforcement actions based upon their status as crypto asset securities, including crypto assets trading under the symbols ADA, AXS, ALGO, ATOM, CHZ, COTI, DASH, FIL, FLOW, ICP, MANA, MATIC, NEAR, OMG, SAND, and SOL, which were alleged in one or more of the following actions against other unregistered intermediaries: SEC v. Bittrex, No. 2:23-cv-580 (W.D. Wash. filed April 17, 2023); SEC v. Binance Holdings Ltd., Civ. No. 23-1599 (D.D.C. filed June 5, 2023); SEC v. Coinbase, Inc., No. 23-cv-4738 (S.D.N.Y. filed June 6, 2023).

59. For purposes of prevailing on the Exchange Act claims set forth herein, the SEC need only establish that Kraken has engaged in regulated activities relating to a single crypto asset security during the Relevant Period. Nevertheless, set forth herein are details regarding a non-exhaustive list of 11 crypto asset securities available on the Kraken Trading Platform and through the Kraken Services under the following trading symbols: ADA, ALGO, ATOM, FIL, FLOW, ICP, MANA, MATIC, NEAR, OMG, and SOL (the “Kraken-Traded Securities”).

60. Each of these Kraken-Traded Securities was offered and sold on the Kraken Trading Platform or through the Kraken Services during the Relevant Period.

61. Each of the Kraken-Traded Securities was offered and sold as part of an investment contract.

62. Based on the public statements of their respective issuers and promoters—at least some of which were rebroadcast by Kraken itself on the Kraken Trading Platform—a reasonable investor would have understood the offer and sale of each of the Kraken-Traded Securities as offers and sales of investment contracts. Specifically, purchasers of the Kraken-Traded Securities would reasonably have expected to profit from the efforts of these issuers and promoters to grow and maintain the technology platforms and blockchain ecosystems associated with these crypto assets because such growth or operations could in turn increase the price of the underlying crypto asset and/or provide increased value to holders of the Kraken-Traded Securities.

63. Further, the economic reality of the offerings as presented by their respective issuers and promoters—and rebroadcast by Kraken itself—would have indicated to a reasonable investor that future profits through the increased value of the Kraken-Traded Securities would come through the efforts of these issuers and promoters.

64. In light of the ongoing statements and efforts of these issuers and promoters, such as those set forth below, this expectation would have persisted whether the investor acquired the Kraken-Traded Securities from the issuer or from other investors.

65. For example, FIL is the native crypto token of the Filecoin network, a self-described open-source data storage network that runs on a blockchain created by Protocol Labs, Inc. Protocol Labs conducted initial sales of FIL in 2017, saying the sales “raised the funding necessary to grow our team, to create the network, and build all the software tools needed to operate and use the network.” Underscoring the aligned financial incentives between the network and the FIL token, Protocol Labs publicly stated, “Filecoin success will reward the investment of supporters like you by simultaneously driving down the cost of storage and increasing the value of the Filecoin tokens that incentivize miners to provide storage.”

66. FIL has been available for purchase and sale on the Kraken Trading Platform and through the Kraken Services since October 2020. And Kraken’s own public statements about FIL have since reinforced the expectation of profits from an investment in FIL due to the managerial efforts of Protocol Labs. As Kraken has stated on its website: “If the Filecoin network grows and more users trust it with their data, and more miners supply disk-space, then the amount of transactions requiring FIL should grow. The price of FIL should rise since the amount of FIL available is limited.”

67. Section V.E of this Complaint provides further allegations specific to the 11 Kraken-Traded Securities, detailing the development of these crypto assets and the public statements and economic realities based upon which reasonable investors would have expected to profit from these crypto assets.

C. Kraken Was Required to Register with the Commission

68. Because the crypto assets available through the Kraken Trading Platform and the Kraken Services included crypto asset securities traded as investment contracts, Kraken was subject to U.S. securities laws.

69. As previously noted, to fulfill the purposes of the Exchange Act, Congress imposed registration and disclosure obligations on certain defined participants in the national securities markets, including but not limited to brokers, dealers, exchanges, and clearing agencies.

70. During the Relevant Period, Kraken acted as an exchange, broker, dealer, and clearing agency with respect to crypto asset securities.

71. Nonetheless, Kraken has never registered with the Commission as a national securities exchange, broker, dealer, or clearing agency. Moreover, there is no exemption from registration with the Commission that would apply to Kraken.

1. Kraken Failed to Register as a National Securities Exchange

a. Registration of Exchanges

72. In enacting registration provisions for national securities exchanges, Congress found in Section 2(3) of the Exchange Act [15 U.S.C. §78b(3)] that:

Frequently the prices of securities on such exchanges and markets are susceptible to manipulation and control, and the dissemination of such prices gives rise to excessive speculation, resulting in sudden and unreasonable fluctuations in the prices of securities which (a) cause alternately unreasonable expansion and unreasonable contraction of the volume of credit available for trade, transportation, and industry in interstate commerce, (b) hinder the proper appraisal of the value of securities and thus prevent a fair calculation of taxes owing to the United States and to the several States by owners, buyers, and sellers of securities, and (c) prevent the fair valuation of collateral for bank loans and/or obstruct the effective operation of the national banking system and Federal Reserve System.

73. Accordingly, Section 5 of the Exchange Act [15 U.S.C. § 78e] requires an organization, association, or group of persons that meets the definition of “exchange” under Section 3(a)(1) of the Exchange Act, unless otherwise exempt, to register with the Commission as a national securities exchange pursuant to Section 6 of the Exchange Act.

74. Section 3(a)(1) of the Exchange Act [15 U.S.C. § 78c(a)(1)] defines “exchange” to mean “any organization, association, or group of persons, whether incorporated or unincorporated, which constitutes, maintains, or provides a market place or facilities for bringing together purchasers and sellers of securities or for otherwise performing with respect to securities the functions commonly performed by a stock exchange as that term is generally understood, and includes the market place and the market facilities maintained by such exchange.”

75. Exchange Act Rule 3b-16(a) [17 C.F.R. § 240.3b-16(a)] further defines certain terms in the definition of “exchange” under Section 3(a)(1) of the Exchange Act, including “an organization, association, or group of persons,” as one that: “(1) brings together the orders for securities of multiple buyers and sellers; and (2) uses established, non-discretionary methods (whether by providing a trading facility or by setting rules) under which such orders interact with each other, and the buyers and sellers entering such orders agree to the terms of a trade.”

76. Registration of a trading platform as an “exchange” under the Exchange Act is a bedrock Congressional requirement that permits the SEC to carry out its role overseeing the national securities markets.

77. For example, registered exchanges must enact rules that, as required by Section 6 of the Exchange Act, are “designed to prevent fraudulent and manipulative acts and practices, to promote just and equitable principles of trade … and, in general, to protect investors and the public interest.”

78. These rules are subject to review by the SEC under Section 19 of the Exchange Act [15 U.S.C. § 78s], both at the time of initial registration and subsequently whenever the exchange wishes to add, delete, or amend a rule. This review process is designed to ensure that securities marketplaces operate in a manner consistent with the Exchange Act as their practices and procedures evolve over time and to protect investors and the integrity of securities markets that affect national commerce and the economy.

b. Kraken Operates an Unregistered Securities Exchange

79. During the Relevant Period, Kraken used means and instrumentalities of interstate commerce to bring together the orders of multiple buyers and sellers of crypto asset securities, including the Kraken-Traded Securities. Using a trading facility programmed with non-discretionary rules under which orders interact, Kraken connected these buyers and sellers to agree upon terms for trades in these securities. As a result, Kraken maintained and provided a marketplace for bringing together buyers and sellers of securities. Kraken was therefore required to register with the Commission as a national securities exchange or operate pursuant to an exemption to such registration but failed to do so.

80. The Kraken Trading Platform makes available to its customers more than 220 crypto assets, including crypto asset securities, for trading.

81. Kraken operates the Kraken Trading Platform through the use of a “trading engine” that matches customer orders based, in part, on price and time priority.

82. Orders are stored in Kraken’s central limit order book, a common functionality for many exchanges that tracks the price, size, time of submission, and other characteristics of each submitted order. Kraken maintains a separate order book for each crypto asset trading pair.

83. Kraken not only engaged in the conduct of a securities exchange, it described itself as one. Kraken describes its operations, the Kraken Trading Platform, and the Kraken Services using terms from securities laws and the securities industry. For example, Kraken calls its Trading Platform an “Exchange” or the “Kraken Exchange.”

84. According to a document prepared by Kraken’s finance department in September 2022:

The trading platform (the “Exchange” or “Kraken Exchange”) allows institutional and retail investors (the ‘customers’) to purchase, sell or exchange [a crypto asset] for another [crypto asset] or fiat currency. Customers can initiate a limit order, market order, and certain other order types similar to those available on a traditional commodities or stock exchanges. Kraken then fills those orders using an internally developed matching algorithm that allows multiple order transactions being matched amongst each other.

85. Kraken further acted as an exchange by: (i) handling customer applications, order entries, and displaying order information; (ii) offering a variety of order types; (iii) charging fees per executed order; and (iv) matching the orders of buyers and sellers.

i. Customer Applications, Order Entry, and Display

86. Kraken allows customers to enter orders to trade on the Kraken Trading Platform via Kraken’s customer applications or an API. An API is a software intermediary permitting two programs to communicate.

87. Kraken itself also may enter orders into the Kraken Trading Platform as principal and be a counterparty to trades against customers. Customers are not provided with any disclosures as to whether the counterparty to their trade on the Kraken Trading Platform is another Kraken customer or Kraken acting as principal, or any additional protections when Kraken is acting as principal.

88. Through Kraken’s customer applications or API, Kraken customers can place a variety of buy and sell orders for crypto assets, including crypto asset securities. Through the Kraken Trading Platform, Kraken then matches the orders of buyers and sellers with each other.

89. Kraken provides customers with a live feed of Kraken’s order book—which shows bids and offers for each crypto asset available for trading on the platform—as well as a crypto asset’s trading history on the Kraken Trading Platform. A customer may also view their own account information, including the customer’s trade history, and the prices and sizes of its executed trades.

90. Kraken has multiple customer applications, including web, mobile, and desktop applications. Some are designed to be “beginner friendly,” and others are designed for a “professional trading experience.”

91. The “professional” style applications offer features that mimic trading terminals offered or used by registered securities intermediaries. For example, Kraken advertises its “Kraken Pro” application as “a one-stop destination for advanced crypto traders” that is “fully equipped with must-have advanced trading tools and features, addressing all your trading needs in one place,” where traders can “identify trades with full-featured charting, technical indicators and compare up to 4 markets at once” as well as “monitor the action with live order books and streaming trades.”

92. From 2017 until it was retired on September 30, 2023, Kraken offered an application named Cryptowatch which it described as a “premium trading terminal.” Through Cryptowatch, Kraken provided “trading services for over 25 cryptocurrency exchanges,” including the Kraken Trading Platform. Cryptowatch, among other things, allowed Kraken customers to place orders on “multiple crypto exchanges from a single platform.” For example, Kraken customers who were also customers of one of those “exchanges” could place orders on that trading platform using the Cryptowatch application’s automated connection.

93. Kraken’s website (www.Kraken.com) also functioned as a web-based application providing customers with an interface for trading crypto assets on the Kraken Trading Platform. A tab or link on the Kraken website called “Markets” led customers to a page listing the current price for the hundreds of crypto assets available for trading on the Kraken Trading Platform, and also displayed the high and low price for each asset over the previous 24 hours, the percentage change in price during that same period, and the total value of all trading of that asset that occurred over that period.

94. The crypto assets listed on the “Markets” page were listed by full name and trading symbol and displayed in descending order from largest to smallest based on the previous 24-hour trading volume. The “Markets” page also displayed approximately five crypto assets under the category of “trending” for those assets that had the highest volume of trading over the previous 24 hours and those that had the highest percentage of gains or losses in value over that same period.

95. Another tab or link on the Kraken Trading Platform website called “Trade” led visitors to a listing of the order book for the various crypto assets available for trade on the platform. One side of the order book displays the current buy orders in descending order from highest bid price to lowest while the other side of the order book displays the sell orders in ascending order from lowest asking price to the highest.

96. The “Trade” page also displayed a “price chart” graph for the selected crypto asset which reflects the trading volume of the token over a selected period of time (i.e., 1 day, 5 days, 1 month, 3 months, 6 months, 1 year, 5 years) and a “depth chart” graph which displayed the current “mid-market price” (i.e., the middle point between the highest bid price and lowest asking price for a particular asset) and the “spread” (i.e., the difference between the highest bid and lowest asking price) for that asset.

ii. Order Types

97. Kraken offers the ability for buyers and sellers to place multiple order types, including but not limited to, market (trade at the best available price in the order book), limit (trade at a specified price or better), stop loss (market order triggered at the stop price), take profit (market order entered when last traded price reaches a specified price), and settle position (closes a customer’s margin position).

98. Kraken requires customers, when submitting orders, to input various parameters, including those similar to parameters used in trading non-crypto securities: crypto asset trading symbol, size, price, and order type. Customers may also place automated, algorithmic trades using Kraken’s APIs.

99. Kraken offers certain customers the ability to trade using margin on the Kraken Trading Platform. Kraken extends margin credit (from its proprietary inventory) to these customers for buying and selling certain crypto assets, including crypto asset securities. Kraken charges percentage-based fees for opening a leveraged position as well as for maintaining a leveraged position.

100. Unless trading on margin, a Kraken customer must have an available balance of the relevant crypto asset or fiat currency in their account to cover the total value of the order plus any applicable fees.

101. All orders are stored in Kraken’s order book.

iii. Fees

102. Similar to brokers and exchanges in the traditional securities markets, Kraken charges a fee or commission on each executed trade.

103. Kraken’s transaction-based fees vary depending on the trading pair, a user’s 30-day trading volume, and other factors.

104. Kraken’s website states: “Trading fees are reduced according to the USD value of [the customer’s] total volume traded by [a customer’s] account over the previous 30 days.” Kraken’s website states that Kraken “rewards users who drive liquidity to Kraken” and “the more you trade, the more you save.”

105. More specifically, Kraken uses a maker-taker fee schedule with volume incentives based on the customer’s previous 30-day activity. In a maker-taker model, an executed order that takes liquidity is charged a fee, while the resting order that makes liquidity (the order against which the taker order executes) is given a rebate, which is generally less than the amount of the taker fee, allowing the platform to keep the difference.

106. Kraken’s maker fee ranges from 0.00% to 0.16% of the principal amount traded, depending on the trader’s 30-day volume.

107. The taker fee ranges from 0.10% to 0.26% of the principal amount traded, depending on the trader’s 30-day volume. Kraken deducts the taker fee for each transaction from the customer’s Kraken account.

iv. Order Matching

108. The Kraken Trading Platform matches the orders of buyers and sellers pursuant to rules that Kraken has programmed into its matching engine.

109. After a buyer or seller enters an order, Kraken’s software performs certain checks, such as for erroneous order conditions, disruptive pricing, self-trading and other violations of Kraken policies, and ensures that the customer has sufficient funds (in the form of crypto assets, fiat currency, or margin) to settle any resulting transaction and pay applicable fees.

110. If the order passes these checks, Kraken sends the order to its central limit order book where it is eligible to be matched and executed by the Kraken Trading Platform’s automated matching engine (the “Kraken Matching Engine”).

111. Aside from periods of maintenance or outages, the Kraken Trading Platform is always open for trades, operating 24 hours a day, every day.

112. The servers for the Kraken Matching Engine are located within the United States.

113. If an order is not immediately executed upon entry, the Kraken Trading Platform will include the order in its order book for potential matching with one or more orders from other buyers or sellers. The platform will then update the customer’s account balance to reflect the open order.

114. There is an order book for each crypto asset trading pair, e.g., an order for trading U.S. Dollars to the crypto asset security called “Cardano” and represented by the trading symbol “ADA” may be referred to as the “ADA-USD” order book. The Kraken Matching Engine matches orders based on price-time priority within that order book.

115. Kraken describes publicly on its website some of the “detailed trading rules for operating” the Kraken Trading Platform. Kraken’s website informs traders that: (i) orders placed on Kraken’s order book are prioritized according to price; (ii) buy orders are prioritized in decreasing order of price with the highest bid placed at the top of the order book; (iii) sell orders are prioritized in increasing order of price with the lowest ask placed at the top of the order book; (iv) orders with same price are aggregated in the order book and are filled in a first in, first out manner; and (v) conditional orders are stored separately from the order book on a “not held” or reserved basis and are placed on the order book when an asset’s price meets the prespecified condition and price.

v. Direct Sales

116. Kraken does not restrict issuers or promoters from publicly offering and selling crypto assets, including each of the Kraken-Traded Securities, on the Kraken Trading Platform. Nor does Kraken implement any policies or procedures to prevent issuers from offering and selling their crypto assets to the public on the Kraken Trading Platform.

117. Multiple issuers sold their respective crypto assets on the Kraken Trading Platform through market makers.

118. Kraken is aware that crypto asset issuers offer and sell their own holdings via the Kraken Trading Platform, in part because Kraken itself facilitated them doing so.

119. For example, the issuer of ALGO (the native crypto asset to the Algorand blockchain) used a market maker (“Market Maker 1”) to offer and sell ALGO, including on the Kraken Trading Platform.

120. In April 2020, a representative of Market Maker 1 emailed Kraken representatives, stating in part, “As you know we are providing liquidity for a number of customers (token issuers), Algorand is the only one from our existing customers that is listed in Kraken and we would like to know if we can help you in any way with your due diligence with other [Market Maker 1] customers that would in my opinion be suited for Kraken.”

121. In response, a Kraken representative stated, in part, “I saw [Market Maker 1] and assumed straight market making-related discussions” and that another Kraken representative was “moving forward with all new asset reviews.” A call was arranged to “cover both new asset DD + MM discussions.”

122. In this context, “DD” is shorthand for “due diligence” and “MM” is shorthand for “market maker.”

123. In May 2020, the Kraken representative emailed the Market Maker 1 representative, stating in part, “I hope that you have been well since we spoke a few weeks ago. As a quick follow-up, I wanted to provide some general benefits and liquidity guidelines that we look for in MM parents (attached). It would also be great to explore how Kraken and [Market Maker 1] can further collaborate going forward. Do you have for a call early next week to discuss these?”

124. Market Maker 1 also offered and sold ADA, FIL, FLOW, ICP, MATIC and NEAR via the Kraken Trading Platform on behalf of their respective issuers.

125. Other market makers offered and sold crypto assets via the Kraken Trading Platform on behalf of their issuers.

126. The issuers of the following Kraken-Traded Securities all sold their respective crypto asset securities on the Kraken Trading Platform through market makers during the Relevant Period: ADA, ALGO, FIL, FLOW, ICP, MATIC, and NEAR.

127. Such sales were part of the respective issuer’s offers and sales of their crypto asset securities into the public trading markets.

128. Kraken did not inquire or query whether a market maker was selling crypto assets on behalf of an issuer.

2. Kraken Failed to Register as a Broker-Dealer

a. Registration of Broker-Dealers

129. Absent an applicable exemption or exception, Section 15(a) of the Exchange Act [15 U.S.C. § 78o(a)] generally requires brokers and dealers to register with the SEC, and a broker or dealer must also become a member of one or more “self-regulatory organizations” (“SROs”), which in turn require members to adhere to rules governing the activities of the SRO’s members.

130. Section 3(a)(4) of the Exchange Act [15 U.S.C. § 78c(a)(4)] defines “broker” generally as “any person engaged in the business of effecting transactions in securities for the account of others.”

131. Section 3(a)(5) of the Exchange Act [15 U.S.C. § 78c(a)(5)] defines “dealer” generally as “any person engaged in the business of buying and selling securities for his own account, through a broker or otherwise.”

132. The regulatory regime applicable to broker-dealers is a cornerstone of the federal securities laws and provides important safeguards to investors and market participants. Registered broker-dealers are subject to comprehensive regulation and rules that include recordkeeping and reporting obligations, SEC and SRO examination, and general and specific requirements aimed at addressing conflicts of interest, among other things. All of these rules and regulations are critical to the soundness of the national securities markets and to protecting investors in the public markets.

133. To preserve the maintenance of fair and orderly markets, avoid conflicts of interests, and protect investors, Section 11(a) of the Exchange Act [15 U.S.C. § 78k(a)] prohibits broker-dealers from effecting transactions for their own accounts on exchanges where they are a member.

134. Further, broker-dealers must abide by certain financial responsibility requirements under the Exchange Act. For example, broker-dealers are required to make and maintain certain business records to assist the firm in accounting for its activities and to assist securities regulators in examining the firm’s compliance with securities laws. 17 C.F.R. § 240.17a-3, 17a-4. Broker-dealers are also prohibited under what is known as the “Customer Protection Rule” from using customer securities and cash to finance their own business. 17 C.F.R. § 240.15c3-3. By segregating customer securities and cash from a firm’s proprietary business activities, the rule increases the likelihood that customer assets will be readily available to be returned to customers if a broker-dealer fails.

b. Kraken Functions as a Broker

135. During the Relevant Period, Kraken used, and continues to use, means and instrumentalities of interstate commerce to effect transactions in crypto asset securities for the accounts of others, and regularly participated in these securities transactions at key points in the chain of distribution.

136. Kraken solicited, and continues to solicit, potential investors in crypto asset securities and hold itself out as selling crypto asset securities.

137. As alleged above, Kraken provided, and continues to provide, a system for customers to enter orders in securities, to route and handle those customer orders, and to take compensation by charging customers fees for these services.

138. Kraken handled, and continues to handle, customer funds and customers’ crypto asset securities (which it commingled and treated as fungible with its own crypto assets) through Kraken-controlled accounts and crypto wallets.

139. Kraken was therefore required to register with the Commission as a broker but did not do so.

i. Kraken Views Itself as a Broker and Solicits Customers for Trading Crypto Asset Securities

140. In internal documents, Kraken calls itself a “broker” and states that its operations are similar to brokers in traditional markets.

141. Internally, Kraken identifies itself as a broker in other ways. For example, on a Kraken corporate organizational chart, Kraken labels Payward Ventures (along with other Kraken entities) as a client-facing “Broker Entity.”

142. In its internal policies, Kraken refers to Payward Ventures as a “Local Spot Broker” or the acronym “LSB.”

143. Kraken further refers to its customer accounts containing crypto assets or fiat as a customer’s “brokerage account.”

144. Kraken regularly solicits customers to open accounts at Kraken to trade crypto assets, including the Kraken-Traded Securities, on the Kraken Trading Platform and through the Kraken Services, including through marketing and posts on its website, applications, and on social media.

145. For example, Kraken has posted on X (formerly known as Twitter), with the handle “@KrakenFX” information about: crypto assets, including crypto asset securities, available to trade on the Kraken Trading Platform, including new assets or those newly available for margin trading; Kraken’s promotions for customers; trading support notifications; enhanced trading features of the Kraken Trading Platform; links to Kraken interviews and publications; and responses to specific posts by Kraken customers.

146. Kraken regularly posts comments in the Kraken forum on Reddit, including referring customers to Kraken’s support services and providing updates about the status of the Kraken Trading Platform.

147. Kraken regularly posts to its blog (blog.kraken.com) promotional materials and information encouraging customers to trade crypto assets, including crypto asset securities, on the Kraken Trading Platform and through the Kraken Services.

148. Through these various communication channels, Kraken provides instructions to potential customers on how to open a trading account.

149. Through its website and applications, Kraken provides detailed information about the crypto assets, including the Kraken-Traded Securities, that trade on the Kraken Trading Platform and through the Kraken Services, including price charts and market statistics, price movements, volume, and information about how to trade those crypto assets. For example, Kraken maintains a “Learn” webpage and online “Crypto Guides” that provide resources regarding crypto assets and trading crypto assets, as well as a “Prices” webpage that highlights top “Trending Cryptocurrencies” and crypto assets with the “Biggest Gains.”

150. Kraken also has marketed monetary incentives and promotions aimed at attracting more customers to the Kraken Trading Platform. For example, in or around November 2019, Kraken launched the “Kraken Affiliate Program,” which rewards existing Kraken customers who refer new customers to Kraken. Under the Kraken Affiliate Program, existing Kraken customers receive “20% on the trading fees collected from clients you refer to us for the lifetime of the client with Kraken – up to $1,000 USD payout per referral.”

ii. Kraken Controls Customer Assets

151. In 2021, Kraken held more than $5 billion in customer fiat and more than $33 billion in customer crypto assets.

152. Kraken maintains its customers’ crypto assets and funds in crypto wallets and bank accounts that it controls.

153. To deposit crypto assets into a Kraken trading account, customers must transfer crypto assets from an existing crypto wallet to a Kraken-controlled crypto wallet. Similarly, to deposit fiat currency into a Kraken trading account, customers must make a deposit to a Kraken-controlled bank account using a wire transfer, bank transfer, or other means.

154. When a customer submits a request to withdraw funds or crypto assets, Kraken transfers them from a Kraken-controlled bank account or crypto wallet to the customer’s designated account or crypto wallet.

155. According to Kraken’s terms of service, all digital assets held in a Kraken account are “custodial assets held by Payward for” the benefit of the customer. Kraken disclaims any ownership or title to digital assets held in Kraken customer accounts.

156. Kraken uses shared blockchain addresses called “omnibus accounts,” which it controls, to hold crypto assets on behalf of customers. Kraken holds the private keys for these addresses and maintains internal, or off-chain ledgers, to record individual customer holdings for their respective accounts.

157. In documents provided to its auditor, Kraken stated “crypto assets are not separated by type of client, geography, margin vs. non-margin etc.”

iii. Kraken Offers Trading on Margin

158. During the Relevant Period, Kraken offered, and continues to offer, extensions of margin credit (from its proprietary inventory) to customers for buying and selling certain crypto assets, including crypto asset securities.

159. Kraken advertises on its website that it offers “over 100 margin-enabled markets for you to buy (go ‘long’) or sell (go ‘short’) a growing number of cryptocurrencies with up to 5x leverage.”

160. If executed, margin transactions are executed on the Kraken Trading Platform using the Kraken Matching Engine.

161. Kraken maintains physical or constructive custody of all crypto assets or fiat currency using margin for the duration of a customer’s open margined position.

162. Kraken charges additional fees for margin orders.

163. Kraken charges percentage-based fees, based on the amount of margin credit extended, for opening a leveraged position as well as maintaining a leveraged position.

c. Kraken Functions as a Dealer

164. During the Relevant Period, Kraken used means and instrumentalities of interstate commerce to effect transactions in crypto asset securities while engaged in the business of buying and selling securities for its own account. Through the Kraken Services, such as Instant Buy and the OTC Desk, as well as its own proprietary trading, Kraken bought and sold crypto asset securities on multiple platforms, including the Kraken Trading Platform, as part of its regular business. Kraken was therefore required to register with the Commission as a securities dealer but did not do so.

i. Instant Buy

165. Kraken Instant Buy allows customers to “instantly” buy, sell, or “convert” crypto assets, including the Kraken-Traded Securities, with Kraken acting as the counterparty in all cases.

166. Kraken’s website states that the Instant Buy feature “allows you to convert between any crypto and cash assets.”

167. To use the service, a customer logs in to her account and click Buy, Sell, or Convert. The customer would then be presented with a default asset and a price offered by Kraken to Buy, Sell, or Convert the asset.

168. To change the asset, the customer opens a search field where she can scroll through a list of assets (shown with the asset’s price) or type in the name of the asset to Buy, Sell, or Convert.

169. Kraken charges users of the Instant Buy feature a fee and in certain cases, a “spread.”

170. Kraken does not publish a general fee schedule or explain when or how a “spread” will be charged in addition to the fee. Instead, Kraken displays the fees for the particular transaction.

171. The customer must agree to the price for the asset offered by Instant Buy as well as the transaction fee, which Kraken assesses if the transaction is executed.

172. The price quote Kraken provides to a customer in the Instant Buy feature is derived from Kraken’s review of the pending orders on its order book on the Kraken Trading Platform.

173. For example, if a customer wants to purchase 10 units of the Kraken-Traded Security Cardano (ADA) using Instant Buy, Kraken reviews the order book for ADA on the Kraken Trading Platform and presents a price quote valid for a specified period of time and the fees it would charge to complete the transaction. If the customer accepts, Kraken then uses or leverages its own capital or crypto assets to acquire the 10 ADA on the Kraken Trading Platform, and then sells these 10 ADA to its customer and promptly settles the trade by ledger debits and credits.

ii. OTC Desk

174. During the Relevant Period, Kraken offered the OTC Desk as a “premium service that allows traders to execute orders off the open Kraken exchange” for large orders of crypto assets, including the Kraken-Traded Securities, valued at $100,000 or more (although it may service smaller orders).

175. Customers may send a request for a quote to the OTC Desk. Kraken would typically respond with a quote at which it would be willing to trade with the customer.

176. Kraken acts as principal to fill orders placed through the OTC Desk.

177. To fill the orders placed with the OTC Desk, Kraken uses proprietary assets, places orders (in its own account) on the Kraken Trading Platform, uses its own inventory, or places orders on third-party trading platforms.

178. Customers interface with the OTC Desk through email or telephone, or by logging into their Kraken account and using the OTC Desk’s online portal or an online chat function.

179. On its website, Kraken states, “We do not charge you any fees for our [OTC Desk] service. The bid or offer price we show is the ‘all inclusive’ price.”

180. Kraken’s Terms of Service state that it may charge a mark-up or markdown “between the price [Kraken] buys or sells an Asset in a transaction with you and the price it is able to obtain in subsequent transactions with third parties, and . . . such spread will not be reflected in the transaction fees you are charged at the time of your purchase or sale.”

181. Kraken’s OTC Desk settles transactions in various ways depending on the manner it filled the customer’s order.

182. Kraken offered the OTC desk for orders of crypto assets, including Kraken-Traded Securities.

iii. Proprietary Trading

183. During the Relevant Period, Kraken also engaged in proprietary trading of crypto assets, including crypto asset securities and Kraken-Traded Securities, for its own account separate from the Kraken Services.

184. According to Kraken’s financial statements, it stopped engaging in proprietary trading separate from the Kraken Services during the second quarter of 2020.

185. From the beginning of 2020 until it stopped in the second quarter, Kraken generated approximately $47 million in revenue from the proprietary trading of crypto assets.

3. Kraken Failed to Register as a Clearing Agency

a. Registration of Clearing Agencies

186. Congress has determined that “the prompt and accurate clearance and settlement of securities transactions, including the transfer of record ownership and the safeguarding of securities and funds related thereto, are necessary for the protection of investors and persons facilitating transactions by and acting on behalf of investors.” 15 U.S.C. § 78q-1.

187. Section 17A(b) of the Exchange Act [15 U.S.C. § 78q-1(b)] accordingly generally makes it unlawful “for any clearing agency, unless registered in accordance with this subsection, directly or indirectly, to make use of the mails or any means or instrumentality of interstate commerce to perform the functions of a clearing agency with respect to any security.”

188. Section 3(a)(23)(A) of the Exchange Act [15 U.S.C. § 78c(a)(23)(A)] defines the term “clearing agency” as “any person who acts as an intermediary in making payments or deliveries or both in connection with transactions in securities or who provides facilities for comparison of data respecting the terms of settlement of securities transactions, to reduce the number of settlements of securities transactions, or for the allocation of securities settlement responsibilities,” as well as “any person … who (i) acts as a custodian of securities in connection with a system for the central handling of securities whereby all securities of a particular class or series of any issuer deposited within the system are treated as fungible and may be transferred, loaned, or pledged by bookkeeping entry without physical delivery of securities certificates, or (ii) otherwise permits or facilitates the settlement of securities transactions or the hypothecation or lending of securities without physical delivery of securities certificates.”

189. Registered clearing agencies are subject to comprehensive regulation—including recordkeeping requirements and SEC examination—under the Exchange Act and the rules thereunder, providing important safeguards to investors and market participants, and to the maintenance of fair competition. Moreover, properly registered clearing agencies must enact a set of rules to govern their and their members’ behavior, and these rules are subject to review by the SEC.

b. Kraken Functions as a Clearing Agency

190. During the Relevant Period, Kraken’s conduct in the settlement of crypto asset securities transactions and as a security depository with respect to crypto asset securities traded on the Kraken Trading Platform and through the Kraken Services, including Instant Buy and the OTC Desk, constitutes clearing agency activity. Kraken was therefore required to register with the Commission as a clearing agency but did not do so.

191. Kraken has and continues to act as an intermediary in making payments and deliveries when facilitating the settlement of crypto asset securities transactions, including transactions in the Kraken-Traded Securities.

192. After a customer order is matched, resulting in a trade (whether against another customer or Kraken itself), Kraken settles the trade through its internal ledger system by debiting and crediting the relevant balances of funds or crypto assets in the customer’s (or customers’) account(s).

193. According to a Kraken internal document, its internal ledgers are “designed to function similarly to a ‘stock record’ account, like the one that is typically maintained by a broker-dealer that custodies its customers’ holdings.”

194. In this way, all trades on Kraken’s Trading Platform “occur ‘off-chain’ on the Kraken Exchange,” meaning that they are recorded and settled on Kraken’s internal ledgers without any crypto asset being transferred from one blockchain address to another (i.e., “on-chain”).

195. According to trading rules posted on Kraken’s website, after matching buy and sell orders, “Kraken settles all filled orders immediately, by debiting and crediting the relevant balances of assets in both traders’ accounts.”

196. Kraken’s Terms of Service state that Kraken will use “commercially reasonable efforts to settle trades” within two days of execution.

197. Kraken has and continues to act as a security depository for crypto asset securities, including the Kraken-Traded Securities, that are traded on the Kraken Trading Platform and through the Kraken Services.

198. Kraken holds these crypto assets in omnibus wallets for which Kraken holds the private keys, and Kraken provides a system for the central handling of securities whereby crypto asset securities are treated as fungible and ownership entitlements are transferred by bookkeeping entry without any on-chain transfers.

D. Kraken’s Business Practices Create Heightened Risks for its Customers

199. As an unregistered entity that nonetheless operates as a securities broker, dealer, exchange, and clearing agency, Kraken operates in ways that would not be permissible under the federal securities laws and regulations.

1. Kraken Fails to Separate the Competing Functions of Its Business

200. In U.S. securities markets, the functions of “exchanges,” “brokerdealers,” and “clearing agencies” described above are typically carried out by separate legal entities that are independently registered and regulated by the SEC. Separation of these core functions aims to minimize conflicts between the interests of securities intermediaries and the investors they serve. Registration and concomitant disclosure obligations allow the SEC to oversee the business of intermediaries and their relationship with investors, in order to, among other things, protect investors from manipulation, fraud, and other abuses.

201. While providing the services of an exchange, broker, dealer, and clearing agency to its customers, Kraken does not separate these functions.

202. Investors in securities markets do not interact directly with exchanges or clearing agencies but instead are customers of broker-dealers who effect transactions on investors’ behalf. Only broker-dealers (or natural persons associated with a broker-dealer) may become members of a national securities exchange. In addition, broker-dealers who have customers must become members of the Financial Industry Regulatory Authority (“FINRA”), an SRO that imposes its own rules and oversight over broker-dealers, particularly as to protecting retail investors.

203. Kraken is not a member of FINRA.

204. Registered national securities exchanges and clearing agencies are also SROs, and therefore must submit all of their proposed rules and rule changes to the SEC for review.

205. Kraken does not submit its rules or proposed rules to the SEC for review.

206. As noted, the Exchange Act also subjects registered intermediaries to important record keeping and inspection requirements. For example, Section 17 of the Exchange Act [15 U.S.C. § 78q] requires registered national securities exchanges, broker-dealers, and clearing agencies to make and keep records as the SEC prescribes by rule, and subjects those records to reasonable periodic, special, or other examinations by representatives of the SEC.

207. Kraken does not submit itself to examinations by representatives of the SEC.

208. These provisions are designed to ensure that intermediaries follow the rules designed to protect investors and to promote fair and efficient operation of the securities markets, given their importance to the economic health of the nation. These provisions also seek to ensure, among other things, that investors’ securities orders are handled fairly and transparently, that securities transactions result in settlement finality, and that investors’ assets are protected and can be recovered if necessary.

209. In failing to comply with any SEC registration requirements, Kraken puts its customers’ assets at a higher risk of loss than customers of registered securities intermediaries.

2. Kraken Commingles Its Customers’ Crypto Assets and Fiat with Its Own

210. The U.S. securities laws protect customer assets by, among other things, ringfencing customer assets from corporate use. Had it registered as a broker-dealer, Kraken would be required to appropriately account for and segregate customer cash and securities and would be subject to examination, inspection, and disclosure requirements aimed at detecting and preventing the failure to appropriately segregate customer assets.

211. Kraken’s Terms of Service stated that “custodial assets held by Payward [are] for [a customer’s] benefit” and title is “not transferred to Payward.”

212. Nonetheless, Kraken’s commingles customer crypto assets with its own.

213. Commingling customer and proprietary assets creates a risk that, when customers request withdrawals of their assets, those assets might be encumbered (e.g., due to hypothecation, or liens or other interests being filed against such property to secure an obligation of Kraken) or gone completely.

214. Concerning Kraken’s custody of crypto assets, in its audit plan for 2022, Kraken’s independent auditor stated: “There is a significant risk of loss of custodial (and proprietary) digital assets through theft/loss of public keys or improper controls over accounting for custodial digital assets that are comingled between customers and with the Company’s proprietary digital assets.”

215. Kraken’s Terms of Service also stated that “Payward makes no warranty” that customers’ crypto assets “are held by [the customer] free and clear of any security interest or other lien or encumbrance by Payward or others, including but not limited to Payward’s creditors.”

216. With respect to fiat, Kraken maintains bank accounts that are designated as custodial accounts for the purpose of holding customer fiat.

217. Kraken maintains separate bank accounts that are designated as operational accounts for the purpose of holding corporate fiat.

218. Yet, Kraken commingles corporate and customer fiat in some of these accounts.

219. In its 2020 and 2021 financial statements, Kraken describes how it may commingle custodial funds with its own. Kraken’s financial statements state that “amounts shown as Customer custodial funds are restricted to use based on the terms of service with our customers. Such funds may be in separate accounts or commingled with cash that is unrestricted.” “Unrestricted” cash is Kraken’s proprietary or corporate cash for which it has “unrestricted rights of withdrawal and use….”

220. Kraken’s independent auditor has observed that as of December 31, 2021, approximately $33.6 million of customer custodial fiat appeared to be in Kraken’s operational bank accounts. Kraken’s independent auditor similarly observed that as of December 31, 2020, approximately $30.8 million of customer custodial fiat appeared to be in Kraken’s operational accounts.