SEC対Coinbase訴訟の訴状の文字起こしです。機械翻訳用に括弧を削除してあります。

Plaintiff Securities and Exchange Commission (the “SEC” or the “Commission”) for its Complaint against Defendants Coinbase, Inc. (“Coinbase”) and Coinbase Global, Inc. (“CGI”) (collectively, “Defendants”) alleges as follows:

Contents

- 1 SUMMARY

- 2 VIOLATIONS

- 3 NATURE OF THE PROCEEDING AND RELIEF SOUGHT

- 4 JURISDICTION AND VENUE

- 5 DEFENDANTS

- 6 BACKGROUND

- 6.1 I. STATUTORY AND LEGAL FRAMEWORK

- 6.1.1 A. The Securities Act’s Registration and Disclosure Requirements

- 6.1.2 B. The Exchange Act’s Registration and Other Requirements

- 6.1.3 C. Registration of Exchanges, Broker-Dealers, and Clearing Agencies is Essential to the Proper Functioning of the U.S. Securities Markets and to the Protection of Investors.

- 6.2 II. BACKGROUND ON CRYPTO ASSETS AND CRYPTO TRADING PLATFORMS

- 6.1 I. STATUTORY AND LEGAL FRAMEWORK

- 7 FACTS

- 7.1 I. COINBASE’S OPERATIONS AND RELATIONSHIP WITH CGI

- 7.2 II. THROUGH THE COINBASE PLATFORM, COINBASE PROVIDES EXCHANGE, BROKERAGE, AND CLEARING AGENCY SERVICES TO U.S. CUSTOMERS, AND COINBASE ALSO OFFERS BROKERAGE SERVICES THROUGH PRIME AND WALLET.

- 7.2.1 A. Coinbase Solicits Customers and Facilitates Trading.

- 7.2.2 B. Coinbase Holds and Controls Customers’ Funds and Crypto Assets.

- 7.2.3 C. Through the Coinbase Platform, Coinbase Maintains and Provides a Marketplace and Facilities for Trading Crypto Assets.

- 7.2.4 D. Coinbase Settles Customers’ Trades.

- 7.2.5 E. Coinbase Charges Fees on Executed Trades.

- 7.3 III. THE CRYPTO ASSETS TRADED ON THE COINBASE PLATFORM AND THROUGH PRIME AND WALLET INCLUDE ASSETS THAT ARE OFFERED AND SOLD AS SECURITIES.

- 7.3.1 A. Before Making Crypto Assets Available, Coinbase Has Conducted Risk Assessments that Acknowledge the Potential Application of the Federal Securities Laws to Its Products and Services.

- 7.3.2 B. CGI Has Publicly Disclosed the Risks of Coinbase’s Unregistered Business Operations.

- 7.3.3 C. Coinbase Has Made Available for Trading Assets that Are Offered and Sold as Securities.

- 7.4 IV. COINBASE WAS REQUIRED TO, BUT DID NOT, REGISTER AS A NATIONAL SECURITIES EXCHANGE, BROKER, AND CLEARING AGENCY.

- 7.5 V. THROUGH ITS STAKING PROGRAM, COINBASE HAS ENGAGED IN THE UNREGISTERED OFFER AND SALE OF SECURITIES IN VIOLATION OF SECTION 5 OF THE SECURITIES ACT.

- 7.5.1 A. Staking Background

- 7.5.2 B. Coinbase Offers Investors in the Coinbase Staking Program Unique Features that May Not Be Available to Investors Staking on Their Own.

- 7.5.3 C. Coinbase Has Marketed the Coinbase Staking Program as an Investment Opportunity.

- 7.5.4 D. Coinbase Has Profited as a Result of the Coinbase Staking Program.

- 7.5.5 E. The Coinbase Staking Program as It Applies to Each of the Five Stakeable Crypto Assets Is a Security.

- 7.5.6 F. Coinbase Has Failed to Register Its Offers and Sales of the Coinbase Staking Program as It Applies to Each of the Five Stakeable Crypto Assets.

- 8 FIRST CLAIM FOR RELIEF Violations of Section 5 of the Exchange Act (Coinbase)

- 9 SECOND CLAIM FOR RELIEF Violations of Section 15(a) of the Exchange Act (Coinbase)

- 10 THIRD CLAIM FOR RELIEF Violations of Section 17A(b) of the Exchange Act (Coinbase)

- 11 FOURTH CLAIM FOR RELIEF Violations of Sections 5, 15(a), and 17A(b) of the Exchange Act (CGI as Control Person of Coinbase)

- 12 FIFTH CLAIM FOR RELIEF Violations of Sections 5(a) and 5(c) of the Securities Act (Coinbase)

- 13 PRAYER FOR RELIEF

- 14 JURY DEMAND

SUMMARY

1. Coinbase operates a trading platform (the “Coinbase Platform”) through which U.S. customers can buy, sell, and trade crypto assets. The assets that Coinbase makes available include crypto asset securities. Coinbase is the largest crypto asset trading platform in the United States and has serviced over 108 million customers, accounting for billions of dollars in daily trading volume in hundreds of crypto assets. The Coinbase Platform merges three functions that are typically separated in traditional securities markets—those of brokers, exchanges, and clearing agencies. Yet, Coinbase has never registered with the SEC as a broker, national securities exchange, or clearing agency, thus evading the disclosure regime that Congress has established for our securities markets. All the while, Coinbase has earned billions of dollars in revenues by, among other things, collecting transaction fees from investors whom Coinbase has deprived of the disclosures and protections that registration entails and thus exposed to significant risk.

2. Congress enacted the Securities Exchange Act of 1934 (the “Exchange Act”) in part to provide for the regulation of the national securities markets. And Congress charged the SEC with protecting investors, preserving fair and orderly markets, and facilitating capital formation, in part through a series of registration, disclosure, recordkeeping, inspection, and anti-conflict-of-interest provisions. These provisions have led to the separation of key functions in the securities markets— including those carried out by brokers, exchanges, and clearing agencies—in part to protect investors and their assets from the conflicts of interest that can arise when these functions merge.

3. Since at least 2019, through the Coinbase Platform, Coinbase has operated as: an unregistered broker, including by soliciting potential investors, handling customer funds and assets, and charging transaction-based fees; an unregistered exchange, including by providing a marketplace that, among other things, brings together orders of multiple buyers and sellers of crypto assets and matches and executes those orders; and an unregistered clearing agency, including by holding its customers’ assets in Coinbase-controlled wallets and settling its customers’ transactions by debiting and crediting the relevant accounts. By collapsing these functions into a single platform and failing to register with the SEC as to any of the three functions, and not having qualified for any applicable exemptions from registration, Coinbase has for years defied the regulatory structures and evaded the disclosure requirements that Congress and the SEC have constructed for the protection of the national securities markets and investors.

4. In addition, during the same period, Coinbase has operated as an unregistered broker through two other services it has offered to investors: Coinbase Prime (“Prime”), which Coinbase markets as a “prime broker for digital assets” that routes orders for crypto assets to the Coinbase Platform or to third-party platforms; and Coinbase Wallet (“Wallet”), which routes orders through third-party crypto asset trading platforms to access liquidity outside the Coinbase Platform.

5. Coinbase has carried out these functions despite the fact that the crypto assets it has made available for trading on the Coinbase Platform, Prime, and Wallet have included crypto asset securities, thus bringing Coinbase’s operations squarely within the purview of the securities laws. CGI—Coinbase’s parent company to which Coinbase’s revenues flow—is a control person of Coinbase and thus violated the same Exchange Act provisions as Coinbase.

6. For years, Coinbase has made calculated business decisions to make crypto assets available for trading in order to increase its own revenues, which are primarily based on trading fees from customers, even where those assets, as offered and sold, had the characteristics of securities. Since at least 2016, Coinbase has understood that the Supreme Court’s decision in SEC v. W.J. Howey Co., 328 U.S. 293 (1946) and its progeny set forth the relevant test for determining whether a crypto asset is part of an investment contract that is subject to regulation under the securities laws. And, as part of its public marketing campaign to position itself as a “compliant” actor in the crypto asset space, Coinbase has for years touted its efforts to analyze crypto assets under the standards set forth in Howey before making them available for trading. But while paying lip service to its desire to comply with applicable laws, Coinbase has for years made available for trading crypto assets that are investment contracts under the Howey test and well-established principles of the federal securities laws. As such, Coinbase has elevated its interest in increasing its profits over investors’ interests, and over compliance with the law and the regulatory framework that governs the securities markets and was created to protect investors and the U.S. capital markets.

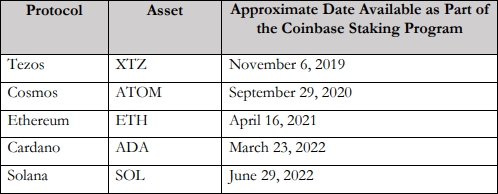

7. In addition, since 2019, Coinbase has offered and sold a crypto asset staking program (the “Staking Program”) that allows investors to earn financial returns through Coinbase’s managerial efforts with respect to certain blockchain protocols. Through the Staking Program, investors’ crypto assets are transferred to and pooled by Coinbase (segregated by asset), and subsequently “staked” (or committed) by Coinbase in exchange for rewards, which Coinbase distributes pro rata to investors after paying itself a 25-35% commission. Investors understand that Coinbase will expend efforts and leverage its experience and expertise to generate returns. The Staking Program includes five stakeable crypto assets, and the Staking Program as it applies to each of these five assets is an investment contract, and therefore a security. Yet, Coinbase has never had a registration statement filed or in effect with the SEC for its offers and sales of its Staking Program, thereby depriving investors of material information about the program, undermining investors’ interests, and violating the registration provisions of the Securities Act of 1933 (“Securities Act”).

VIOLATIONS

8. By engaging in the conduct set forth in this Complaint, Coinbase has acted as an exchange, a broker, and a clearing agency, without registering as an exchange, broker, or clearing agency, in violation of Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a),and 78q-1(b)(1)], and for purposes of Coinbase’s violations of the Exchange Act, CGI was a control person of Coinbase under Exchange Act Section 20(a) [15 U.S.C. § 78t(a)]. In addition, through its Staking Program, Coinbase has offered and sold securities without registering its offers and sales, in violation of Sections 5(a) and 5(c) of the Securities Act [15 U.S.C. §§ 77e(a) and 77e(c)].

9. Unless Defendants are permanently restrained and enjoined, there is a reasonable likelihood that they will continue to engage in the acts, practices, transactions, and courses of business set forth in this Complaint and in acts, practices, transactions, and courses of business of similar type and object in violation of the federal securities laws.

NATURE OF THE PROCEEDING AND RELIEF SOUGHT

10. The Commission brings this action pursuant to Section 20(b) of the Securities Act[15 U.S.C. § 77t(b)] and Section 21(d)(1) of the Exchange Act [15 U.S.C. § 78u(d)(1)].

11. The Commission seeks a final judgment: (a) permanently enjoining Defendants from violating Sections 5, 15(a), and 17A(b) of the Exchange Act [15 U.S.C. §§ 78e, 78o(a) and 78q-1(b)(1)], and permanently enjoining Coinbase from violating Sections 5(a) and 5(c) of the Securities Act [15 U.S.C. §§ 77e(a) and 77e(c)]; (b) ordering Defendants to disgorge their ill-gotten gains and to pay prejudgment interest thereon, pursuant to Sections 20(a), 21(d)(3), 21(d)(5) and 21(d)(7) of the Exchange Act [15 U.S.C. §§ 78u(a), 78u(d)(3), (5), and (7)]; (c) imposing civil money penalties on Coinbase pursuant to Section 20(d) of the Securities Act [15 U.S.C § 77t(d)] and on Defendants pursuant to Section 21(d)(3) of the Exchange Act [15 U.S.C. § 78u(d)(3)]; and granting any equitable relief that may be appropriate or necessary for the benefit of investors pursuant to Section 21(d)(5)of the Exchange Act [15 U.S.C. § 78u(d)(5)].

JURISDICTION AND VENUE

12. This Court has jurisdiction over this action pursuant to 28 U.S.C. § 1331, Sections20(b), 20(d), and 22 of the Securities Act [15 U.S.C. §§ 77t(b), 77t(d), and 77v], and Sections 21(d),21(e), and 27 of the Exchange Act [15 U.S.C. §§ 78u(d), 78u(e), and 78aa].

13. Defendants, directly or indirectly, have made use of the means or instruments of transportation or communication in interstate commerce or of the mails in connection with the transactions, acts, practices, and courses of business alleged herein.

14. Venue is proper in the Southern District of New York pursuant to Section 22(a) of the Securities Act [15 U.S.C. § 77v(a)] and Section 27(a) of the Exchange Act [15 U.S.C. §78aa(a)]. Among other things, Coinbase conducts its business operations in this District, including providing brokerage, trading, and other services to investors located in this District, and holding licenses to conduct crypto asset and money transmitting business activities in this District.

DEFENDANTS

15. Coinbase is a Delaware corporation founded in 2012. Coinbase has operated a crypto asset trading platform servicing U.S. customers since 2012. In April 2014, Coinbase became a wholly-owned subsidiary of CGI. Coinbase purports to be “a remote-first company” that maintains no principal executive office.

16. CGI is a Delaware corporation founded in January 2014 to act as a holding company for Coinbase. CGI’s principal asset is its equity interest in Coinbase. Like Coinbase, CGI purports to have no principal place of business and is a “remote-first company.” CGI filed a Form S-1registration statement with the SEC that was declared effective, and on April 14, 2021 CGI listed its common stock—registered with the SEC pursuant to Section 12(b) of the Exchange Act and trading under the symbol “COIN”—on the Nasdaq Global Select Market.

BACKGROUND

I. STATUTORY AND LEGAL FRAMEWORK

17. As the Supreme Court has recently reemphasized, the Securities Act and the Exchange Act “form the backbone of American securities laws.” Slack Tech., LLC v. Pirani, 598 U.S. ___, 2023 WL 3742580, at *1 (June 1, 2023). These acts define “security” broadly, to include a wide range of assets, including “investment contracts.”

18. Investment contracts are instruments through which a person invests money in a common enterprise and reasonably expects profits or returns derived from the entrepreneurial or managerial efforts of others. As the United States Supreme Court noted in Howey, Congress defined “security” broadly to embody a “flexible rather than a static principle, one that is capable of adaptation to meet the countless and variable schemes devised by those who seek the use of the money of others on the promise of profits.” 328 U.S. at 299. Courts have found novel or unique investment vehicles to be investment contracts, including those involving orange groves, animal breeding programs, cattle embryos, mobile phones, enterprises that exist only on the internet, and crypto assets (which crypto asset market participants at times also label “cryptocurrencies”).

A. The Securities Act’s Registration and Disclosure Requirements

19. Congress enacted the Securities Act to regulate the offer and sale of securities.

20. Sections 5(a) and 5(c) of the Securities Act [15 U.S.C. §§ 77e(a) and (c)] require registering offers and sales of securities with the SEC.

21. Registration statements provide public investors with material, sufficient, and accurate information to make informed investment decisions, in particular about the issuer and the offering, including financial and managerial information, how the issuer will use offering proceeds, and the risks and trends that affect the enterprise and an investment in its securities.

B. The Exchange Act’s Registration and Other Requirements

22. To fulfill the purposes of the Exchange Act, Congress imposed registration and disclosure obligations on certain defined participants in the national securities markets, including but not limited to broker-dealers, exchanges, and clearing agencies. The Exchange Act empowers the SEC to write rules to protect investors who use the services of those intermediaries.

23. In the Exchange Act, Congress explained that such oversight is essential to the proper functioning of the national securities markets and the national economy:

Transactions in securities as commonly conducted upon securities exchanges and over-the-counter markets are effected with a national public interest which makes it necessary to provide for regulation and control of such transactions and of practices and matters related thereto … to perfect the mechanisms of a national market system for securities and a national system for the clearance and settlement of securities transactions and the safeguarding of securities and funds related thereto, and to impose requirements necessary to make such regulation and control reasonably complete and effective, in order to protect interstate commerce, the national credit, the Federal taxing power, to protect and make more effective the national banking system and Federal Reserve System, and to insure the maintenance of fair and honest markets in such transactions.

15 U.S.C. § 78b.

24. Congress also determined that “the prompt and accurate clearance and settlement of securities transactions, including the transfer of record ownership and the safeguarding of securities and funds related thereto, are necessary for the protection of investors and persons facilitating transactions by and acting on behalf of investors.” 15 U.S.C. § 78q-1.

i. Registration of Exchanges

25. In enacting registration provisions for national securities exchanges, Congress found in Section 2(3) of the Exchange Act [15 U.S.C. §78b(3)] that:

Frequently the prices of securities on such exchanges and markets are susceptible to manipulation and control, and the dissemination of such prices gives rise to excessive speculation, resulting in sudden and unreasonable fluctuations in the prices of securities which (a) cause alternately unreasonable expansion and unreasonable contraction of the volume of credit available for trade, transportation, and industry in interstate commerce, (b) hinder the proper appraisal of the value of securities and thus prevent a fair calculation of taxes owing to the United States and to the several States by owners, buyers, and sellers of securities, and (c) prevent the fair valuation of collateral for bank loans and/or obstruct the effective operation of the national banking system and Federal Reserve System.

26. Accordingly, Section 5 of the Exchange Act [15 U.S.C. § 78e] requires an organization, association, or group of persons that meets the definition of “exchange” under Section3(a)(1) of the Exchange Act, unless otherwise exempt, to register with the Commission as a national securities exchange pursuant to Section 6 of the Exchange Act.

27. Section 3(a)(1) of the Exchange Act [15 U.S.C. § 78c(a)(1)] defines “exchange” to mean “any organization, association, or group of persons, whether incorporated or unincorporated, which constitutes, maintains, or provides a market place or facilities for bringing together purchasers and sellers of securities or for otherwise performing with respect to securities the functions commonly performed by a stock exchange as that term is generally understood, and includes the market place and the market facilities maintained by such exchange.”

28. Exchange Act Rule 3b-16(a) [17 C.F.R. § 240.3b-16(a)] further defines certain terms in the definition of “exchange” under Section 3(a)(1) of the Exchange Act, including “an organization, association, or group of persons,” as one that: “(1) [b]rings together the orders for securities of multiple buyers and sellers; and (2) uses established, non-discretionary methods(whether by providing a trading facility or by setting rules) under which such orders interact with each other, and the buyers and sellers entering such orders agree to the terms of a trade.”

29. Registration of a trading platform as an “exchange” under the Exchange Act is a bedrock Congressional requirement that permits the SEC to carry out its role of oversight over the national securities markets.

30. For example, properly registered exchanges must enact rules to govern their and their members’ behavior. Under Section 6 of the Exchange Act, the rules, among other things, must be “designed to prevent fraudulent and manipulative acts and practices, to promote just and equitable principles of trade … and, in general, to protect investors and the public interest.”

31. These rules are subject to review by the SEC under Section 19 of the Exchange Act[15 U.S.C. § 78s], including before an exchange can be registered and begin operating. This reviewprocess is designed to ensure that securities marketplaces operate in a manner consistent with theExchange Act as its practices and procedures evolve over time, in part to protect investors and theintegrity of securities markets that affect national commerce and the economy.

ii. Registration of Broker-Dealers

32. Section 15(a) of the Exchange Act [15 U.S.C. § 78o(a)] generally requires brokers anddealers to register with the SEC, and a broker or dealer must also become a member of one or more“self-regulatory organizations” (“SROs”), which in turn require members to adhere to rulesgoverning the SRO’s members’ activities.

33. Section 3(a)(4) of the Exchange Act [15 U.S.C. § 78c(a)(4)] defines “broker” generally as “any person engaged in the business of effecting transactions in securities for the account of others.”

34. The regulatory regime applicable to broker-dealers is a cornerstone of the federal securities laws and provides important safeguards to investors and market participants. Registered broker-dealers are subject to comprehensive regulation and rules that include recordkeeping and reporting obligations, SEC and SRO examination, and general and specific requirements aimed at addressing certain conflicts of interest, among other things. All of these rules and regulations are critical to the soundness of the national securities markets and to protecting investors in the public markets who interact with broker-dealers.

35. To preserve the maintenance of fair and orderly markets, avoid conflicts of interests, and protect investors, Section 11(a) of the Exchange Act [15 U.S.C. § 78k(a)] prohibits broker-dealers that are members of exchanges from effecting transactions on that exchange for their accounts.

iii. Registration of Clearing Agencies

36. Section 17A(b) of the Exchange Act [15 U.S.C. § 78q-1(b)] generally makes it unlawful “for any clearing agency, unless registered in accordance with this subsection, directly or indirectly, to make use of the mails or any means or instrumentality of interstate commerce to perform the functions of a clearing agency with respect to any security.”

37. Section 3(a)(23)(A) of the Exchange Act [15 U.S.C. § 78c(a)(23)(A)] defines the term “clearing agency” as “any person who acts as an intermediary in making payments or deliveries or both in connection with transactions in securities or who provides facilities for comparison of data respecting the terms of settlement of securities transactions, to reduce the number of settlements of securities transactions, or for the allocation of securities settlement responsibilities,” as well as “any person … who (i) acts as a custodian of securities in connection with a system for the central handling of securities whereby all securities of a particular class or series of any issuer deposited within the system are treated as fungible and may be transferred, loaned, or pledged by book keeping entry without physical delivery of securities certificates, or (ii) otherwise permits or facilitates the settlement of securities transactions or the hypothecation or lending of securities without physical delivery of securities certificates.”

38. Registered clearing agencies are subject to comprehensive regulation—including recordkeeping requirements and SEC examination—under the Exchange Act and the rules thereunder, providing important safeguards to investors and market participants, and to the maintenance of fair competition. Moreover, properly registered clearing agencies must enact a set of rules to govern their and their members’ behavior, and these rules are subject to review by the SEC.

C. Registration of Exchanges, Broker-Dealers, and Clearing Agencies is Essential to the Proper Functioning of the U.S. Securities Markets and to the Protection of Investors.

39. In U.S. securities markets, the functions of “exchanges,” “broker-dealers,” and“ clearing agencies” described above are typically carried out by separate legal entities that are independently registered and regulated by the SEC. Separation of these core functions aims to minimize conflicts between the interests of securities intermediaries and the investors they serve. Registration and concomitant disclosure obligations allow the SEC to oversee the business of intermediaries and their relationship with investors, in order to, among other things, protect investors from manipulation, fraud, and other abuses.

40. Investors in securities markets do not interact directly with exchanges or clearing agencies but instead are customers of broker-dealers who effect transactions on investors’ behalf. Only broker-dealers (or natural persons associated with a broker-dealer) may become members of a national securities exchange. In addition, broker-dealers who have customers must become members of the Financial Industry Regulatory Authority (“FINRA”), an SRO that imposes its own rules and oversight over broker-dealers, particularly as to protecting retail investors.

41. Registered national securities exchanges and clearing agencies are also SROs, and therefore must submit all of their proposed rules and rule changes to the SEC for review.

42. As noted, the Exchange Act also subjects registered intermediaries to important record keeping and inspection requirements. For example, Section 17 of the Exchange Act [15U.S.C. § 78q] requires registered national securities exchanges, broker-dealers, and clearing agencies to make and keep records as the SEC prescribes by rule, and subjects those records to reasonable periodic, special, or other examinations by representatives of the SEC.

43. These provisions are designed to ensure that intermediaries follow the rules designed to protect investors and to promote fair and efficient operation of the securities markets, given their importance to the economic health of the nation. These provisions also seek to ensure, among other things, that investors’ securities orders are handled fairly and transparently, that securities transactions result in settlement finality, and that investors’ assets are protected and can be recovered if necessary.

II. BACKGROUND ON CRYPTO ASSETS AND CRYPTO TRADING PLATFORMS

A. Crypto Assets

44. As used herein, the terms “crypto asset,” “digital asset,” or “token” generally refer to an asset issued and/or transferred using blockchain or distributed ledger technology, including assets referred to colloquially as “cryptocurrencies,” “virtual currencies,” and digital “coins.”

45. A blockchain or distributed ledger is a database spread across a network of computers that records transactions in theoretically unchangeable, digitally recorded data packages, referred to as “blocks.” These systems typically rely on cryptographic techniques to secure recording of transactions.

46. Some crypto assets may be “native tokens” to a particular blockchain—meaning that they are represented on their own blockchain—though other crypto assets may also be represented on that same blockchain.

47. Crypto asset owners typically store the software providing them control over their crypto assets on a piece of hardware or software called a “crypto wallet.” Crypto wallets offer a method to store and manage critical information about crypto assets, i.e., cryptographic information necessary to identify and transfer those assets. The primary purpose of a crypto wallet is to store the “public key” and the “private key” associated with a crypto asset so that the user can make transactions on the associated blockchain. The public key is colloquially known as the user’s blockchain “address” and can be freely shared with others. The private key is analogous to a password and confers the ability to transfer a crypto asset. Whoever controls the private key controls the crypto asset associated with that key. Crypto wallets can reside on devices that are connected to the internet (sometimes called a “hot wallet”), or on devices that are not connected to the internet (sometimes called a “cold wallet” or “cold storage”). All wallets are at risk of being compromised or “hacked,” but internet connectivity makes hot wallets easier to access and, therefore, puts them at greater risk from certain hacks.

B. Consensus Mechanisms and Validation of Transactions on a Blockchain

48. Blockchains typically employ a “consensus” mechanism that, among other things, aims to achieve agreement among users as to a data value or as to the state of the ledger.

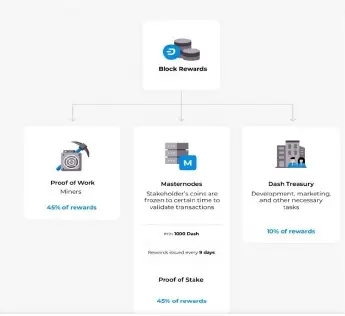

49. A consensus mechanism describes the particular protocol used by a blockchain to agree on, among other things, which ledger transactions are valid, when and how to update the blockchain, and potentially to compensate certain participants for validating transactions and adding new blocks. There can be multiple sources for compensation under the terms of the blockchain protocol, including from fees charged to those transacting on the blockchain, or through the creation or “minting” of additional amounts of the blockchain’s native crypto asset.

50. “Proof of work” and “proof of stake” are the two major “consensus mechanisms” used by blockchains. Proof of work, the mechanism used by the Bitcoin blockchain, involves computers, known as “validator nodes,” attempting to “mine” a “block” of transactions, in part by guessing a predetermined number. The first “miner” to successfully guess this number earns the right to update the blockchain and is rewarded with the blockchain’s native crypto asset. Proof of stake, the consensus mechanism currently used on Ethereum, involves selecting block validators from crypto asset holders who have committed or “staked” a minimum number of crypto assets.

C. The Offer and Sale of Crypto Assets

51. Persons have offered and sold crypto assets in capital-raising events in exchange for consideration, including but not limited to through so-called “initial coin offerings” or “ICOs,” “crowd sales,” or public “token sales.” In some instances, the entities offering or selling the crypto assets may release a “whitepaper” or other marketing materials describing a project to which the asset relates, the terms of the offering, and any rights associated with the asset.

52. Some issuers continue to sell the crypto assets after the initial offer and sale, including directly or indirectly by selling them on crypto asset trading platforms.

D. Crypto Asset Trading Platforms

53. Crypto asset trading platforms—like the Coinbase Platform, which is described in more detail below—are marketplaces that generally offer a variety of services relating to crypto assets, often including brokerage, trading, and settlement services.

54. Crypto asset trading platforms allow their customers to purchase and sell crypto assets for fiat currency (legal tender issued by a country) or for other crypto assets. “Off-chain” transactions are tracked in the internal recordkeeping mechanisms of the platform but do not involve transferring crypto assets from one wallet to another, while “on-chain” transactions involve the transfer of a crypto asset from one blockchain address to another.

55. Crypto asset trading platforms typically possess and control the crypto assets deposited and/or traded by their customers and, thus, function as a central depository. The customers’ entitlements are then typically tracked and maintained on the crypto asset trading platform’s internal ledgers. Consistent with Coinbase’s failures to register with the SEC in any capacity and follow rules applicable to registered intermediaries, the Coinbase Platform does not segregate a customer’s crypto assets from other customers’ or the firm’s assets.

56. The graphic user interfaces employed by crypto asset trading platforms—such as on websites, mobile apps, or other software—typically emulate and function like traditional securities trading screens: they show order books of the various assets available to trade, and historical trading information like high and low prices, trading volumes, and capitalizations.

57. However, unlike in traditional securities markets, crypto asset trading platforms(including the Coinbase Platform) typically solicit, accept, and handle customer orders for securities; allow for the interaction and intermediation of multiple bids and offers resulting in purchases and sales; act as an intermediary in making payments or deliveries, or both; and maintain a central securities depository for the settlement of securities transactions.

58. By contrast, a registered national securities exchange submits information regarding executed trades to a registered clearing agency that takes responsibility for ensuring settlement finality and safekeeping of the assets being traded and, in doing so, protects investors’ interests. Thus, registered national securities exchanges typically do not assume possession or control of the underlying assets being traded. Moreover, crypto asset trading platforms usually settle transactions by updating internal records with each investor’s positions, a function typically carried out by clearing agencies in compliant securities markets.

59. Likewise, crypto asset trading platforms typically perform roles traditionally assigned to broker-dealers in compliant securities markets, without following or even recognizing the legal obligations and restrictions on activities that accompany status as a broker-dealer.

E. The DAO Report

60.

On July 25, 2017, the SEC issued the Report of Investigation Pursuant to Section 21(a) of the Securities Exchange Act of 1934: The DAO (the “DAO Report”), advising “those who would use …distributed ledger or blockchain-enabled means for capital raising[] to take appropriate steps to ensure compliance with the U.S. federal securities laws,” and finding that the offering of crypto assets at issue in the DAO Report were offerings of securities.

61. The DAO Report also advised that “any entity or person engaging in the activities of an exchange must register as a national securities exchange or operate pursuant to an exemption from such registration,” and “stressed the obligation to comply with the registration provisions of the federal securities laws with respect to products and platforms involving emerging technologies and new investor interfaces.” The DAO Report also found that the trading platforms at issue there“ provided users with an electronic system that matched orders from multiple parties to buy and sell [the crypto asset securities at issue] for execution based on non-discretionary methods” and therefore “appear to have satisfied the criteria” for being an exchange under the Exchange Act.

FACTS

I. COINBASE’S OPERATIONS AND RELATIONSHIP WITH CGI

62. In 2012, Coinbase launched the original version of its trading platform, which, according to Coinbase, allowed “anyone, anywhere [to] be able to easily and securely send and receive Bitcoin.” Today, the Coinbase Platform has evolved into an expansive online trading platform that allows customers to buy, sell, and trade hundreds of crypto assets. Publicly, Coinbase refers to its trading platform as an “exchange.” In addition to the Coinbase Platform, Coinbase offers a host of other services to customers in the United States and abroad, including Prime and Wallet.

63. Since at least May 2021, Coinbase has offered Prime, a service Coinbase has marketed to its institutional customers as a “prime broker” (a broker that offers certain services to institutional clients) for digital assets. Prime routes orders to the Coinbase Platform and to third-party platforms, thereby providing customers with what Coinbase describes as “access to the broader crypto marketplace rather than relying solely on prices from Coinbase’s exchange.”

64. Wallet, which Coinbase has made available to both retail and institutional customers since 2017, routes customer orders through third-party so-called “decentralized” trading platforms(often referred to as “decentralized exchanges” or “DEXs”) to access liquidity outside the Coinbase Platform. Unlike with orders placed directly for routing to and execution on the Coinbase Platform or through Prime, Coinbase does not maintain custody over the crypto assets traded through Wallet. Rather, the assets are “self-custodied” in that “private keys (that represent ownership of the crypto) are stored directly on [the customer’s] device.” Crypto assets from numerous blockchains are available to buy, sell, receive, “swap,” or “bridge” via Wallet.

65. In addition to facilitating secondary market transactions through crypto asset trading, Coinbase allows issuers to offer crypto assets for sale for the first time through the Coinbase “Asset Hub.” Coinbase describes Asset Hub on its website as the place “[w]here asset issuers list, launch, and grow … [their] asset across Coinbase products.” Coinbase touts that Asset Hub gives issuers the ability to “use a single application to list on the Exchange, Custody, and all our trading interfaces.” Furthermore, Coinbase typically does not limit or restrict the ability of crypto asset issuers or promoters (or their agents) to trade on the Coinbase Platform.

66. Coinbase describes the services it offers as “safe, trusted, easy-to-use technology and financial infrastructure products and services that enable any person or business with an internet connection to discover, transact, and engage with crypto assets and decentralized applications.” As Coinbase touts on its website, “we offer a trusted and easy-to-use platform for accessing the broader crypto economy.”

67. The Coinbase Platform and Prime are both available through Coinbase’s website(coinbase.com) and mobile application. Customers can open accounts, deposit funds and crypto assets, enter orders, and trade crypto assets 24 hours a day, seven days a week. Wallet is marketed on coinbase.com but customers need to download a separate program to access its services and the crypto assets it supports.

68. Coinbase claims to service over 108 million customers, including U.S. customers, accounting for billions of dollars in daily trading volume. Today, the Coinbase Platform is one of the largest crypto asset trading platforms in the world and the largest in the United States, with exponential growth in the last few years: In April 2021, Coinbase made available approximately 55crypto assets for trading on the Coinbase Platform; that number had increased to approximately 254 assets by March 2023. In addition, as of December 2022, Coinbase allowed users to trade more than16,000 crypto assets via Wallet.

69. Coinbase generates most of its revenue from transaction fees collected on crypto asset trades made through the Coinbase Platform, Prime, and Wallet. For example, in 2021, Coinbase generated $6.8 billion in “transaction revenue,” out of a total net revenue of $7.4 billion. Likewise, in 2022, Coinbase generated over $2.2 billion in transaction revenue out of a total net revenue of $3.1 billion.

70. The revenue and expenses generated by Coinbase flow up to Coinbase’s parent company, CGI. For instance, CGI’s consolidated balance sheets and statements of operations for2022 include, among other items: funds and crypto assets and liabilities associated with Coinbase’s services; total revenue produced by Coinbase’s services; Coinbase’s technology and development expenses; and Coinbase’s sales and marketing expenses.

71. Coinbase and CGI share the same board of directors and the majority of CGI’s executive officers hold the same executive positions at Coinbase, including Brian Armstrong, who acts as CEO for both Coinbase and CGI. Both entities operate through the same website (coinbase.com) and disseminate public information through the same blog, Twitter feed, Facebook page, LinkedIn page, and YouTube channel.

72. Indeed, in their public statements, Coinbase and CGI do not distinguish between themselves. For example, for the year 2022 in its Form 10-K—a comprehensive report filed annually by public companies with the SEC about their financial performance—CGI defines its “Company” to include Coinbase and its other consolidated subsidiaries, and its “Business” as offering “a safe, trusted, easy-to-use platform that serves as a gate to the crypto economy for [its]three customer groups via both custodial and self-custodial solutions: consumers, institutions, and developers.” Furthermore, CGI’s Form 10-K includes the following statements, among many other similar statements, regarding the nature of its business:

- “We serve as the consumers’ primary crypto account, offering both a custodial solution with the Coinbase application and self-custodied solution with Coinbase Wallet.”

- Defining “Supported crypto assets” as “the Crypto assets we support for trading and custody on our platform, which include crypto assets for trading and crypto assets under custody.”

- “The Coinbase app provides customers a single platform to discover, trade, stake, store, spend, earn, borrow, and use their crypto assets in both our own proprietary and third party product experiences as we enable access to decentralized applications via an integrated web3 wallet.”

- “In connection with our Prime trading service, we routinely route customer orders to third-party exchanges or other trading venues.”

- “We have a digital asset support committee that is composed of senior leaders from our product, legal, compliance, finance, and accounting departments. The digital asset support committee reviews the relevant aspects of any asset escalated to it in connection with a listing on our trading platform in accordance with our digital asset support policies and procedures that are designed to mitigate conflicts. Only the digital asset support committee decides which of these escalated assets we can and cannot list on our platform, and it does not coordinate such decisions with anyone outside of the committee.”

73. Finally, CGI’s Code of Business Conduct & Ethics (also found on coinbase.com)governs CGI as well as Coinbase and refers to both collectively as “Coinbase,” the “Company,” “we,” or “our.”

II. THROUGH THE COINBASE PLATFORM, COINBASE PROVIDES EXCHANGE, BROKERAGE, AND CLEARING AGENCY SERVICES TO U.S. CUSTOMERS, AND COINBASE ALSO OFFERS BROKERAGE SERVICES THROUGH PRIME AND WALLET.

74. Coinbase has never registered with the Commission as a national securities exchange, a broker-dealer, or a clearing agency, and no exemption from registration applies. Nonetheless, from at least 2019 to the present (the “Relevant Period”), Coinbase has acted as an exchange, a broker, and a clearing agency with regard to crypto asset securities available for trading on the Coinbase Platform (as demonstrated in Section III.C below), including through the following conduct:

A. Coinbase Solicits Customers and Facilitates Trading.

75. Coinbase regularly solicits customers by advertising on its website and social media the features of the Coinbase Platform, Prime, and Wallet—especially those that allow customers to trade in crypto assets. Coinbase facilitates trading in crypto assets by assisting customers in opening and using trading accounts, handling customer funds and crypto assets, and routing and handling customer orders.

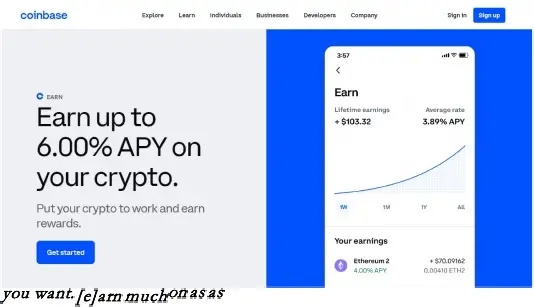

76. On its website, Coinbase markets its services to “individuals who want to trade, send and receive crypto” and “businesses … who want to accept, custody, [and] trade crypto,” while touting the advantages of trading on the Coinbase Platform. For instance, Coinbase’s website(coinbase.com) advertises that: “over 108 million people and businesses trust us to buy, sell, and manage crypto;” the Coinbase Platform provides “access to hundreds of cryptocurrencies” in a “safe & secure” manner; and by using the Coinbase mobile application, trading in crypto assets is available “anytime, anywhere.”

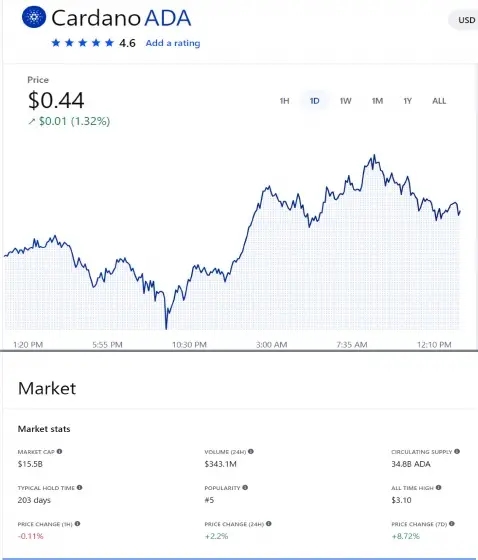

77. In addition, Coinbase uses the Coinbase blog and its Twitter account—which has over five million followers—to announce when Coinbase first makes a crypto asset available for trading through the Coinbase Platform. For example, on or about March 19, 2021, Coinbase announced on its blog that “Cardano (ADA) is now available on Coinbase,” and stated that “customers can now buy, sell, convert, send, receive, or store ADA.” The blog post included a link to an “informal asset page[]” for Cardano and instructions for opening a Coinbase account. As of February 2023, the page for Cardano (ADA) included a price chart, “market stats,” information about Cardano, such as links to its official website and whitepaper, and information about buying and storing Cardano on Coinbase. The page also included a list of “Related Assets,” “Trending assets,” “Popular crypto currencies,” and frequently asked questions (“FAQs”) about Cardano.

78. Indeed, Coinbase expends hundreds of millions of dollars a year on marketing and sales to maintain and recruit new investors. According to CGI’s 2022 Form 10-K filing, Coinbase’s “success depends on our ability to retain existing customers and attract new customers, including developers, to increase engagement with our products, services, and platform.” To that end, the Coinbase website is replete with links to open a Coinbase account as well as advertisementsmarketing monetary incentives and promotions, aimed at attracting more investors to the CoinbasePlatform, such as: offers of $5 in bitcoin as a “first trade incentive”; “50% of each referral’s tradingfees for their first 3 months”; “Get up to $400 in rewards with Coinbase”; and “Get up to $200 forgetting started. Earn free crypto after making your first purchase.”

79. Moreover, the Coinbase website features a “Learn” page, which includes “Beginner guides, practical tips, and market updates for first-timers, experienced investors, and everyone in between,” as well as answers to “Crypto questions.” The “Learn” page also features articles and video tutorials entitled “When is the best time to invest in crypto?,” “How to earn crypto rewards,” and “How to invest in crypto via your retirement account.”

80. Coinbase’s “Learning Rewards” program, which is within Coinbase’s “Asset Hub” on its website, allows crypto asset issuers and promoters to deliver their content to Coinbase customers, and enables customers to earn crypto assets in exchange for engaging with the content. Coinbase touts the “Worldwide reach” of the program, allowing issuers to “launch campaigns to our 90m+ user base.”

81. In fact, Coinbase holds itself out as providing brokerage services. For example, Coinbase markets Prime as a “[a] full-service prime brokerage platform with everything that institutions need to execute trades and custody assets at scale.” According to Coinbase’s website, Prime “delivers an institutional-grade trading platform that aggregates multi-venue liquidity, empowers advanced trading strategies, and helps you deploy capital at scale.” Coinbase provides Prime users with the ability to view a pricing feed that aggregates prices from the Coinbase Platform and third-party trading venues (which Coinbase anonymizes, e.g., “Exchange A” or “Exchange B”)and allows users to select from a number of order types they can utilize to submit orders through Prime to those venues. Coinbase also provides analytics and promotes them as a resource to “stay ahead of the market with this comprehensive analytics toolkit built to meet the needs of sophisticated investors and market participants.” For instance, Coinbase advertises its “agency trading desk,” which “provides insight into the market environment, liquidity characteristics, and trading activity in order to help you plan or execute your trade.”

82. Similarly, on its public blog, Coinbase boasts that “Coinbase Wallet brings the expansive world of DEX trading to your fingertips, where you can easily swap thousands of tokens, trade on your preferred network, and discover the lowest fees” and “makes it easy to access [] tokens through its trading feature, which compares rates across multiple exchanges.”

B. Coinbase Holds and Controls Customers’ Funds and Crypto Assets.

83. Coinbase requires that customers seeking to buy, sell, or trade through the Coinbase Platform and Prime create an account on coinbase.com and transfer their crypto assets or fiat currency to Coinbase. Once assets are transferred to Coinbase, Coinbase credits the customer account with the corresponding amounts in Coinbase’s internal ledger. The Coinbase internal ledger individually tracks each deposit and withdrawal of crypto assets and fiat currency for each customer, but Coinbase otherwise commingles customer funds and crypto assets that are similar in nature.

84. The Coinbase user agreement (“User Agreement”), which applies to some of Coinbase’s services (including the Coinbase Platform and Staking Program), states that crypto assets and fiat currency transferred by a customer to Coinbase are “custodial assets held by Coinbase for [the customer’s] benefit.”

85. Specifically, the User Agreement provides that customers’ crypto assets are held by Coinbase in digital wallets that, according to Coinbase, allow customers to “store, track, transfer, and manage” the balances of their crypto assets. However, Coinbase “store[s] Digital Asset private keys, which are used to process transactions, in a combination of online and offline storage.” And Coinbase uses “shared blockchain addresses” (

i.e., omnibus wallets on the relevant blockchains), controlled by Coinbase, to hold customers’ crypto assets in Coinbase’s digital wallets. Coinbase does not create a “segregated blockchain address” for each customer’s crypto assets and treats crypto assets held in its wallets—that are the same type and made available across multiple blockchain protocols—as “fungible and the equivalent of each other.”

86. Fiat currency deposited with Coinbase is held in what Coinbase describes as a “US Dollars wallet” (“USD Wallet”). The Coinbase User Agreement notes that the balance of a customer’s “USD Wallet is maintained in pooled custodial accounts” controlled by Coinbase.

C. Through the Coinbase Platform, Coinbase Maintains and Provides a Marketplace and Facilities for Trading Crypto Assets.

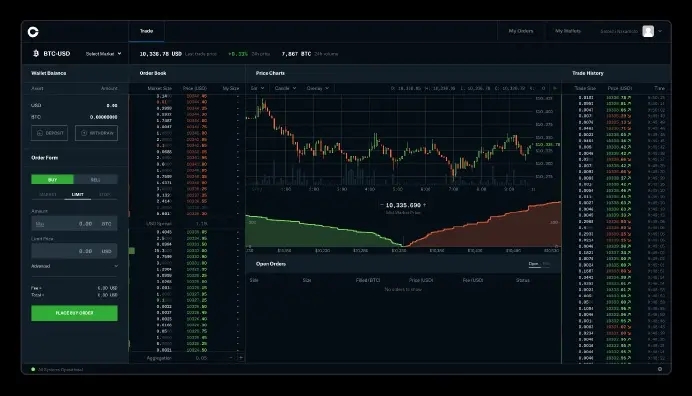

87. According to Coinbase’s website, the Coinbase Platform allows customers to “buy, sell, and spend crypto on the world’s most trusted crypto exchange.” The Coinbase Platform displays current and historical pricing information and other information relevant for trading crypto assets that is akin to what users see on traditional securities platforms (such as those that display aggregate stock market data) on which they can transact in stocks and bonds.

88. Coinbase allows multiple buyers and sellers to enter orders (any firm indication of a willingness to buy or sell a security, as either principal or agent, including any bid or offer quotation, market order, limit order, or other priced order) for crypto assets into the Coinbase Platform. Buyers and sellers can enter orders for crypto assets in any available “trading pair,” which typically involves two crypto assets that can be exchanged directly for each other using their relative price or a crypto asset exchanged for a fiat currency. Coinbase maintains and provides individual orderbooks for each trading pair, e.g., an ADA-USD order book, and all order books reside on a centralized server maintained by Coinbase.

89. Coinbase makes clear that when customers buy or sell crypto assets through Coinbase, they are not buying from Coinbase or selling to Coinbase. Rather, the Coinbase User Agreement states that Coinbase acts as “the agent,” transacting on the customers’ behalf, to facilitate the purchase and sale of crypto assets between the customers.

90. As demonstrated below, the design and functionality of the unregistered Coinbase Platform is similar to those of properly registered national securities exchanges, including its (i)display of orders, (ii) order book and order types, and (iii) order matching and trading rules.

i. Display

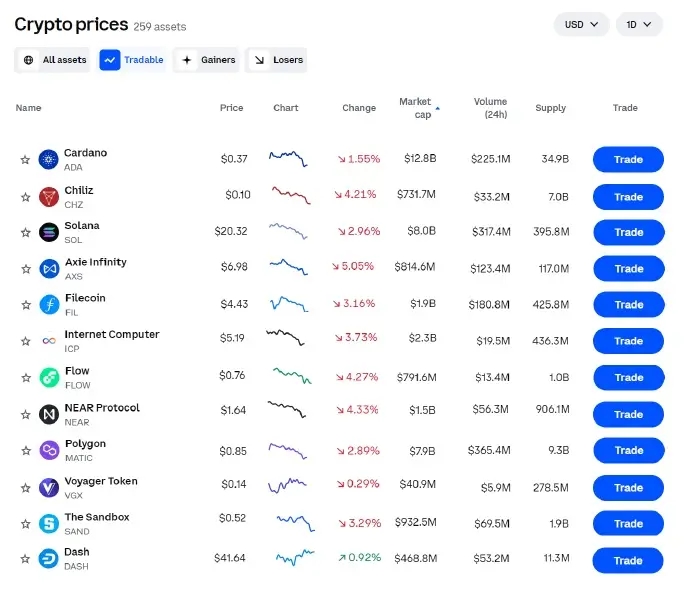

91. A subpage within the Coinbase website called “Explore” leads customers to a list of “Crypto prices” for more than 16,000 crypto assets. A customer that selects the filter “Tradable” on this page can consolidate this list (by removing those assets only available through Wallet) into approximately 260 crypto assets available for “trade” on the Coinbase Platform (the “Trading Page”). The Trading Page provides customers with the current price of each crypto asset in U.S. dollars (or other fiat currencies), the current “Market cap,” traded volume for that asset over the past 24 hour period, and circulating supply of the crypto asset, as well as the option to view historical data for each asset (by previous hour, day, week, month, or year) in the form of price trends represented by a graph and the percentage change in price of the asset during the chosen period.

92. The crypto assets on the Trading Page appear by full name and ticker symbol and are displayed in descending order from largest to smallest based on “Market cap” (or market capitalization—purportedly measured by the total supply of a crypto asset available in the secondary market multiplied by its price, as in markets for traditional equity securities). Below is an example of how the crypto asset securities set forth in Section III.C herein are displayed on the user interface of the Trading Page of Coinbase’s website:

93. Upon clicking the “Trade” button associated with a crypto asset, and logging in to an account with the Coinbase Platform, customers can view their account balances, and the Coinbase Platform provides fields for customers to enter orders in any available trading pair—including the ability to trade with other customers for the crypto asset selected from the Trading Page.

94. Through the Coinbase Platform, Coinbase displays open orders for each crypto asset trading pair resting on the order book and real time data with respect to those open orders in terms of bid and ask prices, trading volume, and trade history. Additionally, Coinbase displays historical trade data (in price, quantity, and time) for each crypto asset available for trading on the Coinbase Platform and allows customers to compare data relating to the terms of crypto asset transactions (i.e., a comparison of the value of proposed crypto asset trading pairs).

ii. Order Types and Order Book

95. On the Coinbase Platform, customers can place various types of buy and sell orders, including: (1) a market order ( i.e., an order to buy or sell a specified quantity of a crypto asset at the current best available market price); (2) a limit order ( i.e., an order to buy or sell a specified quantity of a crypto asset at a specified price or better); or (3) a stop limit order ( i.e., an instruction to post an order to buy or sell a specified quantity of a crypto asset but only if and when the best price quotation reaches or passes the selected stop price). Once placed, these orders appear on Coinbase’s order book. To place an order to buy, a customer must have sufficient funds in their Coinbase account to cover the value of the order (and similarly, to place an order to sell, the customer must have the asset available in their account) plus any applicable fees.

96. Orders that can execute immediately ( i.e., orders posted to the order book at the same price as one or more existing orders) are referred to as “taker orders” because they “take” liquidity from the Coinbase Platform. Orders that do not execute immediately ( i.e., orders posted to the order book at a different price than all existing orders) are referred to as “maker orders” because they “make” liquidity in the market. A maker order will rest on the order book at that price until: (1)it is cancelled by the customer; (2) it expires due to a time limit instruction by the customer; or (3) it is completely filled by one or more taker orders by another customer at the same price.

iii. Order Matching and Trading Rules

97. Coinbase provides a trading facility through the electronic automated matching engine that it operates on the Coinbase Platform. According to the “Trading Rules” Coinbase publishes on its website, the matching engine is programmed with rules that determine how orders will interact and how the users entering such orders agree to the terms of a trade. For instance, according to Coinbase, the matching engine matches orders based on a price-time priority. Moreover, neither the buyer nor the seller knows the identity of the counterparty to the trade.

98. Under its price-time priority rule, Coinbase matches orders first based on the best price for the order, and if there are multiple orders at the same price, the order with the earlier time will be matched against the corresponding opposite order first. When a customer enters an order into the order book that is marketable ( i.e., the order can match with one or more orders on the opposite side and thus is a taker order), it will be matched with the earliest in time maker order, at the best price on the order book. If the taker order is not completely filled by the first maker order, the taker order will match with the next marketable maker order(s) resting on the book until the taker order is exhausted or there are no more maker orders with which the taker order can match.

99. A customer may cancel an entered order up until the order matches. If there is a match, Coinbase removes the orders from the order book and updates the accounts of the customers who placed the executed orders to reflect their new positions.

D. Coinbase Settles Customers’ Trades.

100. After the matching engine matches orders between customers trading on the Coinbase Platform, Coinbase’s Trading Rules state that Coinbase settles the transaction immediately by making corresponding debits and credits in each customer’s account on the internal ledgers it maintains to track customers’ balances in crypto assets and fiat currency. According to Coinbase, these debits and credits occur “off-chain,” meaning the transaction is recorded on Coinbase’s internal ledgers, not on any blockchain. Subject to daily withdrawal limits, a customer may immediately arrange to withdraw the assets in their account by instructing Coinbase to transfer the customer’s assets to another blockchain wallet (or fiat currency to the customer’s bank account)after a transaction is settled.

E. Coinbase Charges Fees on Executed Trades.

101. Coinbase charges fees for trades executed through the Coinbase Platform and Prime. For trades on the Coinbase Platform, the fee is either a percentage of the order quantity ranging up to 0.60%, or a flat fee based upon the value of the trade. Coinbase charges transaction-based fees for its Prime order routing and execution services, with customers having the option of a single all-in fee or a “transparent, flat commission in addition to pass-through exchange fees.” During the relevant period and through at least March 2023, Coinbase charged a flat fee of 1% of the principal amount for each transaction executed through the swap/trade feature in Wallet.

III. THE CRYPTO ASSETS TRADED ON THE COINBASE PLATFORM AND THROUGH PRIME AND WALLET INCLUDE ASSETS THAT ARE OFFERED AND SOLD AS SECURITIES.

102. Throughout the Relevant Period, Coinbase—through the Coinbase Platform, Prime,and Wallet—has made available for trading crypto assets that are offered and sold as investment contracts, and thus as securities. This includes, but is not limited to, the 13 crypto asset securities discussed in Section III.C below—a non-exhaustive list of such crypto asset securities.

A. Before Making Crypto Assets Available, Coinbase Has Conducted Risk Assessments that Acknowledge the Potential Application of the Federal Securities Laws to Its Products and Services.

103. Even before the SEC issued the DAO Report in 2017, Coinbase understood that crypto assets could be offered and sold as securities under the federal securities laws—and the implications for Coinbase if it made such securities available for trading to the investing public. For example, in or around December 2016, Coinbase released on its website a document entitled, “A Securities Law Framework for Blockchain Tokens.” This document included a section on “How to determine if a token is a security,” and explained: “The US Supreme Court case of SEC v Howey established the test for whether an arrangement involves an investment contract. An investment contract is a type of security.” This “Framework” acknowledged that “[f]or many blockchain tokens, the first two elements of the Howey test”— i.e., investment of money and common enterprise—“are likely to be met.”

104. Recognizing that at least certain crypto assets were being offered, sold, and otherwise distributed by an identifiable group of persons or promoters, in or around September 2018, Coinbase publicly released the “Coinbase Crypto Asset Framework,” which included a listing application form for crypto asset issuers and promoters seeking to make their crypto assets available on the Coinbase Platform.

105. Coinbase’s listing application required issuers and promoters to provide information about their crypto assets and blockchain projects. It specifically included requests for information relevant to a

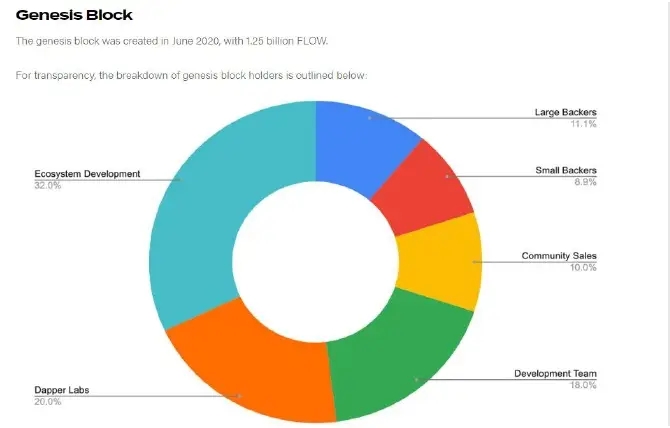

Howey analysis of the crypto asset. For example, the application asked the relevant issuer to identify and/or describe: (i) the “project team” and its involvement in the “development, promotion or function of the [relevant] network”; (ii) any “token sale”; (iii) “the allocation of tokens” to “founders, advisors, employees, a foundation” and others; (iv) “any statements … made about the token/network noting the potential to realize returns, profits or other financial gain”; and (v) “any efforts to affect the token supply or impact token price (including supply caps, buybacks, repurchases, [and] burning … ).”

106. Additionally, in or around September 2019, Coinbase and other crypto asset businesses founded the Crypto Rating Council (“CRC”). The CRC subsequently released a framework for analyzing crypto assets that “distilled a set of yes or no questions which are designed to plainly address each of the four Howey test factors” and assigned to the crypto asset a score ranging from 1 to 5, with a score of 1 indicating that an “asset has few or no characteristics consistent with treatment as an investment contract,” and a score of 5 meaning that an “asset has many characteristics strongly consistent with treatment as a security.”

107. In announcing the CRC’s creation, Coinbase stated, “although the U.S. Securities and Exchange Commission has issued helpful guidance, whether any given crypto asset is a security ultimately requires a fact-intensive analysis.” In referencing the SEC staff’s “helpful guidance,” Coinbase provided a hyperlink to that guidance, entitled “Framework for ‘Investment Contract’ Analysis of Digital Assets,” which was and remains publicly available on the SEC’s website athttps://www.sec.gov/corpfin/framework-investment-contract-analysis-digital-assets.

108. Starting in 2019, Coinbase used and relied on the CRC framework to assess certain crypto assets in determining whether to make them available for trading on the Coinbase Platform. Meanwhile, between late 2019 and the end of 2020, Coinbase more than doubled the number of crypto assets available for trading on the Coinbase Platform, and it more than doubled that number again in 2021. During this period, Coinbase made available on the Coinbase Platform crypto assets with high “risk” scores under the CRC framework it had adopted. In other words, to realize exponential growth of the Coinbase Platform and boost its own trading profits, Coinbase made the strategic business decision to add crypto assets to the Coinbase Platform even where it recognized the crypto assets had the characteristics of securities.

109. As part of these efforts, Coinbase worked closely with issuers of crypto assets who sought to have their crypto assets listed on the Coinbase Platform. Coinbase’s “Listings Team” engaged in a dialogue with issuers focused on identifying potential “roadblocks” under Howey. For example, on one occasion, Coinbase identified “problematic statements” by an issuer that described its crypto asset “with language traditionally associated with securities,” “implying that the asset is an investment or way to earn profit,” “emphasizing the profitability of a project and/or the historic or potential appreciation of the value of the assets,” “attempts by the project team to have the asset listed on exchanges,” and “using terms referring to the asset[s] that are commonly associated with securities such as ‘dividend,’ ‘interest,’ ‘investment’ or ‘investors.’” As “possible mitigation[],” Coinbase suggested that the issuer “remove any existing problematic statements, and refrain from making problematic statements in the future.”

110. Coinbase was thus aware of the risk that it could be making available for trading on the Coinbase Platform crypto assets that were being offered and sold as securities. Indeed, Coinbase touted to the investing public its familiarity with the relevant legal analysis governing the offer and saleof securities. Coinbase also understood that an evaluation of whether an offer and sale of crypto assets is an offer and sale of securities is dependent on individualized facts and circumstances. And Coinbase acknowledged that the different facts and circumstances that accompanied each offer and sale of crypto assets had to be separately weighed, and that such an exercise necessarily involved an assessment of the risk that the offer and sale involved securities.

B. CGI Has Publicly Disclosed the Risks of Coinbase’s Unregistered Business Operations.

111. As part of its effort to become a public company, CGI publicly filed with the SEC a Form S-1 on February 25, 2021, to register an offering of its Class A Common Stock. SEC staff reviewed that registration statement (and earlier confidential draft versions and subsequent publicly filed amendments) with respect to applicable disclosure and accounting requirements. As part of that review process, SEC staff issued comments and CGI submitted response letters and amended registration statements. On April 1, 2021, CGI’s Form S-1 was declared effective. Declaring effective a Form S-1 registration statement does not constitute an SEC or staff opinion on, or endorsement of, the legality of an issuer’s underlying business.

112. In its Form S-1, CGI acknowledged the risks that the crypto assets Coinbase makes available for trading could be deemed securities and thus that Coinbase could be found to be engaging in unregistered brokerage, exchange, and/or clearing-agency activity. Specifically, CGI stated the following in the “Risk Factors” section of its Form S-1 (emphases added):

A particular crypto asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty and if we are unable to properly characterize a crypto asset, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, operating results, and financial condition. The SEC and its staff have taken the position that certain crypto assets fall within the definition of a “security” under the U.S. federal securities laws. The legal test for determining whether any given crypto asset is a security is a highly complex, fact-driven analysis that evolves over time, and the outcome is difficult to predict. The SEC generally does not provide advance guidance or confirmation on the status of any particular crypto asset as a security. Furthermore, the SEC’s views in this area have evolved over time and it is difficult to predict the direction or timing of any continuing evolution. It is also possible that a change in the governing administration or the appointment of new SEC commissioners could substantially impact the views of the SEC and its staff … With respect to all other crypto assets, there is currently no certainty under the applicable legal test that such assets are not securities, notwithstanding the conclusions we may draw based on our risk-based assessment regarding the likelihood that a particular crypto asset could be deemed a “security” under applicable laws.

* * * * *

The classification of a crypto asset as a security under applicable law has wide-ranging implications for the regulatory obligations that flow from the offer sale trading and clearing of such assets … Persons that effect transactions in crypto assets that are securities in the United States may be subject to registration with the SEC as a “broker” or “dealer.” Platforms that bring together purchasers and sellers to trade crypto assets that are securities in the United States are generally subject to registration as national securities exchanges, or must qualify for an exemption, such as by being operated by a registered broker-dealer as an alternative trading system, or ATS, in compliance with rules for ATSs. Persons facilitating clearing and settlement of securities may be subject to registration with the SEC as a clearing agency.

113. CGI has made the same disclosures, almost verbatim, in each of its annual and quarterly reports (on Forms 10-K and 10-Q, respectively) filed with the SEC since its Form S-1 became effective.

C. Coinbase Has Made Available for Trading Assets that Are Offered and Sold as Securities.

114. Throughout the Relevant Period, Coinbase has made available for trading crypto assets that are being offered and sold as investment contracts, and thus as securities. This includes, but is not limited to, the units of each of the crypto asset securities further described below—with trading symbols SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO—(the “Crypto Asset Securities”).

115. The crypto assets on the Coinbase Platform, or made available through Prime or Wallet, including but not limited to each of the Crypto Asset Securities, may be bought, sold, or traded for consideration, including U.S. dollars, fiat currencies, or other crypto assets.

116. Each unit of a particular crypto asset on the Coinbase Platform, or made availablethrough Prime or Wallet, including but not limited to each of the Crypto Asset Securities, trades atthe same price as another unit of that same asset.

117. These assets, including but not limited to each of the Crypto Asset Securities, are interchangeable ( e.g., any ADA or fraction thereof is just like any other). Accordingly, to the extent the assets change in price, all tokens of the same asset increase or decrease in price in the same amounts and to the same extent, such that one token is equal in value to any other one token, on a pro rata basis.

118. The purchase of any particular asset, including but not limited to each of the Crypto Asset Securities, does not appear to give an investor any special rights not available to any other investor in that asset, such as separately managed accounts, or different capital appreciation as to the value of the crypto assets that other investors in the same assets hold.

119. The crypto assets on the Coinbase Platform, including but not limited to each of the Crypto Asset Securities (but excluding NEXO which is available only via Wallet), are available for sale broadly to any person who creates an account with Coinbase, and Coinbase’s website displays information (like asset price changes) in a format highly similar to trading platforms offered by registered broker-dealers in the traditional securities markets, who permit investors to transact insecurities. Coinbase makes these crypto assets available for trading without restricting transactions to those who might acquire or treat the asset as anything other than as an investment.

120. For example, the below page on Coinbase’s website provides price movement and other “Market Stats” for ADA (Cardano):

121. Coinbase customers can access the page for ADA and other asset-specific pages from the “Explore” page on Coinbase’s website; they simply click on the name of a particular crypto asset and are redirected to a page where Coinbase provides additional information about that crypto asset. The information on each asset-specific page is typically provided by an identifiable set of asset promoters and/or developers, and it includes, but is not limited to: (i) the persons who “developed,” “launched,” or “created” the crypto asset; (ii) links to any “whitepaper” for the asset’s original or ongoing sales; (iii) links to the “website” associated with the asset and its developers or creators; (iv)a compendium of public statements (including on social media) about the asset by its developers or creators and additional information about the asset and its creators that may be available such as the issuer’s homepage; (v) information about whether market participants are “bearish,” “neutral,” or “bullish” about the asset (referring to terms typically associated with whether an investor thinks the price of securities such as stocks are going to go down, stay the same, or go up); (vi) historical information about the “price” of the asset including its “all-time high” price and the “price change” over the last seven days stated as a percentage return on investment; and (vii) “detailed instructions” for “how to buy” the asset on the Coinbase Platform. Because Coinbase has not registered as a broker, national securities exchange, or clearing agency, there is no formal mechanism to ensure the accuracy or consistency of the information Coinbase now selectively discloses about the crypto assets it makes available for trading, including each of the Crypto Asset Securities.

122. Coinbase does not restrict how many units of a crypto asset, including but not limited to each of the Crypto Asset Securities, any given investor may purchase. Moreover, investors are not required to purchase quantities tied to a purported non-investment “use” that may exist for the asset, if any. To the contrary, investors may and typically do purchase these assets in any amount.

123. The assets available for sale on the Coinbase Platform, and through Prime and Wallet, including but not limited to each of the Crypto Asset Securities, are transferable and immediately eligible for resale on the Coinbase Platform, Wallet, or other crypto asset trading platforms without any apparent restrictions on resale (including as to the prices or amounts of resale, or the identity of the new buyers).

124. During the Relevant Period, Coinbase has made available for trading on the Coinbase Platform, and through Prime and Wallet, crypto assets that have been the subject of prior SEC enforcement actions based upon their status as crypto asset securities. Those crypto assets include but are not limited to the following assets that Coinbase has made available for trading on the Coinbase Platform: AMP (the AMP token, available since June 2021), DDX (the DerivaDAO token, available since September 2021), LCX (the LCX token, available since October 2019), OMG(the OMG Network token, available from May 2020 to March 2023), POWR (the Powerledger token, available since November 2021), RLY (the Rally token, available from July 2021 to March2023), and XYO (the XYO token, available since September 2021).

125. For purposes of prevailing on the Exchange Act claims set forth herein, the SEC need only establish that Coinbase has engaged in activities relating to a single crypto asset security during the Relevant Period. Nevertheless, set forth below are additional details regarding a non-exhaustive list of 13 Crypto Asset Securities—12 available on the Coinbase Platform (and through Prime and Wallet) and one available only via Wallet (NEXO).

126. From the time of their first offer or sale, each of these Crypto Asset Securities was offered and sold, and continues to be offered and sold today, as an investment contract and thus a security. For each of the Crypto Asset Securities, statements by the crypto asset issuers and promoters have led investors reasonably to expect profits based on the managerial or entrepreneurial efforts of such issuers and promoters (and associated third persons). This was investors’ reasonable expectation whether they acquired the Crypto Asset Securities in their initial offering, from prior investors, or on crypto asset trading platforms including the Coinbase Platform (or through Prime or Wallet). For each of the Crypto Asset Securities, such statements by issuers and promoters include statements made and/or available to the investing public during the period when those Crypto Asset Securities were available for trading on the Coinbase Platform or via Prime or Wallet, as well as other statements described below.

i. SOL

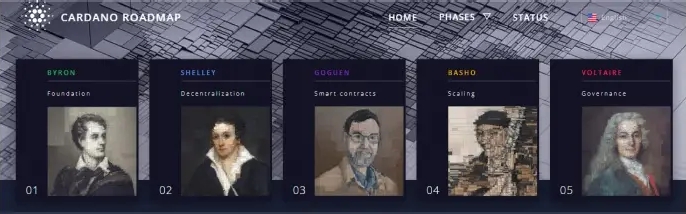

127. “SOL” is the native token of the Solana blockchain. The Solana blockchain was created by Solana Labs, Inc. (“Solana Labs”), a Delaware corporation headquartered in San Francisco that was founded in 2018 by Anatoly Yakovenko (“Yakovenko”) and Raj Gokal (Solana Labs’ current CEO and COO, respectively). According to Solana’s website, www.solana.com, the Solana blockchain is a network upon which decentralized apps (“dApps”) can be built, and is comprised of a platform that aims to improve blockchain scalability and achieve high transaction speeds by using a combination of consensus mechanisms.

128. According to Solana’s website, SOL may be “staked” on the Solana blockchain to earn rewards, and a certain infinitesimal amount of SOL must be “burned” to propose a transaction on the Solana blockchain, a common function for native tokens on blockchains that constitutes a method for cryptographically distributed ledgers to avoid a potential bad actor from “spamming” a blockchain by overwhelming it with an infinite number of proposed transactions.