FinCENのバイナンスに対する同意判決『FinCEN Consent Order 2023-04 FINAL508』の文字起こしです。機械翻訳用にフットノートやカギ括弧は省略してあります。

※同意判決とは、罪や責任を認めることなく、二者間の紛争を解決する合意または和解です。

Contents

- 1 CONSENT ORDER IMPOSING CIVIL MONEY PENALTY

- 2 I. JURISDICTION

- 3 II. STATEMENT OF FACTS

- 3.1 A. Binance and its CVC Platforms

- 3.2 B. FinCEN

- 3.3 C. Bank Secrecy Act Requirements

- 3.4 D. Binance Did Business in the U.S. as an Unregistered MSB

- 3.4.1 1. Binance Maintained U.S.-based Personnel and Other Operational Touchpoints to the United States

- 3.4.2 2. Binance’s Delayed and Flawed “Ringfencing” of the United States and Misleading Approach to U.S. Regulatory Inquiries

- 3.4.3 3. Binance Helped U.S. Users Circumvent Its Own “Ringfencing”

- 3.4.4 4. Binance’s Launch of a “U.S.” Entity Was Intended to Shift Regulatory Focus and Did Not Result in Binance Exiting the United States

- 3.5 E. Failure to Develop, Implement, and Maintain an Effective AML Program

- 3.5.1 1. Binance’s KYC “Tiers” Allowed Users to Trade without KYC

- 3.5.2 2. Binance’s Lack of KYC Led to a “Paper-only” AML Program

- 3.5.3 3. Insufficient Policies, Procedures, and Internal Controls for Subaccounts and “Nested” Exchanges

- 3.5.4 4. Insufficient Policies, Procedures, and Internal Controls Around AECs

- 3.5.5 5. Insufficient Policies, Procedures, and Internal Controls for Responding to Law Enforcement Requests

- 3.5.6 6. Insufficient Policies, Procedures, and Internal Controls for High-Risk Jurisdictions

- 3.5.7 7. Binance’s Failure to Designate a Person to Assure Day-to-Day Compliance with the BSA

- 3.5.8 8. Binance’s Failure to Provide Education or Training of Appropriate Personnel

- 3.5.9 9. Binance’s Failure to Provide for Independent Review of its AML Program

- 3.6 F. Failure to File Suspicious Activity Reports

- 4 III. VIOLATIONS

- 5 IV. ENFORCEMENT FACTORS

- 5.1 Nature and seriousness of the violations, including the extent of possible harm to the public:

- 5.2 Impact or harm of the violations on FinCEN’s mission to safeguard the financial system from illicit use, combat money laundering, and promote national security:

- 5.3 Pervasiveness of wrongdoing within an entity, including management’s complicity in, condoning or enabling of, or knowledge of the conduct underlying the violations:

- 5.4 History of similar violations, or misconduct in general, including prior criminal, civil, and regulatory enforcement actions:

- 5.5 Financial gain or other benefit resulting from, or attributable to, the violations:

- 5.6 Presence or absence of prompt, effective action to terminate the violations upon discovery, including self-initiated remedial measures:

- 5.7 Timely and voluntary disclosure of the violations to FinCEN:

- 5.8 Quality and extent of cooperation with FinCEN and other relevant agencies, including as to potential wrongdoing by its directors, officers, employees, agents, and counterparties:

- 5.9 Systemic Nature of the Violations. Considerations include, but are not limited to, the number and extent of violations, failure rates (e.g., the number of violations out of total number of transactions), and duration of violations:

- 5.10 Whether another agency took enforcement action for related activity. FinCEN will consider the amount of any fine, penalty, forfeiture, and/or remedial action ordered:

- 6 V. CIVIL PENALTY

- 7 VI. UNDERTAKINGS

- 8 VII. CONSENT AND ADMISSIONS

- 9 VIII. COOPERATION

- 10 IX. RELEASE

- 11 X. WAIVERS

- 12 XI. VIOLATIONS OF THIS CONSENT ORDER

- 13 XII. PUBLIC STATEMENTS

- 14 XIII. RECORD RETENTION

- 15 XIV. SEVERABILITY

- 16 XV. SUCCESSORS AND ASSIGNS

- 17 XVI. MODIFICATIONS AND HEADINGS

- 18 XVII. AUTHORIZED REPRESENTATIVE

- 19 XVIII. NOTIFICATION

- 20 XIX. COUNTERPARTS

- 21 XX. EFFECTIVE DATE AND CALCULATION OF TIME

- 22 ATTACHMENT A

- 22.1 INDEPENDENT COMPLIANCE MONITOR

- 22.1.1 Monitor’s Mandate

- 22.1.2 Binance’s Obligations

- 22.1.3 Withholding Access

- 22.1.4 Monitor’s Coordination with Binance and Review Methodology

- 22.1.5 Monitor’s Written Work Plans

- 22.1.6 First Review

- 22.1.7 Follow-Up Reviews

- 22.1.8 Monitor’s Discovery of Potential or Actual Misconduct

- 22.1.9 Meetings During Term of Monitorship

- 22.1.10 Contemplated Confidentiality of Monitor’s Reports

- 22.1 INDEPENDENT COMPLIANCE MONITOR

CONSENT ORDER IMPOSING CIVIL MONEY PENALTY

The Financial Crimes Enforcement Network (FinCEN) has conducted a civil enforcement investigation and determined that grounds exist to impose a Civil Money Penalty on Binance Holdings Limited, Binance (Services) Holdings Limited, and Binance Holdings (IE) Limited, collectively doing business as Binance and Binance.com for violations of the Bank Secrecy Act (BSA) and its implementing regulations. Binance admits only to the facts admitted in the November 21, 2023 Plea Agreement of Binance Holdings Limited with the United States Department of Justice (DOJ) for conduct from August 2017 through October 2022 and neither admits nor denies the remainder of the facts set forth herein. Binance consents to the issuance of this Consent Order, agrees to pay the civil money penalty imposed in this Consent Order, and agrees to comply with the Undertakings and Monitor requirements and the other provisions of this Consent Order.

I. JURISDICTION

Overall authority for enforcement and compliance with the BSA lies with the Director of FinCEN, and the Director may impose civil penalties for violations of the BSA and its implementing regulations.

At all times relevant to this Consent Order, Binance was a “domestic financial institution,” specifically a “money services business” (MSB) as defined by the BSA and its implementing regulations. As such, Binance was required to comply with applicable BSA regulations.

II. STATEMENT OF FACTS

The conduct described below took place from on or about July 14, 2017 through July 30, 2023 (the Relevant Time Period), unless otherwise indicated.

A. Binance and its CVC Platforms

1. The Binance.com Platform

Binance’s main platform was launched in 2017 and was accessible to customers through the Binance.com website. The platform currently has five primary CVC trading pairs—bitcoin, ether, litecoin, tether, and Binance Coin (BNB). These CVCs are offered with over 160 separate CVCs in over 580 trading pairs. After launching as a CVC-to-CVC exchange, Binance also began providing fiat-to-CVC trading.

Shortly after its 2017 launch, Binance quickly became one of the largest CVC exchanges by daily trading volume. According to public reporting, Binance processed over $9.5 trillion in trading volume in 2021, or roughly half of all spot trading volume handled by centralized CVC exchanges. Despite a market downturn in 2022, Binance processed spot trades in excess of $5.2 trillion and generally increased its market share during the year to roughly 60% of all centralized CVC exchanges’ spot trading volume. Binance maintained a similar share of the market for trading of CVC derivatives on centralized exchanges. Third-party rankings of CVC exchanges by volume continue to consistently identify Binance as processing more volume per day than roughly the next 9 CVC exchanges combined. Binance customers include both individuals (Retail Users) and businesses (Enterprise Users). Binance advertises its ability to process 100 orders per 10 seconds through its Application Programming Interface (API) and 200,000 orders per 24 hours.

2. The Binance.us Platform

In September 2019, Binance launched a second platform focused on the U.S. and accessible to U.S. customers through the Binance.us website. This U.S.-focused platform was operated by BAM Trading Services, Inc., a Binance-affiliated entity that registered with FinCEN in December 2019. Although both Binance.com and Binance.us are CVC exchanges, Binance.us offers a more limited suite of products (e.g., fewer CVC trading pairs, no derivative products, etc.) and processes a much smaller amount of CVC trading than Binance.com does. Binance.us is an affiliate, but not a subsidiary, of the entities doing business as Binance.

B. FinCEN

FinCEN is a bureau within the U.S. Department of the Treasury and is the federal authority that enforces the BSA by investigating and imposing civil money penalties on financial institutions and individuals for willful violations of the BSA. As delegated by the Secretary of the Treasury, FinCEN has “authority for the imposition of civil penalties” and “overall authority for enforcement and compliance. . . .”

C. Bank Secrecy Act Requirements

The term “money services business” is defined in 31 C.F.R. § 1010.100(ff) as any of the following categories of business: (1) dealers in foreign exchange; (2) check cashers; (3) issuers or sellers of traveler’s checks or money orders; (4) providers of prepaid access; (5) money transmitters; (6) U.S. Postal Service; or (7) sellers of prepaid access. The regulations define the term “money transmitter” as a person that either “provides money transmission services” or who is otherwise “engaged in the transfer of funds.” “Money transmission services” are defined in FinCEN’s regulations as “the acceptance of currency, funds, or other value that substitutes for currency from one person and the transmission of currency, funds, or other value that substitutes for currency to another location or person by any means.” A foreign-located business is an MSB if it does business “wholly or in substantial part within the United States.” Given these definitions and Binance’s activities within the United States, Binance was a “domestic financial institution,” specifically a “money services business,” including a “money transmitter,” operating in the United States. As a result, Binance was required to comply with FinCEN’s regulations applicable to MSBs during the Relevant Time Period.

Registration: The BSA and its implementing regulations require an MSB, such as Binance, to register as an MSB with FinCEN within 180 days of beginning operations and to renew that registration every two years.

AML Program: The BSA and its implementing regulations require an MSB, such as Binance, to develop, implement, and maintain an effective Anti-Money Laundering (AML) program that is reasonably designed to prevent the MSB from being used to facilitate money laundering and the financing of terrorist activities. Binance was required to develop, implement and maintain an effective, written AML program that, at a minimum: (1) incorporates policies, procedures and internal controls reasonably designed to assure ongoing compliance with the BSA and its implementing regulations; (2) designates an individual responsible to assure day-to-day compliance with the MSB’s AML program and all BSA regulations; (3) provides education and/or training for appropriate personnel, including training in the detection of suspicious transactions; and (4) provides for independent review to monitor and maintain an adequate program.

Suspicious Activity Reporting: The BSA and its implementing regulations require an MSB, such as Binance, to identify and report suspicious transactions relevant to a possible violation of law or regulation in SARs filed with FinCEN. Specifically, the BSA and its implementing regulations require MSBs to report transactions that involve or aggregate to at least $2,000, are conducted by, at, or through the MSB, and that the MSB “knows, suspects, or has reason to suspect” are suspicious. A transaction is “suspicious” if an MSB “knows, suspects, or has reason to suspect” the transaction: (a) involves funds derived from illegal activities, or is conducted to disguise funds derived from illegal activities; (b) is designed to evade the reporting or recordkeeping requirements of the BSA or regulations implementing it; or (c) has no business or apparent lawful purpose or is not the sort in which the customer normally would be expected to engage, and the MSB knows of no reasonable explanation for the transaction after examining the available facts, including background and possible purpose of the transaction. An MSB is generally required to file a SAR no later than 30 calendar days after the initial detection by the MSB of the facts that may constitute a basis for filing a SAR.

D. Binance Did Business in the U.S. as an Unregistered MSB

At no time did Binance register with FinCEN. Yet throughout the Relevant Time Period, Binance did business as a money transmitter in substantial part within the United States, including by cultivating and serving over 1 million U.S. customers through its main platform, Binance.com, which solicited and accepted orders to convert CVC through CVC-to-CVC trades, as well as CVCto-fiat currency trades. In connection with these activities, Binance accepted deposits from customers, and, otherwise, accepted money or property, including CVC, to margin, guarantee, or secure trades on Binance.com. As explained in greater detail below, Binance provided these CVC services to U.S. customers, including by allowing persons located in the U.S. to access the Binance.com platform and by exchanging their CVC or fiat currency on the platform.

During the Relevant Time Period and as a result of the flawed controls that Binance deployed (described below), Binance maintained over 1 million U.S. users on the Binance.com platform. Although many of these were Retail Users, a large number were Enterprise Users, which include market makers and liquidity providers, who engage in high levels of activity on the Binance.com platform and were a crucial element in Binance’s commercial success. Accordingly, even as the total number of U.S. users appears to have fluctuated during the Relevant Time Period, the trading volume of U.S. users, which was largely driven by Enterprise Users, continued to rise through mid-2021. Binance’s own estimates of this peak identified U.S. Enterprise Users trading more than 650,000 bitcoin of CVC in a single month in late 2021, which had a prevailing USDequivalent value in excess of $35 billion.

As explained in more detail below, Binance’s substantial business in the United States throughout the Relevant Time Period was a result of ineffective controls and a willful failure to cease serving U.S. customers (including taking steps to obscure the continuing presence of U.S. users on Binance.com), despite assuring a state regulator that it had done so. As detailed in each of the corresponding subsections below, Binance: (i) maintained U.S.-based personnel and other operational touchpoints to the United States; (ii) operated for over two years with no geofencing controls to restrict access by U.S. users, and then employed flawed protocols to “ringfence” the Binance.com platform from U.S. users while misleading U.S. authorities; (iii) circumvented its own “ringfencing” protocols to allow large U.S. firms to continue to operate on the Binance.com platform, including by directly instructing clients on how to change their KYC and use virtual private networks (VPNs) to obfuscate U.S. ties and indirectly through the maintenance of accounts for a subset of Enterprise Users some of which acted as conduits for U.S. users (Exchange Brokers); and (iv) devising a scheme to retain lucrative U.S. users while redirecting regulatory focus through the establishment of Binance.us (a U.S.-located MSB registered with FinCEN that purports to be Binance’s sole presence in the United States and separate from Binance.com, but that in reality lacked autonomy and maintained extensive ties to Binance.com).

1. Binance Maintained U.S.-based Personnel and Other Operational Touchpoints to the United States

In addition to the extensive number of, and trading volume associated with, U.S. users that Binance improperly retained without registering with FinCEN, numerous other factors indicate that Binance engaged in money transmitting activities in the United States, including: (i) employing more than 100 individuals who are based in the United States, including senior personnel, such as an advisor to Binance’s CEO, several c-suite executives (former Chief Business Officer, former Chief Strategy Officer, Chief Technology Officer), Global Director of Brand Marketing, and Vice President of Global Expansion Operations; (ii) until recently, partnering with a U.S. financial institution to offer its users a USD-based stablecoin, which, as of November 2022 had a circulating supply of more than $23 billion; and (iii) acquiring a U.S. company to provide its users with CVC wallet services. In connection with its resolution with FinCEN, Binance agreed to remediate these connections to the U.S.

2. Binance’s Delayed and Flawed “Ringfencing” of the United States and Misleading Approach to U.S. Regulatory Inquiries

During much of the Relevant Time Period, Binance’s geofencing controls were either nonexistent, or were superficial and ineffective: starting in the summer of 2019 (two years after Binance.com launched), U.S. users were identified based on their IP addresses, but users accessing Binance.com from a U.S. IP address were not fully blocked. Instead, those users needed only to “self-certify” that they were not U.S. persons. Until January 2021, Binance processed transactions with U.S. persons who completed this self-certification, even where Binance possessed information contrary to their certification. Moreover, Binance did not even purport to revoke the ability of many U.S. Enterprise Users to access the Binance.com API until August 2021, and, as will be explained in the subsections that follow, this revocation did not apply to many of the most commercially lucrative U.S. Enterprise Users in Binance’s VIP program. As also described below, Binance’s VIP U.S. users also benefited from deliberate actions by Binance personnel to conceal their use of the Binance.com exchange.

Despite Binance’s knowledge of those flaws, however, Binance represented to regulators that it was not serving U.S. customers. In May 2018, Binance assured a U.S. authority that it “did not maintain business operations within the jurisdiction.” Further, in August 2019, Binance was asked to provide a partner company’s state regulator with information about Binance’s geofencing controls. Its response contained false or misleading statements about these controls. For example, Binance stated in its August 2019 response that it detects user IP addresses and “blocks those it determines are based in the U.S.,” but Binance made no such determination apart from simply accepting a “self-certification” that a customer is not a U.S. person. Additionally, Binance stated that if a customer used a VPN to mask their IP address, Binance “employs a secondary manual control during the KYC process to check for U.S. persons.” At the time of Binance’s response, however, the vast majority of users on the platform were not required to undergo KYC, and Binance had no such secondary manual control applicable to users accessing Binance through a VPN, whether required to undergo KYC or not. In fact, Binance took no meaningful steps to limit its U.S. presence until more than two years after launch, and well over a year after it was contacted by a U.S. authority.

3. Binance Helped U.S. Users Circumvent Its Own “Ringfencing”

Binance not only knew of the flaws in its “ringfencing” controls, but it developed a plan to actively assist and encourage its U.S. VIP users to exploit them. From its launch in 2017, Binance catered to higher volume, commercially important users through its “VIP Program,” which offered favorable trading fees and higher limits on the number of orders that users could submit through the Binance.com exchange. Binance thus had significant commercial motivations to go to great lengths to support these VIP users. Binance’s internal reports indicated that, in 2019, VIP users consistently accounted for between two-thirds and three-quarters of both trading volume and trading revenue on Binance.com.

In 2019, Binance even developed a process to notify VIP users if they became the subject of a law enforcement inquiry. This process provided for members of Binance’s VIP team to “contact the user through all available means (text, phone), to inform him/her that his account has been frozen or unfrozen. . . .We cannot in any circumstances directly tell the user to run/withdraw, we can get sued or undertake personal liability. Giving a strong hint, such as your account is unlocked/your account has been investigated by XXX is usually a good enough hint of severity.”

U.S users represented a crucial element of the VIP userbase, at times accounting for roughly 15 to 20% of Binance’s transaction fees. In October 2020, a single U.S. VIP user was responsible for 12% of all trading volume on Binance.com.

In the summer of 2019, as Binance prepared to launch Binance.us and roll out the initial controls applicable to U.S. users accessing Binance.com, Binance senior management conducted a series of meetings to discuss how to facilitate the evasion of its ringfencing by certain U.S. VIP users. As discussed in the meetings, the approach would vary based on whether the U.S. VIP user had already completed KYC with Binance. If a U.S. VIP user had already provided Binance with KYC documents demonstrating its U.S. nexus, Binance would reach out “privately” to obtain new KYC documents showing that the entity was in an offshore jurisdiction. For U.S. VIP users who had not yet completed KYC (and were identified as being U.S. users based on their IP address), Binance personnel would encourage such users to “change their IP.” In practice, this meant using a VPN to give the false impression that the user was located in a different jurisdiction, even though Binance would know that the user was, in fact, located in the United States.

These users were so valuable to Binance that personnel were instructed not to off-board them. A member of Binance’s VIP team wrote in December 2020 that, “we will not be restricting the top 100 users (even after sending them emails [about restrictions applicable to U.S. users who remained on Binance.com]). They will be managed by your VIP team. The CEO’s idea is that they should have enough time to create or find new non-US entities.” Binance then executed the plan it had discussed, and it took additional steps to conceal its retention of U.S. users.

a. Binance Encouraged Customers to Alter KYC Documentation to Hide U.S. Nexus

Binance decided to first focus on the 22 most active U.S VIP users (in the highest tiers of Binance’s VIP program). Binance’s CEO described the goal of this exercise as “reducing the losses to ourselves, and, at the same time, to make the US regulatory authorities not trouble us.” In furtherance of this goal, Binance’s CEO inquired of Binance personnel about the process of getting new KYC documents for this subset of U.S. VIP users that would reflect an offshore entity: “what is the procedure for us to change KYC now,” to which a senior Binance manager responded that “we just change it directly. Just get in touch privately. Only 22 people! We just handle it case by case and do it off-line! There is no work order record.” Similarly, when a VIP U.S. user struggled with changing his company’s registration because the owner held a U.S. passport, the former Chief Compliance Officer replied “can he have someone else submit the entry and use a NON-U.S. passport?” The CEO was updated on the status of these efforts.

b. Binance Encouraged Customers to Access Binance from a VPN to Hide U.S. Activity

Binance’s CEO endorsed Binance’s approach to handling VIP U.S. users that hadn’t already completed KYC. Binance personnel had a special “script” for outreach to these U.S. VIP users wherein VIP personnel were instructed to “encourage user to create a new account on Binance.com.” Because such users had likely been identified as a U.S. person based on their IP address, the script further instructs VIP personnel “if the user doesn’t get the hint, indicate that IP is the sole reason why he/she can’t use .com.” Some Binance personnel used fake names when contacting customers because they were concerned about the process leaking and subsequently facing public pressure to be fired by the company.

Binance’s former Chief Compliance Officer reiterated Binance’s approach in February 2020, writing to another Binance employee that “we try to ask our US users to use VPN / or ask them to provide (if they are an entity) non-US documents / On the surface we cannot be seen to have US users but in reality, we should get them through other creative means.” Similarly, in a December 2020 chat, Binance personnel discussed the issue of applying IP address controls to VIP users who access Binance.com via API: “VIP team wants to give its users temporary whitelist in a short time,” notwithstanding the fact that such whitelisting “has regulatory risk also, because it will be seen that we are ‘allowing’ US ip addresses.”

c. Binance Attempted to Conceal the Retention of U.S. VIP Users

While Binance’s VIP team facilitated the retention of U.S. users, senior management obscured Binance’s ties to U.S. users by changing internal reports. Specifically, starting in January 2020, internal reports prepared by Binance’s finance department included a breakdown of users associated with various countries, identifying a substantial portion in the United States. By late 2020, a senior manager instructed the employee in charge of Binance’s internal database to reclassify the country code from “U.S.” to “UNKWN” and to restrict access to view information about these users within the company. The following month’s report from Binance’s finance department shows that the change was implemented, with the United States no longer appearing on the country breakout and roughly the same proportion of users previously identified as U.S. users now marked as “UNKNWN.”

Binance’s CEO also told an employee “don’t post . . . U.S. data” in an internal group chat and instructed him to delete the message from the chat around the same time. In a contemporaneous October 2020 chat, a member of the VIP team informed the CEO that he was certain that a U.S. trading firm was “normally accessing the Binance.com api for trading via U.S. technology vendor Tokyo,” to which the CEO replied “give them a heads up to ensure they don’t connect from a us IP address. Don’t leave anything in writing.”

d. Specific VIP Users

The following examples further illustrate the lengths that Binance personnel have gone in order to maintain U.S. VIP users—despite supposed contemporaneous improvements in their KYC and AML compliance programs. Binance first purported to focus on the Enterprise User’s beneficial owners as a primary indicator for whether an entity was a U.S. user. In 2022, Binance changed how it defined U.S. users, as the prior definition would require the offboarding of commercially significant VIP users. Binance then purported to rely on a different test to determine whether an Enterprise User is a U.S. user, although as explained in the examples below, Binance continued to allow VIP users with material, commercially relevant ties to the U.S. to remain on Binance.com. Although Binance offboarded certain users by applying the revised test, during the Relevant Time Period, Binance never fully implemented these standards and retained U.S. VIP users on Binance.com through deliberate actions by Binance personnel to keep these users on the platform, vacillating between allowing U.S. VIP users to circumvent geofencing controls and changing the definition of a U.S. user altogether to justify the continued presence of U.S. VIP users with clear U.S. touchpoints. Binance agreed to begin taking steps to identify and offboard additional users following extensive discussions with FinCEN regarding Binance’s continued retention of U.S. VIP users.

i. Customer A

Customer A first opened its account on Binance.com in January 2018, and from inception, Binance’s records identified it as a U.S. user, but it appears that Customer A’s activity on Binance was never restricted in any way. Customer A is a subsidiary of a well-known, U.S.-based trading firm that operates as the firm’s CVC-focused subsidiary. This identification of Customer A as a U.S. user was consistent with U.S. indicia in documentation provided by Customer A during its initial registration and ample publicly available information showing that Customer A’s majority beneficial owner is a U.S. citizen (Individual A-1).

Both Customer A and its parent are well known leaders in providing liquidity, and an affiliate of Customer A is registered with FinCEN as an MSB. Its registration notes that it engages in money transmission within the United States. Customer A’s January 2018 account opening materials provided to Binance clearly identify its U.S. ties: the company’s “Country and Territory” field is listed as “USA,” Customer A attached a photo of a U.S. passport for a Customer A employee, and an organization chart clearly identified Individual A-1 as Customer A’s majority, ultimate beneficial owner. These materials were emailed to Binance’s CEO and other Binance personnel.

Numerous Binance reports identify Customer A as one of the top 10 overall spot market makers and liquidity providers on the Binance.com platform. Beginning in October 2019, Customer A began receiving “Market Maker Program” (sometimes referred to as “Spot Liquidity Provider Program”) reports from Binance personnel, which depicted Customer A’s relative spot trading activity in various CVC pairs on the Binance.com platform. These reports reflected the overall importance of Customer A’s business to Binance. These reports also showed an uptick in Customer A’s activity in the latter part of 2021, a trend that should not have occurred if Customer A was subject to the geofencing controls Binance purported to implement.

Despite Customer A’s readily apparent U.S. indicia, Binance failed to take action with respect to its presence on the Biannce.com platform. In fact, Binance never allowed Customer A’s trading to be affected by its geofencing controls; rather, Binance instructed Customer A on how to circumvent any such controls and designed them to not apply to users like Customer A. In September 2020, a member of Binance’s corporate KYC team emailed Customer A personnel requesting, among other documents, “statutory documents of business registry for [Customer A’s Cayman Islands subsidiary] reflecting the latest registered address instead.” Customer A personnel responded by providing a registered address for the subsidiary in the Cayman Islands, despite Binance’s records reflecting information indicating that Customer A was a U.S. user since

January 2018.

In October 2020, a Binance employee wrote to Binance’s former Chief Compliance Officer requesting for Customer A an “exemption of the US Nexus and passport copy for the [ultimate beneficial owner]” requirement. The former Chief Compliance Officer responded that “the Bitmex incident has made management more cautious of U.S. nexus . . . . can you please forward this message of mine to the biz team to see if they still want to proceed forward. If they still want to, I will exceptionally approve.” The former Chief Compliance Officer provided the approval that same day.

Throughout the Relevant Time Period, Binance never offboarded Customer A. Binance instead granted Customer A several additional extensions and attributed the delays in offboarding to the fact that Customer A is “a big client.” In late 2021, rather than offboarding Customer A entirely, Binance transferred all of Customer A’s “fee tiers, referrals, mm programs, etc.,” to a “new” entity Customer A registered in the British Virgin Islands (BVI). Like Customer A, the BVI registered entity maintains, through its U.S. affiliates, a material presence in, and reliance on, the United States, and continued to trade on the Binance.com platform, despite the fact that the opening of the new account violated Binance’s contemporaneous Corporate Onboarding Procedure. Binance offboarded Customer A in connection with the application of enhanced policies, procedures, and internal controls used to identify and offboard U.S. users that Binance implemented as part of its resolution with FinCEN.

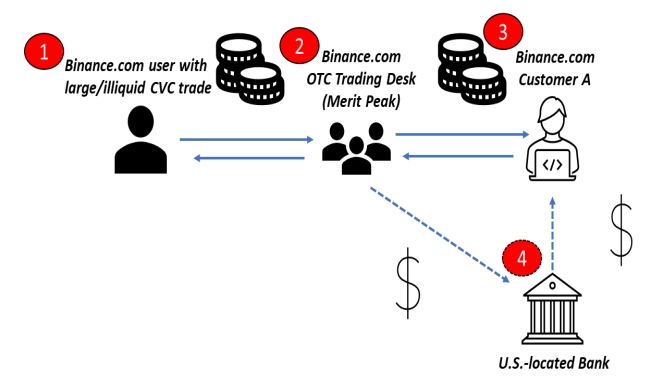

aa. Customer A’s Relationship with Merit Peak

In addition to Customer A’s role as a market maker and liquidity provider on the Binance.com platform, Customer A was also an important trading counterparty to Merit Peak. As explained above, Merit Peak is one of the legal entities involved in Binance.com’s operations, specifically by acting as Binance.com’s OTC trading desk. In this capacity, Merit Peak would fill orders from Binance.com users for CVC trades that could not, or were not well suited to, be executed by Binance.com’s order matching book (e.g., trades of large order sizes or involving illiquid CVC pairs). However, Merit Peak described itself in documents provided to Customer A as a “proprietary trading firm with no client funds” that was “100% owned by [Binance’s CEO].” In its capacity as Binance.com’s OTC trading desk, Merit Peak executed numerous large CVC trades by accepting them from Binance.com customers and submitting corresponding CVC orders to Customer A for execution. As depicted in the diagram below, Binance.com was able to benefit from the U.S. liquidity that Customer A provided through both the Binance.com order book and OTC trades that Merit Peak entered into in a principal capacity to facilitate Binance.com trading.

- Binance.com user wishing to execute a large or illiquid CVC trade places an order with Binance.com’s OTC trading desk (Merit Peak)

- Binance.com’s OTC Trading Desk (Merit Peak) accepts the order and finds a trading firm – often one of Binance’s VIP users – to send the order for fulfillment

- In this example, Customer A accepts Merit Peak’s order and buys or sells CVC to fulfill it

- If the trade is CVC-to-CVC, it settles entirely within Binance.com. If the trades is CVC-to-USD, the CVC would settle within Binance.com, and Customer A and Merit Peak would settle the USD through a U.S.-located bank.

Between April 2019, when Merit Peak entered into an agreement with an affiliate of Customer A, and September 2021, when Customer A and its affiliates ceased trading with Merit Peak, Customer A effected roughly $1.2 billion in CVC transactions with Merit Peak. The CVC portion of these trades settled through Customer A’s account on the Binance.com platform. In connection with one such trade, Merit Peak made a statement to Customer A personnel about Binance’s concerns regarding compliance with U.S. regulations: “we [Merit Peak] can’t use usd pair [to trade with Customer A] since there’s no way to settle usd on Binance.com. . .there’s certain legal risk we gonna face if we put USD on our website.” However, as depicted in the graphic above, subsequent confirmations of trades between Customer A and Merit Peak indicated that trades were effected in USD pairs, with the USD settling through a Merit Peak account at a U.S. financial institution.

ii. Customer B

Customer B became a customer of Binance in May 2018, and Binance sent to Customer B a form communication used with other VIP users that referred to Customer B as one of its “most treasured VIP customers.” Customer B was a privately held, U.S.-based CVC trading firm and Cayman Islands-incorporated subsidiary of a Chicago-based trading firm. Throughout the period in which it maintained an account on Binance.com, Customer B maintained a presence in, and reliance on, the United States and would use a VPN to access its Binance.com account from the United States. As with Customer A, an affiliate of Customer B maintains an MSB registration with FinCEN. Customer B maintained accounts on both Binance.com and Binance.us.

Despite obvious U.S. indicia—both publicly available and within Binance’s own records—Binance failed to offboard or restrict Customer B’s account in a manner consistent with Binance’s purported geofencing controls until late 2022, well after Binance purported to have implemented enhanced controls to identify and offboard U.S. users. Additionally, in June 2019, a Customer B employee specifically asked in a chat with Binance personnel “hey guys, will our account be affected by the new Terms of Service? We registered through our Cayman entity,” to which a member of Binance’s VIP team responded, “you will continue to have access to Binance.com. Amendments to the terms of use apply to the us based entities.” Indeed, Binance never restricted any of Customer B’s activities, even when Binance’s automated IP address detection software logged locations suggesting the use of a VPN by Customer B to hide its U.S. nexus.

iii. Binance Retained Numerous Exchange Brokers that Facilitated U.S. Trading

In addition to Binance continuing to maintain commercially important U.S. trading firms on the Binance.com platform, Binance also maintained relationships with a variety of brokers. Specifically, these brokers generally fell into the following two categories:

- Brokers whose clients were able to access Binance.com, either through the broker’s API or a referral to Binance placed on the broker’s website via a “widget.” Clients of these brokers were required to register with Binance.com and were subject to Binance’s KYC/customer due diligence controls.

- So-called “Exchange Brokers,” whose clients were allowed to trade on Binance.com via sub-accounts under the broker’s Binance.com account. Exchange Brokers clients’ orders were filled through the Binance.com order book and therefore used the Binance.com platform to effect transactions, but such clients were not required to register with Binance.com. Exchange brokers were able to operate in this manner because of Binance’s former policy allowing any entity registered with Binance.com as an Exchange Broker to open an unlimited number of sub-accounts, which existed on Binance’s platform, with “no requirement for extensive verification of sub-account users.” In recognition of the minimal oversight that Binance maintained over these Exchange Brokers, Binance’s relevant procedures described them as “operating their own exchange” within Binance.com.

Binance personnel actively recruited brokers, including Exchange Brokers, to its platform. For example, in a December 2020 chat, Binance personnel discussed an upcoming presentation which noted that the broker program had onboarded hundreds of brokers in more than 40 countries and that this program generated millions of dollars per month for these brokers. Similarly, in a collection of Binance’s marketing team’s “objectives and key results” (referred to as “OKRs”), an employee on the “user operation” team wrote that his objectives included “an average of 400 new customers per day at the end of the year” through the “brokerage broker project,” and that, to help achieve a target average monthly exchange volume, “at least 30 new brokers will be connected by the end of the year.”

Binance maintained effectively no geofencing or AML controls over the broker program until late 2021 (i.e., well after geofencing controls applicable to other Binance.com customers went into effect). Consistent with its overall approach to geofencing, its initial controls were ineffective and, until Binance made certain, recent changes in connection with the resolution of FinCEN’s investigation, remained inadequate. In September 2021, Binance began to update the licensing agreement that Binance required its Exchange Brokers to sign. This update included a new clause containing representations regarding the Exchange Broker’s AML and KYC controls. However, Exchange Brokers were not required to agree to the revised version of this agreement until the end of 2021.

Moreover, Binance did not begin to take steps to independently evaluate an Exchange Broker’s KYC and AML controls until 2022. Prior to 2022, Binance’s corporate onboarding procedures did not include any requirement to review an Exchange Broker’s AML controls.

Although a March 2022 version of Binance’s corporate customer onboarding procedure document includes a section specifically dedicated to Exchange Brokers, it contains no reference to any requirement that Binance personnel review geofencing controls or policies related to U.S. persons. Once Binance actually began to evaluate Exchange Brokers’ controls, many ultimately offboarded from the platform.

As of November 2022, Binance maintained relationships with roughly 100 Exchange Brokers. A detailed review of roughly half of these brokers indicates that, based on publicly available information, 6 are U.S. firms, 16 exhibited clear indicia of serving U.S. users, and 22 brokers appeared not to impose any restrictions applicable to U.S. users. Notwithstanding Binance’s assertion that it has implemented enhanced controls applicable to Exchange Brokers, Binance.com continued to do business with brokers that:

- advertise offering “simplified KYC” for Binance and that they did not require “complex registration procedures;”

- in the case of one broker, described by a third-party website as “welcomeing . . . traders in United States;” and

- in the case of another, Russian broker, allow users to create an “exchange account” by providing only an email address, a practice that mirrors Binance’s “Tier One” (no-KYC) accounts described below that it purported to prohibit starting in August 2021. In connection with Binance’s resolution with FinCEN, Binance agreed to cease its practice

of opening anonymous sub-accounts and permitting them to transact on or through Binance.com.

iv. Customer (Exchange Broker) C

Customer C, a BVI entity, was founded by Individual C-1, who previously worked at a well-known Connecticut-based hedge fund. Customer C’s primary business model appears to be allowing trading firms and other institutional market participants to access various CVC exchanges through Customer’s C platform. By having their orders consolidated with those of other Customer C clients, trading firms and other institutional market participants receive lower fees and better rebates from the various CVC exchanges at which Customer C maintains accounts. Customer C is one of Binance’s largest customers. For example, as-of late May 2022, Customer C’s total transaction activity represented roughly 3.2% of all spot trading activity on the Binance.com platform.

For much of the Relevant Time Period, Customer C did not maintain a publicly accessible website, but was controlled, indirectly, by a U.S.-organized limited partnership that has filed Form D notices with the SEC identifying Individual C-1 as the manager of its general partner and lists a New York address for Individual C-1. In addition to Individual C-1’s role as manager of the partnership, key personnel of Customer C publicly identify themselves as being based in the United States. A Customer C affiliate also maintains a futures commission merchant registration with the CFTC and National Futures Association.

Beyond Customer C’s public connections to the United States, Customer C also discussed with Binance personnel Individual C-1’s status as a U.S. person. In a May 2021 email thread about completing onboarding on the Binance.com platform, Customer C’s General Counsel asked a member of Binance’s VIP team if there was “any concern with a non-US domiciled corporate vehicle having a US domiciled director.” The Binance employee appears to have called Customer C’s General Counsel instead of replying by email. After this discussion, Customer C’s General Counsel wrote to another member of Binance’s VIP team tasked with KYC onboarding and reported that Customer C could not “input anything on [Individual C-1] since it won’t let me choose USA as a place for his passport.” This Binance employee replied, “you can select any other country (Cayman Islands per example) and input his selfie and passport.” Finally, in January 2022, Customer C reported connectivity issues to Binance personnel, and, in doing so, referenced IP addresses that FinCEN identified through open-source research as being located in the United States.

In addition to Customer C’s own U.S. ties, more than twenty percent of Customer C’s trading firm clients exhibit U.S. indicia. Binance should have been aware of this, as it sought “to regularly review [Customer C’s] client list and keep onboarding of new clients as transparent as possible” for Binance’s record and risk management purposes. Customer C also referenced a highprofile U.S. trading firm as one of its clients in communications with Binance personnel, and Binance provided technical support for another U.S.-based Customer C client, stating “seeing that it’s a US entity, API specifications may differ.”

v. Customer (Exchange Broker) D and Customer E

Customer D is an Exchange Broker customer of Binance with a material presence in, and reliance on, the U.S. A Customer D affiliate is registered with FinCEN as a money transmitter with activity occurring throughout the United States and territories. Another Customer D affiliate is provisionally registered with the CFTC as a swap dealer and is a member of the National Futures Association. Customer D offers a “prime service” that is similar to Customer C’s main offering: It allows trading firms to access multiple CVC exchanges under Customer D’s account on those exchanges via Customer D’s user interface. A significant portion of Customer D’s customers are U.S. trading firms and other institutional market participants. Customer D’s subaccounts on Binance.com for these U.S. firms demonstrate that Binance’s geofencing controls—even though they evolved over time—remained ineffective and that, notwithstanding its representations to the contrary, Binance was not ringfenced from the United States.

One of Customer D’s U.S. customers is Customer E. Customer E is an affiliate of a U.S.-based trading firm. Through its U.S. affiliates, Customer E maintains a material presence in, and reliance on, the United States. Customer E became a client of Customer D in order to evade improvements in Binance KYC that limited its ability to continue trading on the Binance platform. When onboarding, Customer D wrote to Customer E, “[Customer E] wouldn’t have to KYC with the exchange, we could do the KYC on our side—you could connect via API and be under the Customer D subaccount.”

This move occurred after Customer E had already changed its KYC with Binance.com three times to avoid regulatory requirements associated with doing business in the United States and other countries. The first registration change occurred in June 2019 in response to Binance’s press announcement that it would stop serving U.S. traders on the Binance.com platform. A member of Binance’s VIP team assured Customer E that it would “help to transfer the VIP level and withdrawal limits and API order limits and other settings” from the existing account to Customer E’s “new” account. The Binance VIP team employee encouraged Customer E to evade Binance’s geofencing controls by stating that “you need to use VPN when you open the registration link, make sure not a US IP address.” After onboarding with Customer D, Customer E has proceeded with its business just as it had under all the various prior registrations facilitated by Binance.

4. Binance’s Launch of a “U.S.” Entity Was Intended to Shift Regulatory Focus and Did Not Result in Binance Exiting the United States

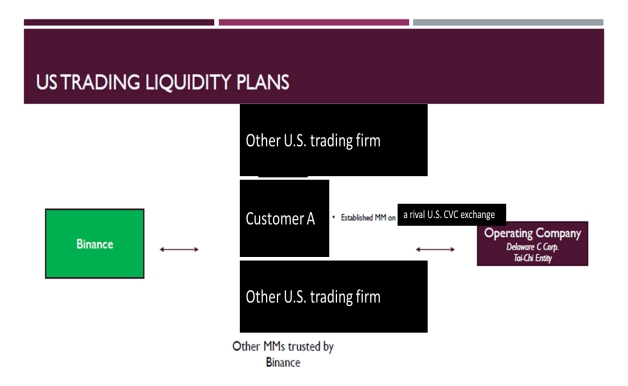

In the fall of 2018, Binance senior management, received two presentations (referred to within Binance, and herein, as the “Tai Chi Presentations”) on how to address issues related to the U.S. market, which discussed ways that Binance could avoid scrutiny from U.S. authorities. Specifically, one of the Tai Chi Presentations stated that the U.S. entity would use “explicit Binance branding to attract regulatory and enforcement attention” and then “accept nominal fines in exchange for enforcement forbearance” on Binance’s behalf. The presentation noted that, in doing so, the U.S. entity would “become the target of all built-up enforcement actions” and therefore “insulate Binance.” In effect, the U.S. entity would serve as a decoy to distract from Binance’s continued U.S. presence, which it would achieve in part by instructing U.S. users on how to evade geofencing controls on Binance.com, as explained above, and by having U.S. users maintain accounts on both Binance.com and Binance.us. Although Binance’s senior management sent the author of the Tai Chi presentation a message rejecting the presentations’ approach, Binance’s actions following these presentations demonstrate Binance’s aim in establishing the Binance.us entity as a vehicle to distract U.S. authorities from Binance.com’s continued U.S. presence while simultaneously increasing Binance’s U.S. footprint.

First, as explained above, Binance.com took deliberate steps to continue (but obscure) its relationships with U.S. trading firms after the launch of Binance.us, despite Binance’s public and private assertions to the contrary. Leading up to the launch of Binance.us, Binance.us’s CEO was assured that Binance would start blocking U.S. users on Binance.com after Binance.us obtained its MSB registration from FinCEN. However, Binance.com did not begin blocking U.S. users after Binance.us obtained its MSB registration from FinCEN. As explained above, the implementation of geofencing controls—which were the primary measures Binance took to try to block U.S. users on the Binance.com platform—was incremental, protracted, and ineffective. Moreover, Binance instructed its personnel to offer U.S. trading firms the possibility of continued, improper retention of accounts on Binance.com in return for a commitment from those firms to increase their activity on Binance.us. This approach was entirely consistent with portions of the Tai Chi Presentations, which specifically contemplated methods to allow U.S. trading firms to play a role on both Binance.com and Binance.us.

Second, correspondence between Binance senior management indicate that certain of them endorsed the Tai Chi Presentations and understood the import. After launching Binance.us, Binance’s former Chief Compliance Officer wrote to Binance’s then-CFO: “Our downside now is we cannot acknowledge US presence (even historical) on Binance.com . . . If US regulators want to hit you for Binance.com’s sins of the past, guess what? you have a direct avenue in BAM [Binance.us] for them to reach/hammer you.” The then-CFO responded, “that was one of the purposes of having BAM in place.”

Third, Binance.us has generally lacked autonomy from Binance in two key respects: (i) Binance.us is dependent on Binance for several business-critical services, including the provision of wallet software services, as well as various IT and software-related services (such as Binance.us’s reliance on Binance.com’s matching engine, risk control center, and Android/iOS mobile applications to operate); and (ii) Binance.us’s board of directors has always consisted of only three individuals: Binance.us’s CEO, the CEO of Binance.com, and a third director affiliated with Binance.com.

This lack of independence allowed Binance’s CEO to use Binance.us to facilitate activity of his proprietary trading firms: Sigma Chain AG (Sigma Chain) and Merit Peak Limited (Merit Peak). Moreover, because Merit Peak also functioned as Binance.com’s over-the-counter (OTC) trading desk, Merit Peak was able to use Binance.us as a way for Binance.com to continue to access the U.S. CVC market. In fact, this approach is entirely consistent with the Tai Chi Presentations: as indicated in the below excerpt, one of the presentations described a structure in which shared market makers would provide liquidity on both Binance.com and Binance.us, with Customer A specifically identified on this slide as one of the firms expected to act in this capacity.

Merit Peak supported this arrangement and contributed to Binance’s operations as an unregistered MSB in two principal capacities: (i) Merit Peak relied on Binance.us’s settlement infrastructure and U.S. dollar liquidity to convert U.S. dollars into Binance’s stablecoin (BUSD) on behalf of Sigma Chain, which acted as a market maker on Binance.us; and (ii) Merit Peak also facilitated OTC trades of CVC (including by sourcing CVC through Customer A, whose CVC trades would settle on Binance.com) for customers of Binance.us, despite the fact that Merit Peak, as a part of Binance.com, was not registered to provide such services to Binance.us users.

In effect, Merit Peak acted as a conduit between Binance.us and Binance.com, while exploiting Binance.us’s corporate governance weaknesses to avoid scrutiny of this activity. Binance.us’s own CEO was never given visibility into what compensation (if any) that Binance.us received for referring lucrative, OTC business to Merit Peak. Moreover, when Binance.us’s CEO questioned several large withdrawals by Merit Peak from Binance.us, Binance.us never received information from Merit Peak or Binance to adequately explain either the purpose or the parties involved.

In sum, for most of the Relevant Time Period, Binance made no serious effort to eliminate U.S. activity from Binance.com, despite its contrary representations, and the creation of Binance.us did not result in a separate platform for all U.S. operations. Instead, Binance.us effectively provided cover for Binance.com’s continued service of U.S. customers.

E. Failure to Develop, Implement, and Maintain an Effective AML Program

In addition to willfully failing to register as an MSB, Binance also during the Relevant Time Period willfully failed to develop, implement, and maintain an effective money laundering program reasonably designed to prevent it from being used to facilitate money laundering and the financing of terrorist activities. Binance launched its initial platform without any AML controls in place, failing to establish a written AML program until July 2018—a year after Binance launched and well after the 90-day deadline required under FinCEN’s regulations. Throughout the Relevant Time Period, Binance’s AML program contained categorical gaps with respect to KYC and transactions in anonymity enhanced cryptocurrencies (AECs), as well as numerous other deficiencies, which rendered it ineffective.

1. Binance’s KYC “Tiers” Allowed Users to Trade without KYC

MSBs are required to develop, implement, and maintain an effective AML program that includes policies, procedures, and internal controls for verifying customer identification. Binance initially adopted a “tiered” approach to identifying and verifying customers. Binance characterized this as a risk-based approach, but in reality it resulted in a categorical gap in its policies, procedures, and internal controls. Most significantly, from July 2017 through at least August 2021, “Tier One” (also referred to as “no-KYC”) customers were permitted to open accounts and conduct CVC-to-CVC transactions with only an email address. Binance performed no due diligence on such accounts. “No KYC” account-holders were permitted to conduct daily withdrawals of CVC under two bitcoin, a value that at times exceeded the equivalent of $130,000 a day. By Binance’s own calculations, it had four times the number of U.S. users for whom Binance had not collected KYC (based on IP address) than U.S. users for whom Binance had conducted KYC.

Indeed, Binance was aware that such a practice was high-risk and constituted a willful failure to comply with the BSA and its implementing regulations. Shortly after Binance launched in July 2017, FinCEN, in collaboration with U.S. law enforcement, brought enforcement actions against the Russian-located money transmitter BTC-e, which also permitted customers to trade without KYC. Soon thereafter, Binance’s third-party service provider briefed Binance’s former Chief Compliance Officer on FinCEN’s action and the parallels with Binance’s practices.

Senior management at Binance were also aware that its “no KYC” accounts were being exploited by illicit actors on the Binance.com platform. In an August 14, 2018 email conversation, one of Binance’s third-party service providers discussed with Binance’s former Chief Compliance Officer a large movement of illicit funds. The service provider explained, “we have been tracking some stolen money that is coming from one of the worst hacking groups we have seen (more than $130m in stolen funds). They seem to be using Binance as one of the cash out venues…There seems to be structuring occurring that is just under your KYC limit of 2 [bitcoin]…” Separately, a third-party service provider company told Binance in March 2019 that effective screening could not be performed without minimal information, including first and last name (as opposed to an email address). In other words, no sanctions screening could occur for “no KYC” accounts.

Despite these warnings from the third-party service providers—and subsequent escalation to senior management—Binance failed to address this significant compliance gap for over four years, when it finally began offboarding the “no KYC” accounts.

2. Binance’s Lack of KYC Led to a “Paper-only” AML Program

An MSB must develop, implement, and maintain an effective AML program, which must be in writing and commensurate with the risks posed by the location, size and nature of the volume of financial services provided by the MSB. When Binance finally drafted an AML program, roughly a year after its initial launch, it listed many practices that were either never fully implemented or were directly contradicted by Binance’s own practices. For example, Binance’s policies, procedures and internal controls specifically set out that Binance customers are prohibited from “opening accounts for or establishing relationships” with potentially suspicious counterparties, including “online casinos and unlicensed casinos.” This is also separately affirmed by Binance’s written transaction monitoring procedures, which state that “gambling” platforms are a “high risk counterparty” that would be “identified and ‘flagged’” through Binance’s use of blockchain analytic tools.

However, Binance’s policy of allowing users to open accounts without undergoing KYC meant that, in practice, Binance users were free to transact with these high-risk counterparties with impunity. A review of Binance’s transactional history on multiple blockchain tools—some of which Binance purports to have utilized (albeit in only a limited capacity)—demonstrates that Binance has directly sent and received over $1 billion with known gambling services and online casinos during the Relevant Time Period. Each of these financial institutions bore additional indicia that they were high-risk as well, as none of these identified counterparties are duly licensed as casinos or card clubs in the United States or registered as MSBs.

Similarly, following Russia’s invasion of Ukraine in early 2022, Binance purported to focus on the risks associated with Russian illicit finance. However, FinCEN identified that Binance continued to have significant, ongoing exposure to Russian illicit finance. Examples of such connections included: (i) processing hundreds of millions of dollars in transactions for a CVC exchange co-owned by a Russian citizen who pled guilty to money laundering in February 2023, including transactions effected after this individual’s guilty plea; (ii) processing several million dollars for a CVC exchange that allowed its users to “cash out” at a Russian bank designated by OFAC and that had substantial exposure to the Russian darknet market Hydra Market; and (iii) as recently as the summer of 2023, continuing to effect transactions with the darknet market Russia Market, one of the largest cybercrime service websites in the world.

The high volume of activity that Binance effected with online and unlicensed casinos as well as Binance’s continued connections to Russian illicit finance despite intense public scrutiny of such activity indicates that Binance did not effectively implement its “paper” policies and procedures.

3. Insufficient Policies, Procedures, and Internal Controls for Subaccounts and “Nested” Exchanges

As noted above, an important source of Binance’s growth and its ongoing, sustained success as the largest CVC exchange by trading volume has been its recruitment and retention of large trading firms, including Exchange Brokers. Binance allows Exchange Brokers’ clients to directly access the Binance.com platform through subaccounts created by the broker under its own Binance.com account. However, Binance initially failed to implement adequate policies, procedures, and internal controls around these customer-opened subaccounts to ensure that the Binance.com platform was not exploited by illicit actors. In fact, Binance told Enterprise Users that this product had “no requirement for extensive verification of sub-account users” and that a single Enterprise User could open up to 1,000 subaccounts on the Binance.com platform under its master account. Exchange Brokers could open an unlimited number of subaccounts. In fact, until the end of 2021, Binance failed to require attestation from Exchange Brokers to confirm that these exchange brokers perform any AML checks on their own customers, including subaccount holders.

These subaccounts, in addition to Binance’s “No KYC” accounts, contributed to the establishment of so-called “nested exchanges” operating within Binance without sufficient oversight and due diligence. Binance knew how nested exchanges operate and the challenges they create. According to Binance’s own educational “Academy” webpage, a nested exchange “provides its customers with [CVC] trading servicers through an account on another exchange . . . . It acts as a bridge between Binance users and other service providers.” Binance further describes this threat adding, “nested exchanges often have lax KYC and AML processes or none at all . . . and support money laundering, scammers, and ransomware payments.” Despite this recognition by Binance itself, numerous nested exchanges operated without any controls on the Binance.com platform until at least 2021, including the nested exchanges described below that were eventually designated by the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and shut down by law enforcement.

One such example was SUEX OTC, S.R.O. (Suex), a Russian CVC exchange which was designated on the Specially Designated Nationals and Blocked Persons (SDN) List maintained by OFAC in September 2021 for its role in facilitating transactions of illicit funds from numerous criminal schemes. Suex processed transactions involving illicit activities ranging from ransomware attacks, including the Colonial Pipeline hack, to transactions involving the illegal CVC exchange BTC-e through accounts held at Binance. The exchange operated on the Binance.com platform through maintaining multiple non-KYC accounts, including subaccounts on the Binance.com platform that Suex itself opened, for years prior to its designation.

Additionally, OFAC-designated CVC exchange Garantex, had been operating as a nested exchange on Binance since its inception in March 2019 until one month before it was designated by OFAC. A blockchain analytic tool, also utilized by Binance, identified close to 100,000 transfers between Garantex and Binance between March 2019 and 2022. Despite Garantex conducting over $100 million in potentially suspicious transactions with illicit actors, including $6 million associated with Conti ransomware, Binance’s lack of KYC and other deficient controls allowed the service to operate on its platform for almost three years without Binance reporting any suspicious activity. Well after Garantex’s designation by OFAC in April 2022, there were tens of millions of dollars in transactions with Garantex by Binance, extending into 2023.

Finally, BestMixer conducted illicit activity and obfuscated law enforcement investigations, and used Binance’s “No-KYC” accounts—which remained in place for the majority of the Relevant Time Period—to achieve its objectives. BestMixer utilized multiple unique accounts on the Binance platform and conducted thousands of transactions between 1.9 and 2 bitcoin—just below, or at, the limit of Binance’s “No-KYC” policy. Through splitting bitcoin between different Binance accounts to remain below Binance’s two bitcoin withdrawal limit, this “mixer” was able to send over $40 million in bitcoin by structuring transactions based on Binance’s “No-KYC” threshold. After the service was taken down by law enforcement, a blockchain analytic tool company that was also a third-party service provider to Binance, informed Binance that “Bestmixer have been consistently using Binance as a source of ‘clean’ coins.”

Despite this information, Binance failed to implement any changes to its policies and procedures on nested exchanges and allowed multiple nested exchanges to continue to operate on the platform without appropriate restrictions or oversight. In connection with its resolution with FinCEN, Binance agreed to cease the practice of opening anonymous sub-accounts and allowing them to transact on or through Binance.com.

4. Insufficient Policies, Procedures, and Internal Controls Around AECs

Throughout the Relevant Time Period, Binance continued to operate without appropriate procedures to manage the risks associated with its various products and services. Most significantly, that includes risks associated with AECs. AECs use various approaches to hide the sender and/or recipient addresses associated with a CVC transaction and therefore pose heightened money laundering and terrorist finance risks, particularly when VASPs that offer AECs to their customers fail to implement mitigating controls specifically tailored to these products. During the Relevant Time Period, Binance offered at least six of the most popular AECs by market share, including the most popular one, monero. To date, Binance processes almost double the volume of transactions in monero relative to the next closest CVC exchange that transacts in it—without policies, procedures, or controls designed to mitigate the inherent AML/CFT risk associated with AECs.

Binance’s failure to implement controls around the specific risks associated with its products and services left it unable to comply with its AML program obligations or its obligation to identify and report suspicious activity occurring on its platform. This, coupled with Binance’s “No-KYC” policy hamstrung reporting critical to law enforcement efforts. In connection with its resolution with FinCEN, Binance began undertaking remedial measures to mitigate this risk, including: (i) delisting some of the highest volume AECs—including monero—from trading on Binance.com and restricting deposits and withdrawals in these AECs by Binance users, and (ii) prohibiting listing, and restricting deposits and withdrawals, of other AECs that are either fully private, or are partially private and that lack sufficient policies, procedures, and internal controls to mitigate the associated illicit finance risks.

5. Insufficient Policies, Procedures, and Internal Controls for Responding to Law Enforcement Requests

As an MSB operating during the Relevant Time Period, Binance wasrequired to implement policies, procedures, and internal controls to respond to law enforcement requests. Binance failed to implement a formal policy to respond to law enforcement requests until 2020. Even then, Binance initially imposed improper restrictions on U.S. law enforcement’s access to information. Rather than comply with subpoenas issued by law enforcement agencies, Binance tried for years to force U.S. law enforcement agents to first sign statements that would “indemnify and hold harmless Binance . . . from and against any regulatory or legal action, financial losses, liabilities, costs (including reasonable attorneys’ fees).” Processes that effectively deny, or delay, U.S. law enforcement and regulators access to information required to be available by law are incompatible with an effective AML policy. Yet, Binance codified this policy of withholding crucial information from U.S. law enforcement without indemnification through at least August 2021.

6. Insufficient Policies, Procedures, and Internal Controls for High-Risk Jurisdictions

Binance’s policies, procedures, and internal controls around the location of its customers were critically deficient, as reflected by its geofencing controls. Binance’s geofencing not only allowed U.S. users to access the platform (as described above), but also allowed users from highrisk jurisdictions to access the platform without appropriate controls. Binance personnel were aware that its poor geofencing controls meant that users from jurisdictions designated by Financial Action Task Force (FATF) on the grey or blacklist or subject to comprehensive sanctions could access the platform; this also meant that Binance’s AML controls would not be sufficient to meet its SAR obligations.

For example, in April 2020, a company with which Binance wanted to partner expressed concern that, “as part of the due diligence process, our Compliance team was able to open accounts with an . . . Iranian address on Binance.com. The Iranian test was opened using an Iranian IP and an Iranian address.” This was far from an isolated incident, as by Binance’s own estimates, between June 2017 and September 2021, Binance processed over 1,000,000 transactions with an aggregate value in excess of $500 million between U.S. users and users accessing the platform via an Iranian IP address. FinCEN has repeatedly highlighted risks associated with transactions with Iran and named Iran a jurisdiction of “primary money laundering concern” in a rulemaking finalized in 2019.

7. Binance’s Failure to Designate a Person to Assure Day-to-Day Compliance with the BSA

As an MSB, Binance was required to designate a person to assure day to day compliance with their AML program and the BSA. Binance failed to designate a person to handle AML compliance until it hired its first Chief Compliance Officer in April of 2018—nearly a year after launch. However, given the size and complexity of Binance’s operations, as well as the high-risk nature of many of its activities, this individual was not qualified for the role. Specifically, he lacked knowledge of AML/CFT obligations and had little-to-no experience designing and overseeing an AML/CFT compliance program. Moreover, the former Chief Compliance Officer actively participated in the development and execution of the strategy to conceal Binance’s efforts to unlawfully serve U.S. customers without registering as an MSB. The former Chief Compliance Officer was specifically briefed on the implications of failing to register with FinCEN and comply with the BSA.

8. Binance’s Failure to Provide Education or Training of Appropriate Personnel

Binance was required to provide education and/or training of appropriate personnel concerning their responsibilities under the AML program including training in the detection of suspicious transactions. Binance did not provide sufficient training on the detection of potentially suspicious transactions and employee obligations under the AML program. Binance operated for almost two years without requiring any AML training to Binance personnel. When Binance eventually began providing training in June 2019, it was only providing that training to select personnel. In fact, the vast majority of Binance personnel employed before July 2020 may not have received any AML training at all, and the early training that Binance provided was insufficient. For example, it included no specificity as to the products and services being offered to Binance customers through its platform. Significantly, the training also failed to cover the risks posed by its “No-KYC” accounts. Personnel were also not given training or tools to mitigate money laundering and terrorist financing risks associated with these accounts (e.g., noting when the same person opens multiple “No-KYC” accounts; identifying structuring to evade Binance’s two bitcoin threshold for collecting customer information; or detecting potentially suspicious transactions involving AECs).

9. Binance’s Failure to Provide for Independent Review of its AML Program

As an MSB, Binance is required to provide for independent review to monitor and maintain an adequate AML program. The scope and frequency of the review must be commensurate with the risk of financial services provided by the MSB. For most of the Relevant Time Period, Binance failed to conduct adequate independent testing with a scope and frequency commensurate with the risk of financial services. With respect to frequency, Binance did not arrange for any audits of its AML program until March 2020, nearly three years after its initial launch. Given the size of Binance’s operations and the nature of the products and services offered by the platform, the timing of this report did not meet the requirement that independent testing be conducted with a frequency commensurate with its risk profile.

When a test was finally conducted in March 2020, it fundamentally failed to assess key elements of Binance’s operations. The testing only looked at accounts for which there was a fiat-to-CVC nexus—entirely overlooking the money laundering and terrorist financing risks associated with any CVC-to-CVC activity on the platform. The review also focused only on customers that went through the KYC process, entirely excluding “no-KYC” customers. Even then, the review only examined 31 Binance accounts in total (25 individuals and 6 corporate customers, only one of which was rated as high-risk by Binance). This review was facially inadequate based on the sample size alone given the immense size and scale of Binance’s operations. It also failed to assess controls applicable to “no KYC” users, a known and immense source of risk for Binance’s platform. Significantly, the test included no transaction testing at all. Without transaction testing, an independent test cannot effectively determine if potentially suspicious transactions are handled

appropriately, including whether suspicious activity reports were appropriately filed.

The scope of the independent testing also did not include an adequate comprehensive assessment of the geographical risks Binance faced given its global presence. Despite Binance’s own 2020 risk assessment listing a risk of “unknowingly exposing Binance to higher risk jurisdictions,” and highlighting that Binance supposedly complied FATF and OFAC lists and conducted IP monitoring from the jurisdictions in which Binance purports to not do business, the independent test failed to assess controls around any of these processes. The review also did not assess geofencing controls that limit exposure to most jurisdictions given the paltry sample size. There was no assessment of whether Binance was conducting transactions with customers in countries designated by FATF on the gray or blacklist. In sum, the review was inadequate and unreliable for assessing Binance’s most significant risks.

F. Failure to File Suspicious Activity Reports

The gaps and deficiencies in Binance’s approach to AML compliance resulted in a substantial volume of suspicious transactions—in number and overall value—processed through Binance accounts, none of which were reported to FinCEN as required. In fact, Binance filed no SARs with FinCEN throughout the Relevant Time Period. FinCEN identified well over a hundred thousand suspicious transactions that Binance failed to timely and accurately report to FinCEN. Moreover, these failures to report suspicious activity resulted from Binance’s initial policy and practice failures that delayed reporting from FinCEN and law enforcement. The former Chief Compliance Officer reported to other Binance personnel that the senior management policy was to never report any suspicious transactions. Binance has taken significant recent steps to enhance its compliance program, including committing substantial resources to address the types of compliance gaps addressed below. As part of its resolution with FinCEN, Binance has committed to a formal SAR lookback.

The unreported suspicious transactions fall into the following categories: ransomware, terrorist financing, high-risk jurisdictions, darknet markets and scams, and child sexual abuse material.

1. Ransomware

Ransomware is malicious software that restricts the victim’s access to a computer in exchange for a specified ransom, usually paid in bitcoin. If the specified ransom is not paid, the victim may be threatened with the loss or exposure of their personal data, including personally identifiable information (PII), such as account numbers and social security numbers. Some ransomware operators, including those located in Iran and North Korea, have purposefully targeted U.S. hospitals, schools, and other vital public services. Following the 2017 FinCEN enforcement action against BTC-e—citing BTC-e’s facilitation of ransomware payments and its failure to report any of these transactions—Binance reportedly became one of the large receivers of ransomware proceeds. Binance was aware of the significant uptick in ransomware activity as early as February 2019.

In fact, Binance was aware of many specific movements of ransomware proceeds through the platform, yet it failed to file SARs with FinCEN. Binance’s third-party service provider identified Binance.com deposit addresses as directly linked to millions of dollars’ worth of Nozelesn ransomware proceeds. Binance’s compliance team determined these same Binance addresses also had indirect exposure to darknet markets and mixing, which are further indicia of money laundering. Nevertheless, on one occasion in 2019, Binance’s former Chief Compliance Officer instructed his team to take no action as the addresses were associated with a high-value client who had indirect exposure to a darknet market. In a separate incident Binance was notified of a ransomware victim by law enforcement, Binance required an indemnity from law enforcement prior to providing any reporting. Although Binance took action to protect the victim, no SARs were filed with FinCEN on either incident.